INP-WealthPk

Qudsia Bano

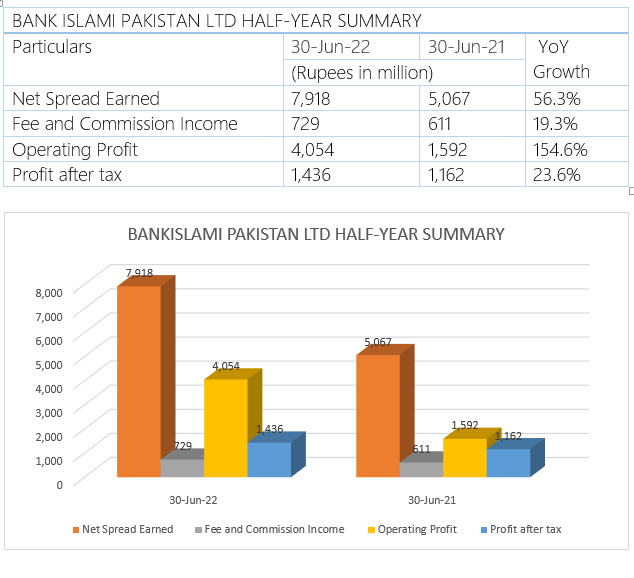

BankIslami Pakistan Ltd.’s net spread increased to Rs7.9 billion in the first six months of CY2022 ending June 30 compared to Rs5.1 billion in the corresponding period of CY2021, registering an increase of 56.3%, reports WealthPk.

Similarly, the fee and commission income increased 19.3% during the six months of CY2022 to PKR729 million from PKR611 million in the corresponding period of the previous year.

The operating profit also increased 154.6% during six months and reached PKR4.1 million compared to PKR1.6 million in June 2021. The profit after tax registered a growth of 23.6% and stood at PKR1.4 million.

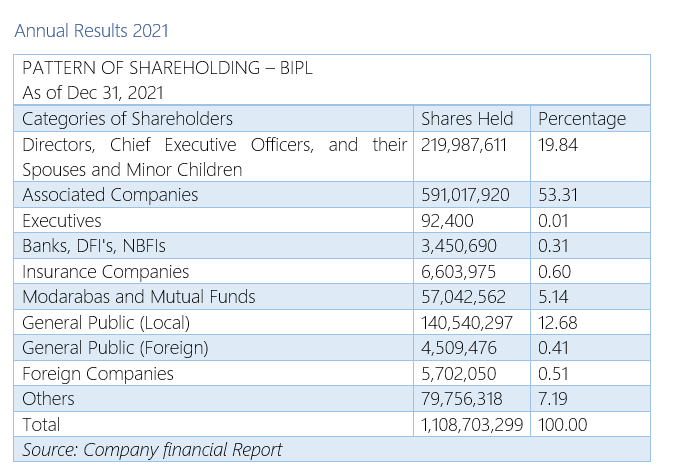

As of Dec 31, 2021, directors, chief executive officers, and their spouses and minor children owned 19.84% of the company’s shares; associated companies 53.31%; banks, development financial institutions, and non-banking financial institutions 0.31%; modarabas and mutual funds 5.14%; general public (local) 12.68%; general public (foreign) 0.41% and others 7.19%.

Financial Performance

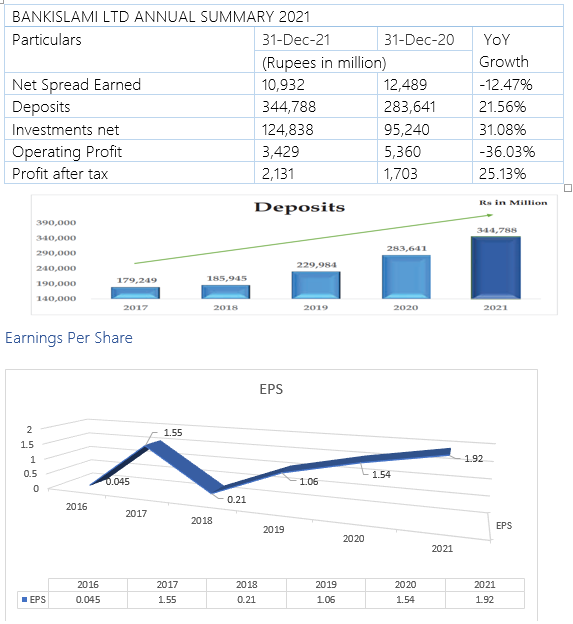

During the CY2021, the bank’s deposits increased 21.56% to PKR344.8 billion from PKR283.6 billion in the corresponding period of the previous year. However, the net spread earned decreased by 12.48% to PKR10.9 billion from PKR12.5 billion in CY2020. The profit after taxation for the year increased 25.13% to PKR2.1 billion from PKR1.7 billion in the corresponding period of the previous year.

The earnings per share (EPS) of the bank witnessed a mix of trends during the recent years. In 2017, the EPS stood at PKR1.55 and then decreased to PKR0.21 in 2018. Ever since, the EPS is on an increasing trend. The EPS stood at PKR1.92 in 2021.

BankIslami Pakistan Limited was established in Pakistan on October 18, 2004 as a public limited company to conduct the operations of an Islamic Commercial Bank in compliance with the Shariah. On March 18, 2005, the State Bank of Pakistan (SBP) authorized the bank as a "Scheduled Islamic Commercial Bank."

Credit: Independent News Pakistan-WealthPk