INP-WealthPk

BF Modaraba revenue, profit plunge year-on-year

October 27, 2022

Qudsia Bano

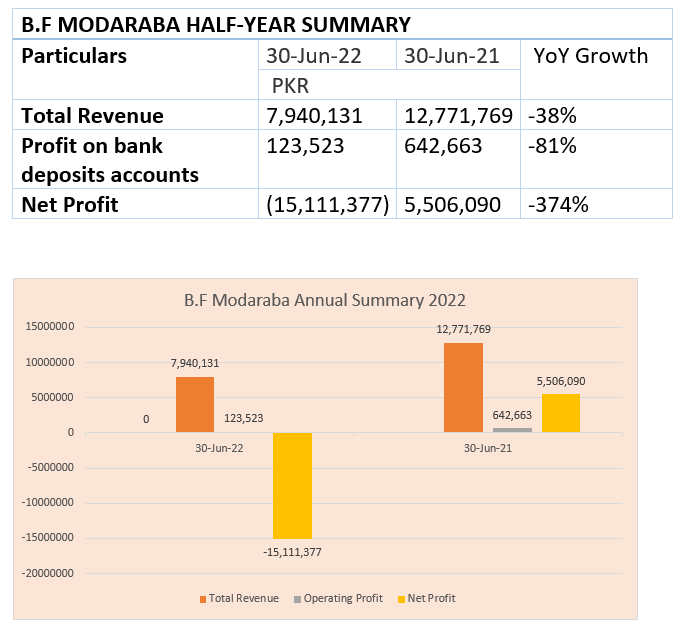

BF Modaraba’s revenue declined 38% to Rs7.9 million in the financial year 2021-22 (FY22) from Rs12.7 million in FY21. Similarly, the profit on bank deposit accounts of the company decreased 81% to Rs123,523 during FY22 as against Rs642,663 in FY21.

The company posted a net loss of Rs15.1 million in FY22 compared to a profit of Rs5.5 million in the previous year, showing a massive negative growth of 374%, reports WealthPK.

Performance in 2021

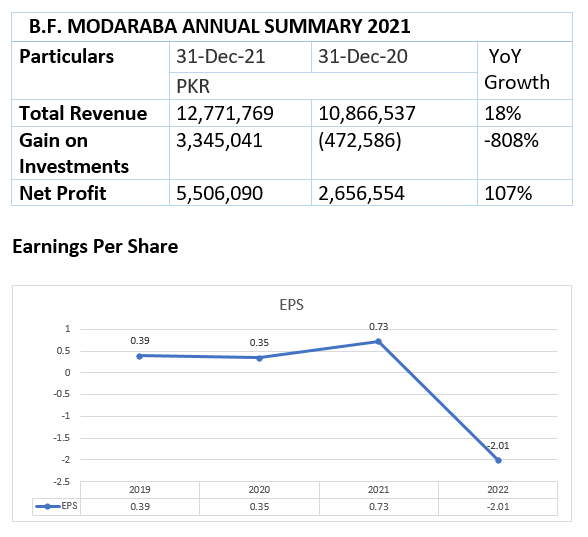

During the calendar year 2021, the company, however, maintained a strong sales trend, generating revenue of Rs12.7 million over Rs10.8 million in 2020, posting an increase of 18% year-on-year.

The gain on investments for CY21 stood at Rs3.3 million, up by gigantic 808% from a loss of Rs0.47 million in CY20.

The profit-after-taxation for the year reached Rs5.5 million, higher by striking 107% than just Rs2.6 million in CY20.

The earnings per share of the company steadily inched upwards from 2019 to 2021, but decreased steeply to minus Rs2.01 in 2022.

BF Modaraba was formed under the Modaraba Companies and Modaraba (Floatation and Control) Ordinance, 1980.

EA Management (Pvt) Limited oversees the management of BF Modaraba, which primarily engages in leasing, Musharika, and Murabaha transactions, as well as makes investments in listed securities and also does sugar trading.

Credit : Independent News Pakistan-WealthPk