INP-WealthPk

Muhammad Soban

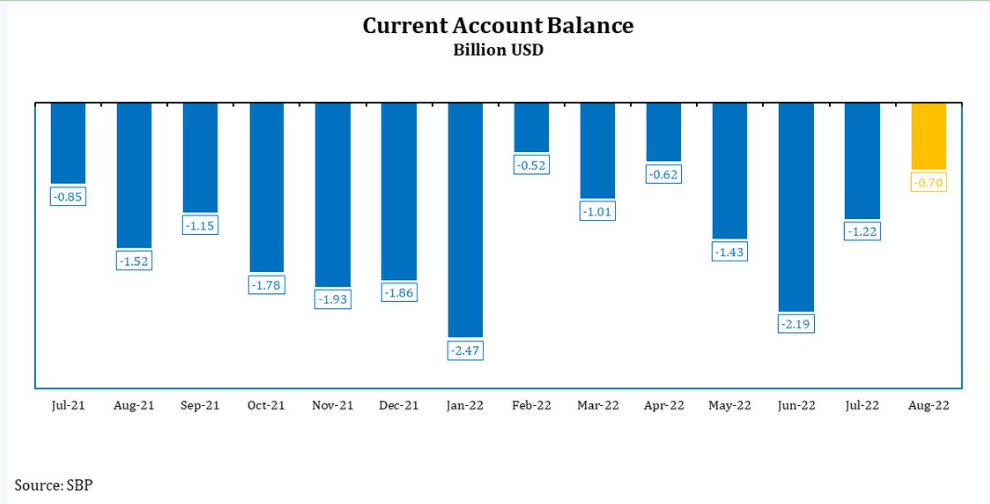

Pakistan’s current account deficit (CAD) shrank by 42 percent in August, reaching $703 million against $1.2 billion in July 2022, according to the statistics released by the State Bank of Pakistan.

According to the SBP data, the CAD shrank by 19 percent during the first two months of the current fiscal year 2022-23 due to decreased import bills and increased exports. In July-Aug of FY23, the country recorded a current account deficit of $1.92 billion compared to $2.374 billion in the same period of last year – a decrease of $456 million. Imports of goods and services declined by $240 million to 11.98 billion dollars in the first two months of this fiscal year. However, exports increased by $519 million to $5.093 billion during the period. Moreover, during the first two months (July-August) of 2022-23, Pakistani workers' remittances declined by 3 percent. In the first two months of the current fiscal year, the expatriates sent $5.25 billion compared with $5.42 billion in the same period last year.

According to the SBP, the decline in the current account deficit is attributed to 11 percent increase in exports and 2 percent decrease in imports. To reduce pressure on the external account and maintain foreign exchange reserves, the State Bank has taken a number of measures to reduce the import bill. The SBP has restricted the imports of goods made its prior approval mandatory. This initiative has helped shrink the imports. There are still some restrictions on the import of various goods since clearances are subject to approval by the SBP before they can be issued.

Pakistan has been facing a severe cash crisis and making efforts to build sliding foreign exchange reserves. The country recently received around $1.1 billion in inflows from the IMF as a tranche of the Extended Fund Facility (EFF). In addition, friendly countries are helping Pakistan to build foreign currency reserves through soft loans to release the pressure on the exchange rate. In this regard, Pakistan’s all-weather friend China has rescheduled a $2.5 billion soft loan.

Moreover, last week, the Saudi Fund for Development (SFD) confirmed the rollover of $3 billion deposits with Pakistan for another year. In December 2021, the SFD deposited the money for one year in an agreement with the State Bank of Pakistan to replenish its depleting foreign exchange reserves.

Credit: Independent News Pakistan-WealthPk