INP-WealthPk

Hifsa Raja

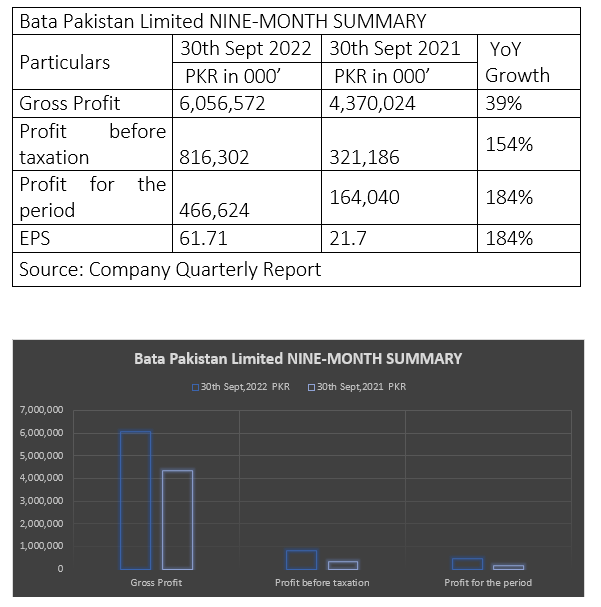

Bata Pakistan Limited’s gross profit stood at Rs6.05 billion in the first nine months of 2022, which was 39% higher than Rs4.37 billion earned over the corresponding period of 2021. Similarly, the before-tax profit jumped 154% to Rs816 million in 9MCY22 from Rs321 million in the corresponding period of CY21. The post-tax profit increased a massive 184% to Rs466 million in 9MCY22 from Rs164 million over the corresponding period of CY21, reports WealthPK.

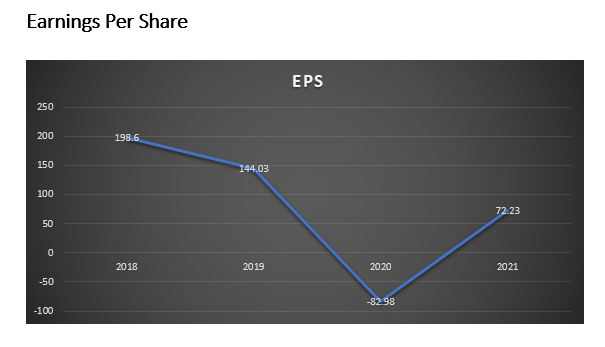

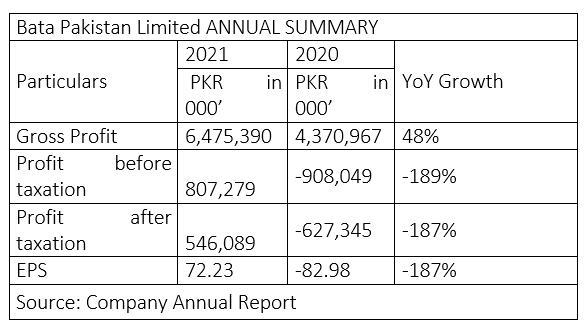

The company’s earnings per share (EPS) stood at Rs198.6 in 2018 before dropping to Rs144.03 in 2019. Then the EPS took a plunge to minus Rs82.98 in 2020. However, the company recovered from losses and showed its EPS value of Rs72.23 in 2021.

Bata earnings growth analysis

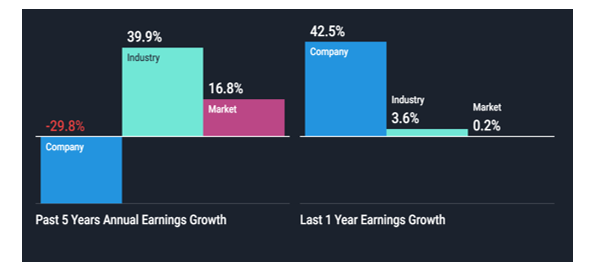

Bata’s earnings growth over the past year (42.5%) far exceeded the luxury industry’s 3.6% growth. However, over the previous five years, Bata's earnings have stayed minus 29.8%.

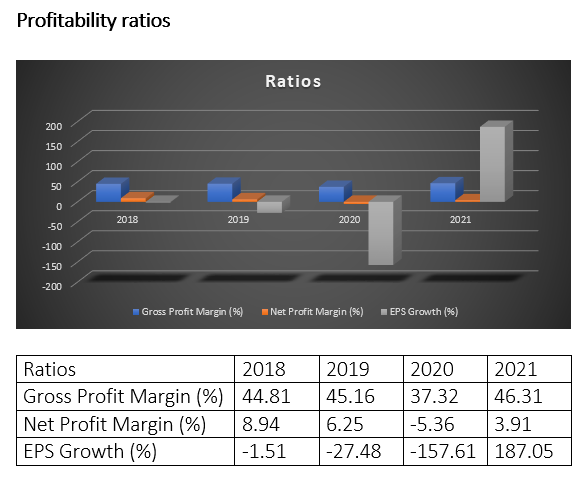

The company’s gross profit margins stood at 44.81% in 2018, 45.16% in 2019, 37.32% in 2020 and 46.31% in 2021, which showed the firm continued to perform well over the years. However, the net profit margin of Bata Pakistan showed below-average performance over these years as its net profit stayed below the 10% average.

The company’s EPS growth was quite impressive in 2021 at 187.05%, meaning the firm rebounded from losses sustained over the preceding three years. Despite slowdown in economy and high inflation, the company remains upbeat about the business's future growth.

Performance in 2021

During 2021, the company’s gross profit stood at Rs6.4 billion against Rs4.37 billion in 2020, registering an increase of 48% year-on-year. The company earned a before-tax profit of Rs807 million in 2021 compared to a loss-before-tax of Rs908 million in 2020. Similarly, the company pocketed an after-tax profit of Rs546 million in 2021, recovering from an after-tax loss of Rs627 million in 2020.

The principal activity of the company is manufacturing and sale of footwear of all kinds along with the sale of accessories and hosiery items.

Credit : Independent News Pakistan-WealthPk