INP-WealthPk

Shams ul Nisa

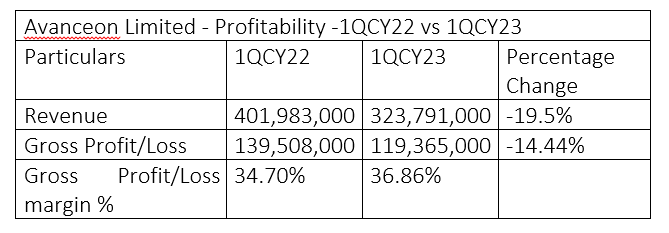

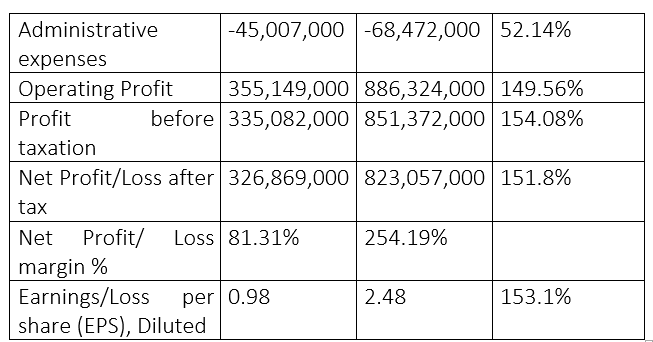

The net profit of Avanceon Limited, a provider of industrial automation, surged by a remarkable 151.8% to Rs823 million in the quarter ended March 31, 2023 from Rs326.8 million over the same period last year. However, the company’s revenue for the quarter declined by 19.5% to Rs323.7 million from Rs401.9 million recorded in the same period last year. The decline in revenue is mainly attributed to tough economic conditions, restrictions on imports, and delay in opening of import letters of credit by banks.

Similarly, the gross profit fell by 14.44% in 1QCY23 to Rs119.36 million from Rs139.5 million in 1QCY22. This decrease in gross profit was because of increased finance costs due to the rapid devaluation of the rupee against the US dollar. However, the gross profit margin got better, reaching 36.86% in 1QCY23, slightly higher than 34.70% recorded in1QCY22.

Administrative expenses increased by 52.14% to Rs68.47 million in 1QCY23 from Rs45 million in 1QCY22. In contrast to the decline in revenue and gross profit, the company’s operating profit surged 149.56% to Rs886.3 million in 1QCY23 from Rs355.1 million in 1QCY22. The surge pushed the net profit margin to a huge 254.19% in 1QCY23 from 81.31% in 1QCY22. The earnings per share (EPS) of the company moved up by 153.1% to Rs2.48 in 1QCY23 against Rs0.98 in 1QCY22.

Assets analysis

![]()

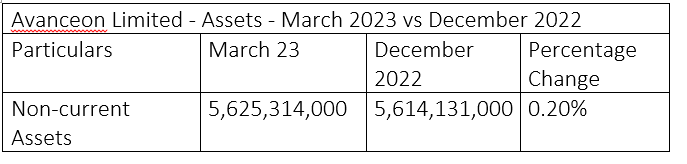

Avanceon Limited’s non-current assets, which include property and equipment, long-term investments, long-term loans and deposits, saw a marginal increase of 0.20% to Rs5.62 billion in March 2023 from Rs5.61 billion in December 2022. However, the company’s current assets, which include stocks in trade, trade debts, contract assets, deposits, short-term investments, cash and bank balance, increased by 24.01% to Rs4.88 billion in March 2023 from Rs3.9 billion in December 2022. As a result, the company’s total assets grew 10.02% to Rs10.5 billion in March 2023 from Rs9.55 billion in December 2022.

Equity and liabilities analysis

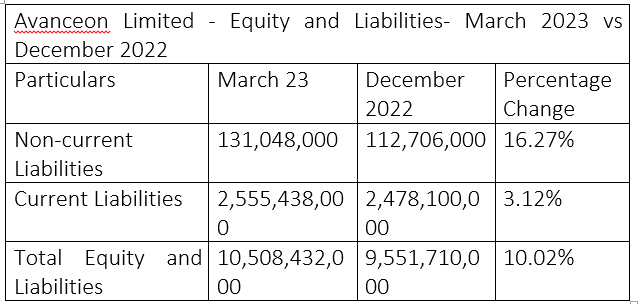

The company’s non-current liabilities increased 16.27% to Rs131.04 million in March 2023 from Rs112.7 million in December 2022. However, the company’s current liabilities increased 3.12% to Rs2.55 billion in March 2023 from Rs2.47 billion in December 2022. Hence, the company recorded total equity and liabilities of Rs10.5 billion in March 2023, higher by 10.02% than Rs9.55 billion in December 2022.

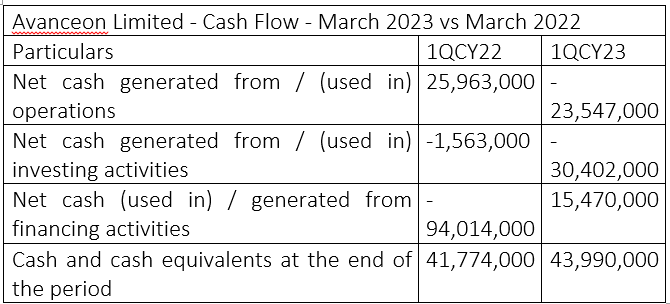

Cash flow analysis

Avanceon Limited used net cash of Rs23.5 million in core operations during 1QCY23 compared to Rs25.9 million generated from operations in the same period last year. The company followed the same trend of using cash in investing activities in 1QCY23 compared to 1QCY22. The investing activities include purchasing property, plant and equipment, profit on bank deposits, and net change in long-term advances and deposits. The company used net cash of Rs30.4 million for the first quarter of 2023, soaring by almost twenty-nine-fold compared to Rs1.5 million in the same period last year.

The company recorded net cash generation of Rs15.47 million from financing activities during the first quarter of 2023, compared to net cash of Rs94 million used in financing activities during the same period last year. Avanceon Limited’s cash and cash equivalents at the end of the period stood at Rs43.9 million in 1QCY23 against Rs41.7 million in 1QCY22.

Credit: INP-WealthPk