INP-WealthPk

Ayesha Mudassar

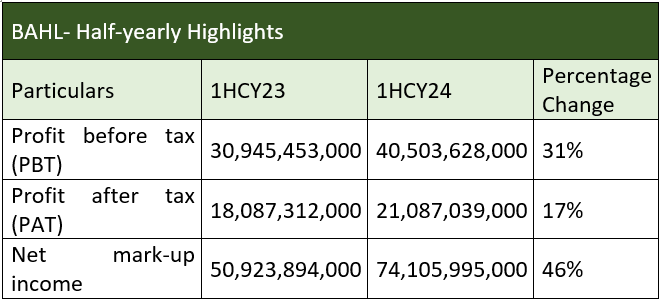

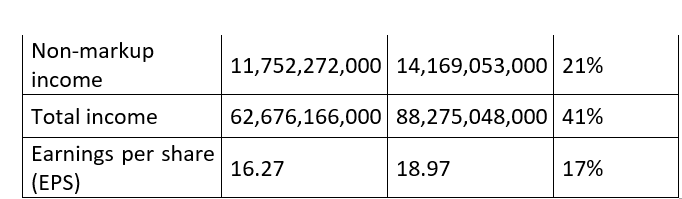

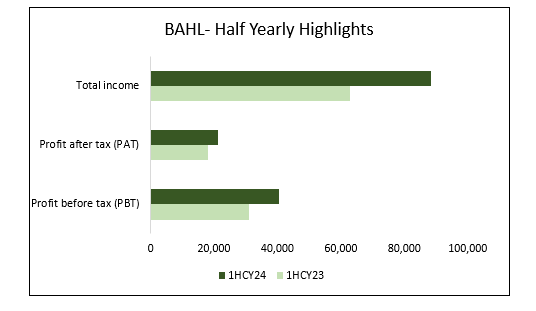

Bank Al Habib Limited (BAHL) reported a 17% rise in net profit during the first half of the ongoing calendar year 2024 compared to the corresponding period of 2023, reports WealthPK.

As per the bank’s unconsolidated interim statement, the profit-before-tax (PBT) increased by 31%. This resulted in earnings per share (EPS) of Rs18.97, up from Rs16.27 recorded in the same period last year.

For the first half of CY24, the bank registered a net markup income of Rs74.1 billion compared to Rs50.9 billion in the same period of 2023. Additionally, the non-markup income reflected a 21% year-on-year (YoY) increase. This rise in non-markup income was primarily driven by higher fee and commission income and growth in other income. The robust financial performance reflects the bank’s commitment to a customer-centric approach and prudent risk management practices.

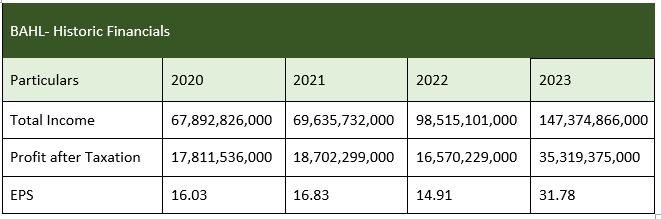

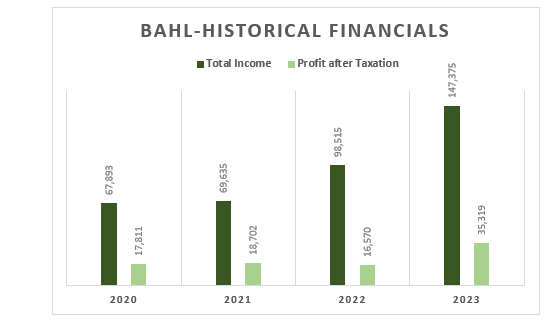

Financial performance in 2020-23

The analysis of Bank Al Habib’s performance over the 2020-23 period reveals a consistent positive trend in total income as it grew from Rs67.8 billion in 2020 to Rs69.6 billion in 2021, before jumping to Rs98.5 billion in 2022 and significantly rising to Rs147.3 billion in 2023. The substantial rise in 2023 was primarily attributed to an enormous rise in both net markup and non-markup income. The bank achieved its highest PAT in 2023, amounting to Rs35.3 billion, driven by considerable growth in total income for the year.

Furthermore, the bank witnessed an increasing EPS over the years, with the highest EPS of Rs31.78 in 2023. This suggests the bank’s enhanced financial performance and greater value generated for shareholders.

Financial ratios

Ratios of Bank Al Habib offer valuable insights into the company’s performance and growth patterns over the past four years. The bank experienced variations in its net profit margin as it plunged to 9.45% in CY23 from 14.22% in CY20, and 16.02% in CY21. This downward trajectory suggests challenges in cost management and pricing strategies, which have adversely affected the company’s profitability. In terms of EPS, the bank saw a significant decline from 59.5% in 2020 to 4.99% in 2021. Between 2021 and 2022, the rate further declined to -11.41%, but then a significant turnaround was observed in 2023, with EPS posting a 113.15% increase. This indicates a notable improvement in profitability in 2023.

The price/earnings to growth (PEG) ratio turned negative (-0.32) in 2022 due to the decrease in EPS growth, reflecting a challenging period.

About the bank

Bank Al Habib was incorporated in Pakistan on October 15, 1991, as a public limited company under the now repealed Companies Ordinance, 1984. It is a scheduled bank principally engaged in the business of commercial banking.

Future outlook

The bank will maintain its critical role in generating sustainable value for stakeholders. In the foreseeable future, the bank’s strategic focus will be on advancing digitisation and expanding financial solutions across all segments.

Credit: INP-WealthPk