INP-WealthPk

Ayesha Mudassar

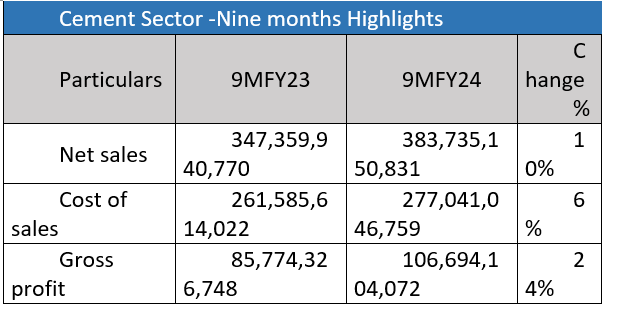

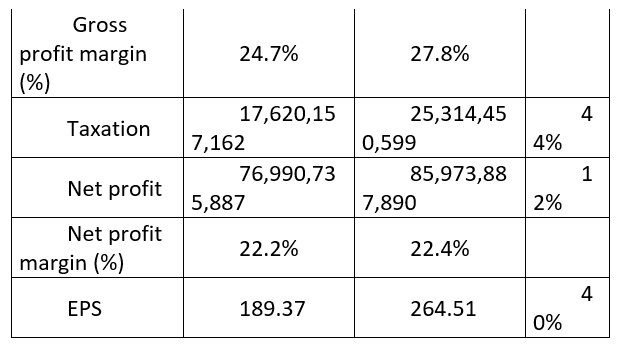

The cement sector showed modest performance in the first nine months of the current fiscal year (9MFY24) as it recorded a 12% year-on-year (YoY) growth in net profits, which clocked in at Rs85.9 billion as against Rs76.9 billion in the same period of last fiscal, reports WealthPK.

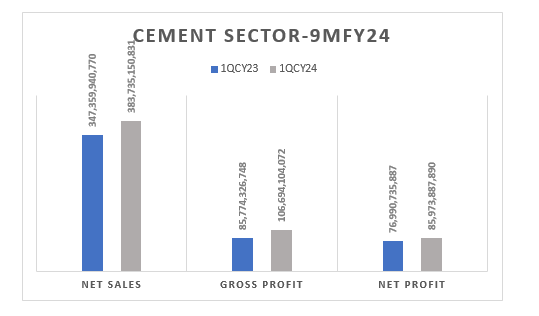

As per the results compiled by WealthPK of the income statements of the 11 PSX-listed cement companies, the sector saw a 10% increase in its net sales, which clocked in at Rs383.7 billion as compared to Rs347.3 billion in 9MFY23. The cement sector includes Cherat Cement Company Limited (CHCC), DG Khan Cement Company Limited (DGKC), Dewan Cement Limited (DCL), Fauji Cement Company Limited (FCCL), Flying Cement Company Limited (FLYING), Kohat Cement Company Limited (KOHC), Lucky Cement Limited (LUCK), Maple Leaf Cement Factory Limited (MLCF), Pioneer Cement Limited (PIOC), Power Cement Limited (POWER), and Thatta Cement Company Limited (THCCL). According to the Monthly Economic Update and Outlook for April 2024, the total cement dispatches (domestic and exports) were 34.5 million tonnes (MT), which is 2.6% higher than the 33.6MT dispatched during the corresponding period of last year.

The improved dispatches were mainly due to the enhanced exports during the period under review. On the cost front, the cost of sales rose by 6% YoY, which stood at Rs277 billion in 9MFY24 compared to Rs261.5 billion in 9MFY23. In addition, the sector paid a higher tax worth Rs25.3 billion against Rs17.6 billion in the corresponding period of last year, depicting a rise of 44%. During 9MFY24, LUCK beat its peers by making the highest sales and declaring the highest net profit. The robust performance is mainly attributable to the company's strong focus on cost optimisation, risk management and innovation to deliver sustainable value to its stakeholders.

On the other hand, POWER and DCL underperformed during this period with negative net profits, suggesting the higher expenses incurred over the nine months.

Challenges facing the cement sector

The cement industry faces two simultaneous but divergent challenges: Pakistan’s per capita cement consumption stands at 182 kilogrammes, which is lower than its regional counterparts, indicating untapped market potential. In addition, the cement industry’s heavy reliance on coal, which accounts for 66% of its energy consumption, exposes it to the fluctuations of global coal prices and diverges from the global trend towards sustainable energy sources.

Future outlook

Smooth formation of the federal and provincial governments, engagement with the International Monetary Fund to secure a longer-term loan programme, and stringent measures against smuggling and illegal currency outflows have yielded positive outcomes, contributing to improved confidence in the business community. However, high inflation and interest rates will continue to pose challenges to the domestic demand for cement in the short term.

Credit: INP-WealthPk