INP-WealthPk

Ayesha Mudassar

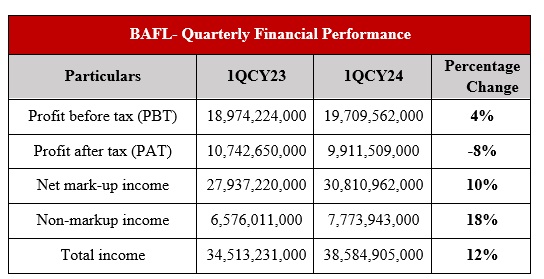

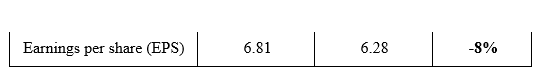

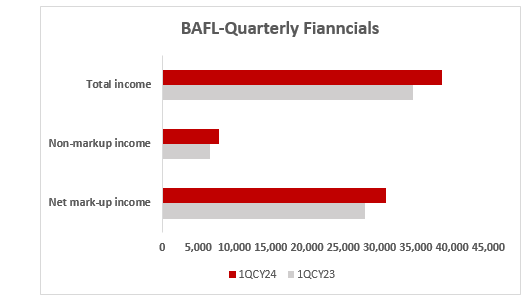

Bank Alfalah Limited (BAFL), one of the country’s largest commercial banks, recorded a total income of Rs38.5 billion for the quarter that ended

on March 31, 2024, with a growth of 12% over the corresponding period of the last calendar year, reports WealthPk. As per the quarterly report, the bank earned a net markup income of Rs30.8 billion compared to Rs27.9 billion in 1QCY23. The combination of net earning assets growth and re-pricing of the asset book at higher rates led to an increase in markup income. Furthermore, the non-markup interest income for the quarter reached Rs7.7 billion, representing an 18% year-on-year (YoY) increase. Higher fee and commission income and gains from derivatives were the key contributing factors to the positive variance.

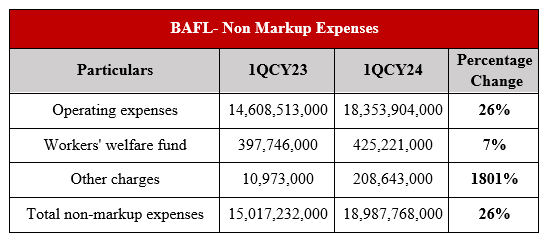

Despite higher income, Bank Alfalah saw its profit fall to Rs9.9 billion during 1QCY24, which is nearly 8% lower than its profit in the same period last year. The decline in profit is primarily due to lower foreign exchange income, higher operating expenses, and increased taxation. The bank’s non-markup expenses ballooned to Rs18.9 billion in 1QCY24, up from Rs15.01 billion in 1QCY23, marking a 26% YoY rise. Its operating expenses, which grew from Rs14.7 billion to Rs18.3 billion, were a major contributor to higher non-markup expenses.

Moreover, other charges experienced a dramatic increase of 1,801% during the quarter under review.

The Year 2023

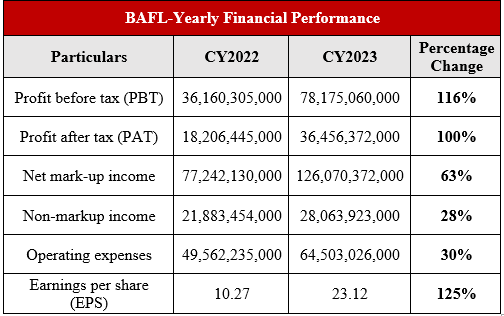

Bank Alfalah delivered exceptional performance throughout 2023, surpassing significant milestones including the establishment of over 1,000 branches and exceeding Rs2 trillion in deposits. These accomplishments have enhanced the bank’s industry ranking in terms of deposit base, total assets, and branch footprints. The bank posted an unconsolidated before and after-tax profit of Rs78.1 and Rs36.4 billion, respectively, for the year ended December 31, 2023. Moreover, the BAFL announced an Earnings per share (EPS) of Rs23.12 during 2023.

The net markup income posted colossal growth, reaching Rs126 billion for CY23, compared to Rs77 billion in CY22. Furthermore, the non-markup interest income for the year reached Rs28 billion, representing a 28% YoY increase. Furthermore, operating expenses increased 30% to Rs64.5 billion, in line with the bank’s strategy to open new branches and invest in digital technology platforms alongside inflation, rupee depreciation, marketing, and flood relief efforts. Overall, the bank pursued its approach of consistent growth through a robust risk management framework and improved customer experience through technologically driven automation and digitization.

Forward Outlook

Bank Alfalah is determined to advance its deposit base, enhance its local presence, and deliver unparalleled services to esteemed customers. The bank's strategic pillars include a heightened focus on the consumer sector, robust support for SME growth, broadened cash management capabilities, and the adept use of technology to cater to our customers' banking needs. Additionally, the bank remains steadfast in its commitment to invest in human capital and nurture a culture characterized by care, collaboration, creativity, and innovation. Through strategic vision, a customer-centric approach, dedication to innovation, and a holistic focus on human capital, Bank Alfalah is poised to embrace the future and achieve sustainable success.

Credit: INP-WealthPk