INP-WealthPk

Qudsia Bano

The State Bank of Pakistan (SBP) has released its mid-year performance review of the banking sector for 2023, covering the period from January to June 2023 (1HCY23). This comprehensive review not only assesses the banking sector's performance and soundness but also provides insights into the broader financial landscape, including financial markets and systemic risk factors. Acknowledging the persistent challenges in the macroeconomic environment during the first half of CY23, the review notes that domestic financial conditions tightened, and the operating environment remained under stress due to elevated inflation and prolonged uncertainty.

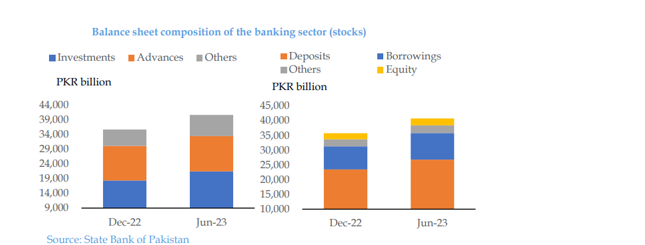

Despite these hurdles, the banking sector exhibited resilience, with its balance sheet expanding by a notable 14%. This growth was primarily driven by investments in government securities, coupled with strong inflows of deposits. Banks also demonstrated a noticeable reliance on borrowings during this period.

While the overall balance sheet grew, advances within the banking sector recorded muted growth. The private sector experienced a contraction in advances, while the public sector sought additional financing, primarily for commodity finance operations. According to the report available with WealthPK, one of the standout features of 1HCY23 was the improvement in asset quality indicators. The net non-performing loans (NPLs) to loans ratio dropped to 0.45% at the end of June 2023, compared to 0.68% in June 2022.

This improvement was attributed to banks setting aside higher provisions from their steady earnings. Profitability indicators also saw significant improvement, with the return on assets (RoA) rising to 1.5% in 1HCY23, up from 1% for the entire CY22. These higher earnings also contributed to an improvement in the Capital Adequacy Ratio (CAR) of the banking sector, which reached 17.8% by the end of June 2023, compared to 17% by the end of December 2022.

In line with the recent trend, the investment portfolio of banks increased at a high rate of 16.9% to Rs21.5 trillion during 1HCY23. Solvency indicators further improved, highlighting the banking sector's ability to withstand severe hypothetical shocks, as indicated by the latest stress testing results. Kashif Ali, Group Head at MCB Bank Limited, said while talking to WealthPK that while advances in the private sector experienced a contraction, the public sector's access to additional financing, especially for commodity finance operations, provided a cushion. “The sector's ability to adapt to the changing lending landscape is indeed commendable,” he said.

One of the most encouraging aspects is the improvement in asset quality indicators, he said. The reduction in the ratio of net NPLs to loans from 0.68% in June 2022 to 0.45% in June 2023 reflected prudent risk management and the banks’ commitment to maintaining a healthy loan portfolio. Kashif said, “While these achievements are noteworthy, we must remain vigilant in address the risks outlined in the systemic risk survey, particularly foreign exchange risk, rising domestic inflation, and political uncertainty. Confidence in our financial system and regulatory oversight is crucial, but proactive risk management remains paramount.”

Credit: INP-WealthPk