INP-WealthPk

Qudsia Bano

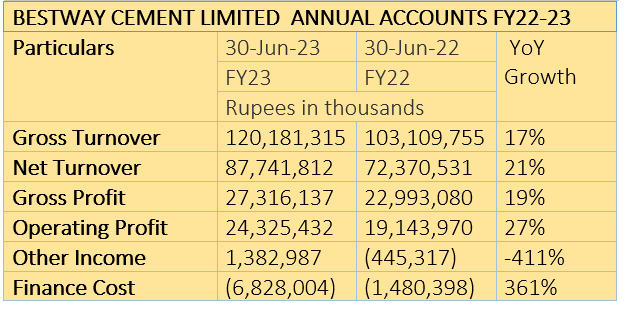

Bestway Cement Limited, a prominent player in the cement industry, has revealed its financial results for the fiscal year ending on June 30, 2023, showcasing a robust growth trajectory with significant improvements across key metrics. During the fiscal year, the company's gross turnover reached an impressive Rs120.18 billion, marking a substantial year-on-year growth of 17%. This growth in gross turnover underlines the company's ability to capture market demand and capitalise on growth opportunities. The net turnover for FY23 stood at Rs87.74 billion, reflecting a noteworthy 21% year-on-year increase. This metric highlights the company's efficiency in generating sales revenue after accounting for discounts and returns. Bestway Cement's gross profit amounted to Rs27.32 billion, demonstrating a commendable 19% year-on-year growth.

This increase in gross profit underscores the company's effective cost-management strategies and robust pricing dynamics. The operating profit for the fiscal year reached Rs24.33 billion, reflecting a strong 27% year-on-year growth. This growth signifies the company's ability to efficiently manage its operational costs and generate profit from its core activities. One remarkable factor influencing the company's financial performance is the significant upturn in other income, reaching Rs1.38 billion. This starkly contrasts the previous year's figures, reflecting a substantial 411% increase. This income diversification underscores the company's ability to explore alternative revenue streams. However, the finance costs increased to Rs6.83 billion, showing a substantial 361% year-on-year growth. This indicates the company's higher financial expenses, likely due to expansion initiatives and the broader economic environment.

Bestway Cement achieved a profit-before-taxation of Rs22.60 billion, demonstrating a 17% growth compared to the previous fiscal year. This growth highlights the company's effective financial management strategies and ability to optimise its tax position. The profit-after-tax for the fiscal year stood at Rs11.89 billion, reflecting a solid 16% year-on-year increase. This growth in profitability emphasises the company's capacity to create substantial value for its stakeholders. The earnings per share (EPS) for FY23 stood at Rs19.94, marking a notable 16% growth compared to FY22. This growth in EPS indicates the company's strong profitability on a per-share basis.

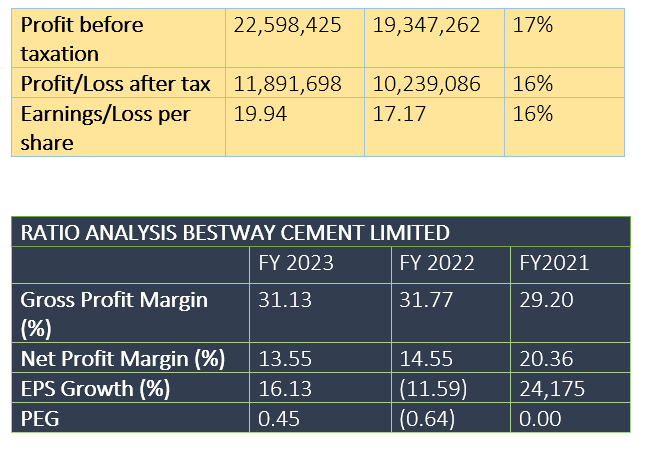

Gross profit margin (%)

Bestway Cement's gross profit margin for FY23 stood at 31.13%, showing a slight decline from the previous year's 31.77%. This decrease could be attributed to factors such as increased production costs or changes in pricing strategies. Despite the minor reduction, the company maintains a healthy gross profit margin, indicating its ability to effectively manage production costs while generating revenue.

Net profit margin (%)

The net profit margin for FY23 was reported at 13.55%, down from 14.55% in the previous fiscal year. This reduction reflects the company's challenges in controlling operational expenses or coping with changes in the broader economic landscape. While the margin has decreased, it's important to note that Bestway Cement continues to maintain a reasonable level of profitability relative to its revenue.

EPS growth (%)

The EPS growth for the fiscal year 2022-23 shows a positive trajectory, with a growth rate of 16.13%. This marks a significant recovery from the negative growth of -11.59% observed in FY22. The positive EPS growth indicates that the company's profitability on a per-share basis has improved, potentially driven by better cost management or increased revenue.

PEG ratio

The Price/Earnings to Growth (PEG) ratio for FY23 stands at 0.45, revealing an improvement compared to the previous fiscal year's -0.64. The PEG ratio is an important metric as it relates the company's price-to-earnings ratio (P/E) to its EPS growth rate. The positive PEG ratio suggests that the company's stock price may be more in line with its growth potential compared to the past year.

About the company

Bestway Cement is a public limited company incorporated in Pakistan on December 22, 1993, under the Companies Ordinance, 1984 (repealed with the enactment of the Companies Act, 2017 on May 30, 2017). The company is principally engaged in the production and sale of cement. It is a subsidiary of Bestway International Holdings Limited (BIHL), which holds 56.43% shares in the firm. BIHL is a wholly owned subsidiary of Bestway Group Limited (BGL) (the ultimate parent company). Both BIHL and BGL have been incorporated in Guernsey, one of the Channel Islands in the English Channel.

Credit: INP-WealthPk