INP-WealthPk

By Irfan Ahmed

The Pakistan Stock Exchange (PSX) commenced on a positive note last week despite the hustle and bustle in the political arena of the country, WealthPK reports.

However, the Pakistani rupee remained under pressure against the greenback, closing at Rs220.84, registering a downtrend of one percent on a week-on-week basis. The reserves of the State Bank of Pakistan (SBP) remained unchanged and stood at $7.6 billion.

The Foreign Direct Investment (FDI) in the country declined by 47% during the first quarter of the current fiscal on a year-on-year basis. The momentum shifted towards the green zone since the current account deficit narrowed by 72.5% to $316 million during September 2022 on a year-on-year basis.

The statement issued by the USA, showing confidence in Pakistan’s nuclear assets, boosted investor sentiment . Moreover, the Asian Development Bank (ADB) finalised a loan of $1.5 billion for Pakistan, thus keeping the momentum strong.

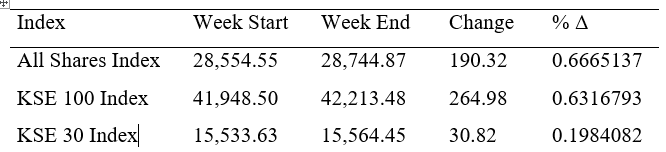

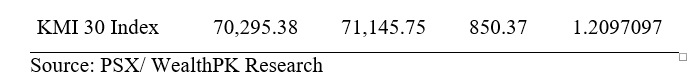

According to WealthPK analysis, the market gained 264.98 points throughout the week and closed at 42,213.48 points, up by 0.63% on a week-on-week basis. The all-share index increased by 190.32 points, the KSE-30 index surged by 30.82 points and the KMI-30 index increased by 850.37 points on a weekly basis.

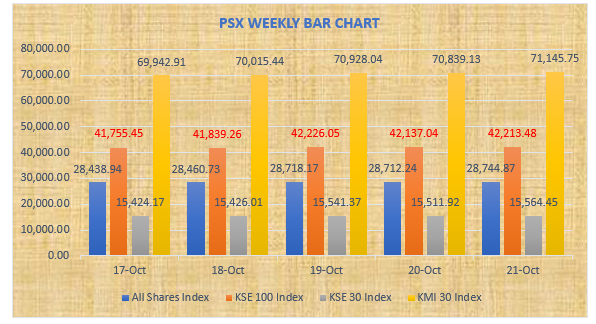

At the start of the new week on October 17, the PSX remained under pressure due to concerns of investors about the country’s political and economic conditions. The KSE-100 index lost 193.05 points and closed at 41,755.45 points against 41,948.50 points on the last working day.

On October 18, the stock market witnessed a lacklustre activity that was observed throughout the trading session due to political unrest. However, the market managed to close on a positive note due to fresh buying in some sectors. It gained 83.82 points as the KSE-100 index closed at 41,839.27 points.

The KSE-100 index continued with a bullish trend on October 19 and gained 386.78 points, showing a positive change of 0.92% and closing at 42,226.05 points against 41,839.27 points on the last working day.

The stock exchange experienced a roller coaster ride on October 20 as the KSE-100 index retreated by 0.21% owing to a persistent decline in the value of the Pakistani rupee against the dollar. By the end of the session, the KSE-100 index fell by 89.01 points and closed at 42,137.04 points.The market remained in anticipation of the Financial Action Task Force’s (FATF) decision over Pakistan’s grey-list status, which was later announced and its name was removed from the list. By the end of the session, the KSE-100 index gained 76.44 points and closed at

42,213.4 points.

By selling its shares last week, the Foreign Investors Portfolio Investment (FIPI) made a profit of up to $3.44 million. Foreign corporates made the most money this week, selling their shares for $3.58 million, followed by banks with $1.46 million and mutual funds with $1.33 million.

Individuals purchased up to $5.43 million in shares, followed by broker proprietary trading, which bought $0.88 million in stock. Insurance companies purchased up to $0.56 million worth of stock.

According to Muhammad Irfan Ahmed, a financial analyst with Arif Habib Limited, the market is expected to remain positive in the upcoming week as investors will celebrate the removal of Pakistan from FATF’s grey list. The market will respond positively after Pakistan gets the $1.5 billion loan pledged by the ADB. However, the political noise will keep the market in check.

Credit : Independent News Pakistan-WealthPk