INP-WealthPk

Ayesha Mudassar

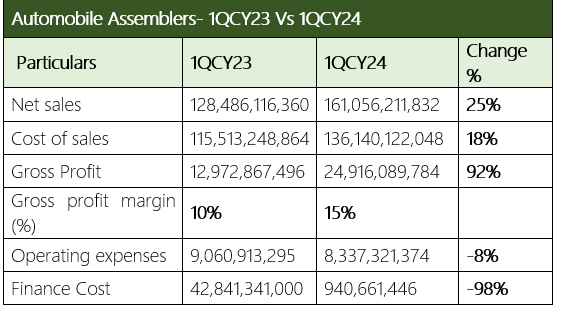

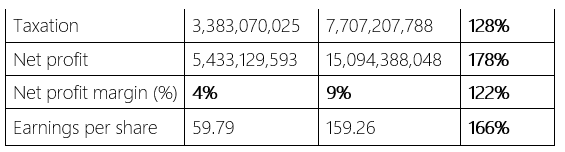

The net sales of large-cap automobile assemblers grew by 25%, gross profit by 92%, and net profit by an enormous 178% in the first quarter (January-March) of the ongoing calendar year 2024, compared to the corresponding quarter of the last calendar, reports WealthPK.

The large-cap automobile assemblers include Indus Motor Company Limited (INDU), Millat Tractors Limited (MTL), Atlas Honda Limited (ATLH), Sazgar Engineering Works Limited (SEWL), and Honda Atlas Cars (Pakistan) Limited. The automobile assemblers posted net sales of Rs161 billion and gross profit of Rs24.9 billion in 1QCY24. The net profit stood at Rs15.09 billion against Rs5.43 billion in the same period last year, resulting in earnings per share (EPS) of Rs159.26 versus Rs59.79 in 1QCY23. The robust performance was driven by a better sales mix, efficient treasury operations, and prudent management of enhanced liquidity.

In addition, the gross and net margins settled at 15% and 9%, respectively, in 1QCY24. Higher margins portray the prudent management of expenses. The operating expenses, encompassing administrative, selling & distribution, and other expenses, declined marginally from Rs9.06 billion to Rs8.3 billion during the quarter under review. Furthermore, the assemblers' finance cost dipped by 98% year-on-year (YoY) and stood at Rs940.6 million compared to Rs42.8 billion in 1QCY23. On the tax front, the sector paid a significantly higher tax of Rs7.7 billion against Rs3.3 billion spent in the corresponding period of last year, depicting a rise of 128% YoY.

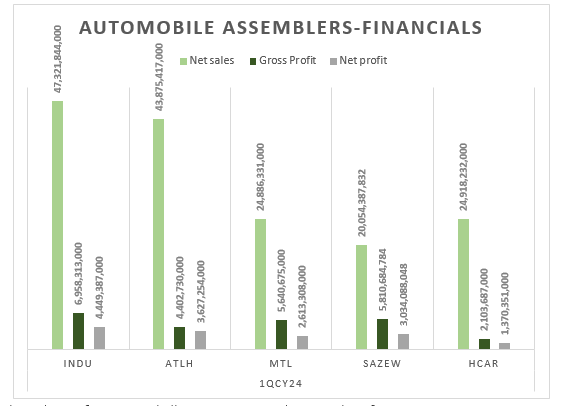

Large auto assemblers-financial comparison- 1QCY4

In 1QCY24, INDU topped the peer companies by grabbing the highest quarterly sales of Rs47.3 billion, followed by ATLH with net sales of Rs43.8 billion. HCAR came in as the third largest revenue collector

with sales of Rs24.9 billion. MTL's sales in the first quarter of CY24 were Rs24.8 billion, whereas SAZEW made the lowest revenue of Rs20.05 billion. In terms of gross profit, INDU earned the highest gross profit of Rs6.9 billion in 1QCY24. SAZEW posted a gross profit of Rs5.8 billion and MTL declared Rs5.6 billion. ATLH and HCAR posted gross earnings of Rs4.4 billion and Rs2.1 billion, respectively, during the quarter under review. Concerning net profit, INDU again posted the highest net profit of Rs4.4 billion followed by ATLH and SAZEW with net profits of Rs3.6 billion and Rs3.03 billion, respectively. MTL earned a net profit of Rs2.6 billion, and HCAR posted the lowest profit at Rs1.3 billion.

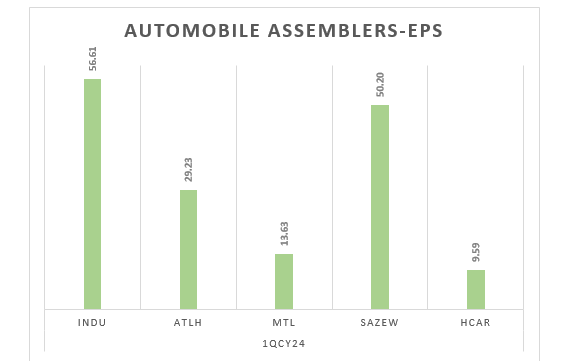

Large Auto Assemblers- EPS Comparison-1QCY24

INDU posted the highest earnings per share of Rs56.61 in 1QCY24, followed by SAZEW's Rs50.20. However, the lowest EPS was reported by HCAR during the period.

Future outlook

The positive momentum in macroeconomics signals promising growth prospects and improved business sentiments. The establishment of the Special Investment Facilitation Council (SIFC) and engagement with the International Monetary Fund (IMF) to conclude the Stand-By Arrangement (SBA) facility will surely attract greater investment, ensure stability and foster sectoral growth.

Credit: INP-WealthPk