INP-WealthPk

Muneeb ur Rehman

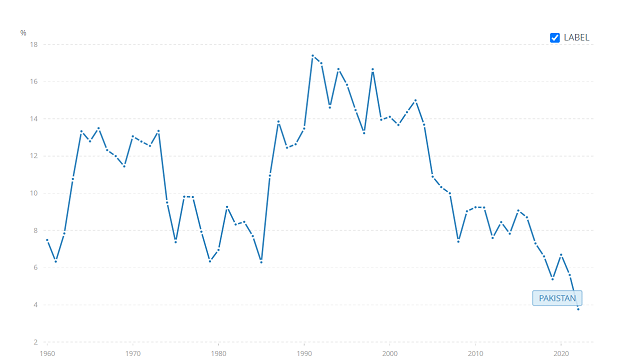

The gap between savings and investment leaves Pakistan with no option but to borrow from external sources to keep its economy afloat. It is, therefore, imperative for Pakistan to bridge this gap through necessary reforms, Asif Ali, former president of the National Bank of Pakistan (NBP), told WealthPK. The following table from the World Bank data clearly shows the declining trend of the savings-to-GDP ratio.

Currently, the investment in Pakistan stands at only 15.1% of the GDP, contrasting with the South Asian average of 30.1%. Lower-middle-income countries, on the other hand, maintain an investment-to-GDP ratio of 28.5%, he mentions. Discussing the causes of low savings that could otherwise be extended to investors, he underscores the role of the informal sector. "The low savings rate in Pakistan is, in part, attributed to the limited inclination of households to save. This trend persists due to the prevalent practice of households refraining from saving within the formal financial sector." Asif Ali added that due to insufficient financial inclusion, a substantial portion of savings in Pakistan is directed towards the informal sector. Individuals often invest in assets such as real estate, and gold, or retain cash in non-formal storage methods, leading to a considerable pool of capital remaining outside the formal financial system. The primary factors contributing to low savings, in his view, extend beyond limited financial inclusion.

They encompass the elevated inflation rate, which channels a substantial portion of income into consumption, and comparatively low-income levels of the people. The savings-investment gap, he says, eventually leads Pakistan to external borrowings due to a mismatch between the domestic savings available and the investment requirements for economic development. To improve the savings rate, the former president put great emphasis on the financial sector. "The financial sector assumes a pivotal role in fostering investment activities within the country, serving as an intermediary that mobilizes resources from savers and allocates them to borrowers." Although foreign savings play a significant role in addressing the saving-investment gap, the most dependable source of funds for investment in a nation is its domestic savings. Unfortunately, Pakistan's performance in this regard is not encouraging, he asserts. In conclusion, bridging the saving-investment gap is indispensable for Pakistan to decrease dependency on external financing.

Credit: INP-WealthPk