INP-WealthPk

Ayesha Mudassar

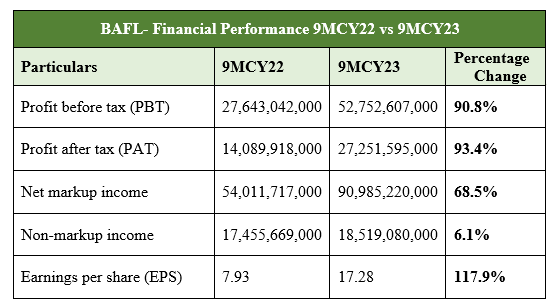

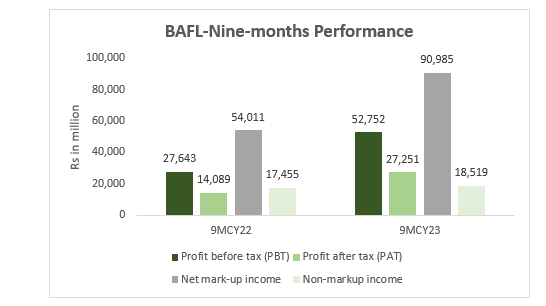

The Bank Alfalah Limited (BAFL) has posted an unconsolidated profit-before-tax (PBT) of Rs 52.7 billion for the nine months ended September 30, 2023, with an impressive growth of 90.8% over the corresponding period of the previous year. According to the financial results submitted to the Pakistan Stock Exchange (PSX), the bank recorded a profit-after-tax (PAT) of Rs 27.2 billion for 9MCY23, against a PAT of Rs 14.08 billion in the corresponding period of the last year. The BAFL announced an earnings per share (EPS) of Rs 17.28 for the period under review.

The net markup income posted colossal growth, reaching Rs 90.9 billion in 9MCY23, compared to Rs 54.01 billion in the 9MCY22. The combination of net earning assets growth and re-pricing of the asset book at higher rates has improved margins over the corresponding period of the previous year. Furthermore, the non-markup interest income for nine months reached Rs 18.5 billion, representing a 6.1% year-on-year increase. Higher fee and derivates income were offset by lower foreign exchange income and capital loss. The bank's continuous focus on expediting the digital transformation journey, combined with delivering unparalleled services to the customers, facilitated a robust fee income growth of 32.8% to reach Rs 10.5 billion during nine months of the calendar year 2023, as compared to Rs 7.9 billion over the corresponding period of the last year.

Dividend income increased by 2.4% to reach Rs 857 million for the nine months ended September 30, 2023, as compared to Rs. 837 million for the nine months ended September 30, 2022. Furthermore, operating expenses increased 32% to Rs 46.2 billion, in line with the bank's strategy to open new branches and invest in digital technologies platforms alongside inflation, rupee depreciation, marketing, and flood relief efforts. The deposits were reported at Rs 1.82 trillion at the end of September '23, with year-on-year (YoY) growth of 31.5%. This reflects the bank's well-thought-out strategy of increasing its market share. Overall, the bank pursued its approach of consistent growth through a robust risk management framework and improved customer experience through technologically driven automation and digitization.

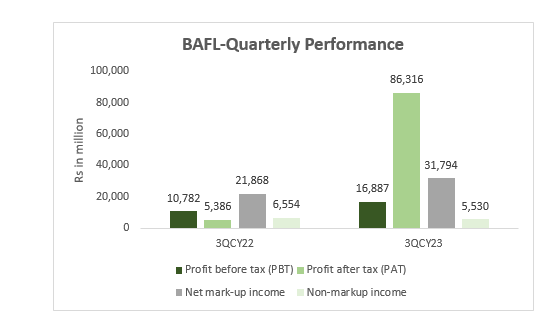

Quarterly Review

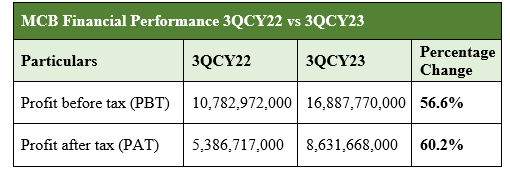

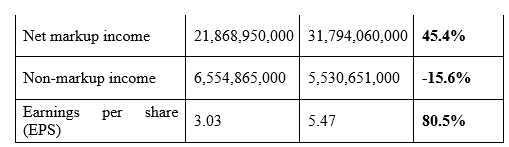

The Bank Alfalah Limited's quarterly accounts reveal significant growth and improved profitability compared to the same quarter of 2022. The net markup and non-markup income increased to Rs 37.3 billion, representing a growth of 31.3%. A key contribution was markup income, which grew significantly by 45.4% and stood at Rs 31.7 billion. Non-markup income was reduced to Rs 5.53 billion, reflecting a decline of 15.6%, suggesting higher operating costs. Furthermore, the BAFL witnessed a profit growth of 60.2% for the quarter ended September 30, 2023, as it declared a profit after tax of Rs 8.6 billion for 3QCY23, compared to Rs 5.3 billion in the same quarter of the previous calendar year.

The earnings per share stood at Rs 5.47, exhibiting a growth rate of 80.5%, indicating higher earnings generated per share. Overall, Bank Alfalah's financial performance highlights significant growth, improved profitability, and vigilant monitoring of expenses during the quarter.

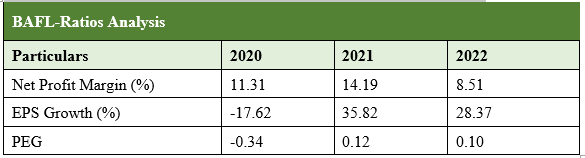

Ratio Analysis (2020-2022)

The net profit margin for calendar years 2020, 2021, and 2022 stood at 11.31%, 14.19%, and 8.51%, respectively. The net profit margin represents the percentage of revenue that translates into net profit. The declining trend from CY21 to CY22 indicates a decrease in profitability, primarily due to increased operating expenses and worker's welfare funds.

The bank's earnings per share (EPS) growth rate for CY20, CY21, and CY22 was -17.62%, 35.82%, and 28.37, respectively. The positive EPS growth in CY21 and CY22 signifies an increase in earnings per share, indicating improved profitability. However, the negative EPS growth rate in CY20 suggests a decline in EPS, indicating reduced profitability during that period. The price/earnings to growth (PEG) ratio for CY20, CY21, and CY22, was -0.34, 0.12, and 0.10, respectively. The PEG ratio evaluates the relationship between a company's price-to-earnings (P/E) ratio and its EPS growth rate. A PEG ratio below 1 is generally considered favorable, as it indicates that the stock may be undervalued relative to its growth potential. In this case, the PEG ratio suggests a positive outlook, with the bank's earnings growth aligning with its valuation.

Future Outlook

Despite prevailing macroeconomic challenges, Bank Alfalah is determined to achieve sustainable growth and create long-term shareholder value. The bank's strategic pillars include the expansion of market share, a heightened focus on the consumer sector, robust support for SME growth, broadened cash management capabilities, and the adept use of technology to cater to our customers' banking needs. Additionally, the bank remains steadfast in its commitment to invest in human capital and nurture a culture characterized by care, collaboration, creativity, and innovation. Through strategic vision, a customer-centric approach, dedication to innovation, and a holistic focus on human capital, Bank Alfalah is poised to embrace the future and achieve sustainable success.

inpCredit: INP-WealthPk