INP-WealthPk

Qudsia Bano

Net sales of Avanceon Limited, the provider of industrial automation, stood at Rs4.6 billion in the first nine months of the calendar year 2022 (9MCY22), up 28%, from Rs3.5 billion during the same period of 2021. The company's profit-before-tax clocked in at Rs1.9 billion in 9MCY22 as opposed to Rs751 million in 9MCY21. The profit-after tax came in at Rs1.8 billion, up a huge 185% from Rs642 million in 9MCY21, reports WealthPK.

According to the company's operating financial statistics for 9MCY22, revenues remained on the lower and higher sides in terms of US dollar and the Pakistani rupee because of the swift depreciation of the latter currency. The rupee devaluation contributed significantly to the other income, but the revenue side was still lower than expected due to the State Bank not approving the letters of credit for foreign vendors in the previous two quarters, which negatively impacted the company's Pakistan business during the reporting period.

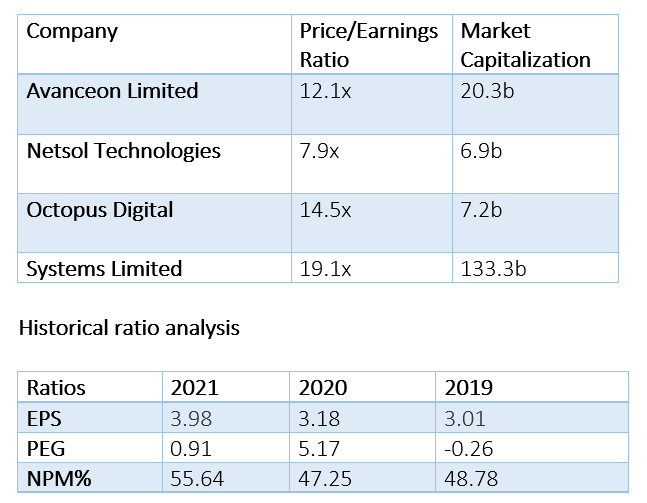

Industry comparison

Based on its price-to-earnings ratio (12.1x) in comparison to the average (15.2x) of its peers, Avanceon Limited remains a solid investment destination. The market capitalisation of Avanceon Limited is the second-highest among its competitors, standing at Rs20.3 billion, behind Systems Limited, which has the highest market capitalisation of Rs133.3 billion.

The earnings per share of the company demonstrated a mixed trend during recent years. During CY19, the EPS stood at Rs3.01, which increased to Rs3.18 in CY20 and then to Rs3.98 in CY21. The price earnings growth (PEG) of the company also showed positive and negative trends during recent years as in CY19 the price earnings growth was -0.26 before improving to 5.17 in CY20 and dropping again to 0.91 in CY21.

The net profit margin of the company also showed steady growth in recent years. During CY19, the net profit margin clocked in at 48.78%, which slightly decreased to 47.25% in CY20. However, net profit margin again increased in CY21 and stood at 55.64%.

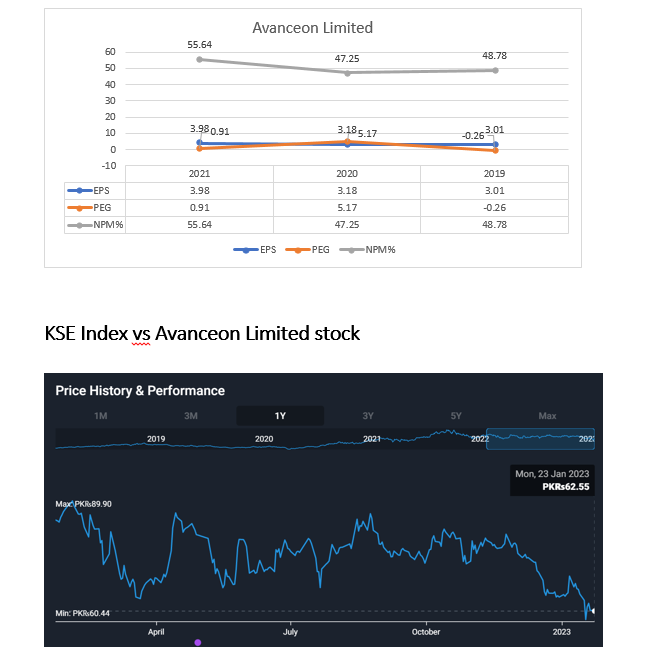

The performance of Avanceon Limited’s stock is streamlined to that of the market average. The share price of the company was high during the first quarter of CY22 and stood at Rs89.90, which gradually increased and decreased as per the market situation. Share price of Avanceon Limited stood at Rs65.55 as per the January 2023 statistics.

About the company

Avanceon Limited was incorporated in Pakistan on March 26, 2003 as a private limited company. It was converted into a public company on March 31, 2008 under the now repealed Companies Ordinance, 1984. The principal activity of the company is trade in products of automation and controlled equipment and to provide related technical services.

Credit: Independent News Pakistan-WealthPk