INP-WealthPk

Ayesha Mudassar

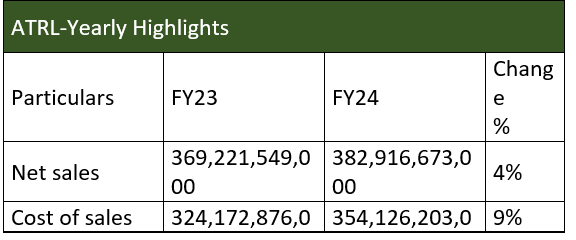

Attock Refinery Limited (ATRL), a subsidiary of Attock Oil Company Limited, posted a drop of 14% in its earnings for the fiscal year ended June 30, 2024, with its net profit declining to Rs25.2 billion from Rs29.2 billion in FY23, according to WealthPK.

The company posted a pre-tax profit of Rs39.2 billion in FY24 against a profit of Rs46.1 billion in FY23. The lower profit was primarily attributed to challenging economic conditions that included higher raw material costs, depreciation of local currency, a rapid increase in the interest rate and high inflation.

Attock Refinery reported a year-on-year (YoY) increase of 4% in its top line, which reached Rs382.9 billion compared to Rs369.2 billion in FY23. However, due to the elevated cost of sales, the company experienced a 36% decline in gross profit for the year. The income statement reflects a rise in administrative and distribution expenses, which rose by 13% and 6%, respectively, during the period under review. Additionally, the company contributed Rs127 billion to the national exchequer through taxes and duties. It also achieved foreign exchange savings of $315 million through import substitution and exports.

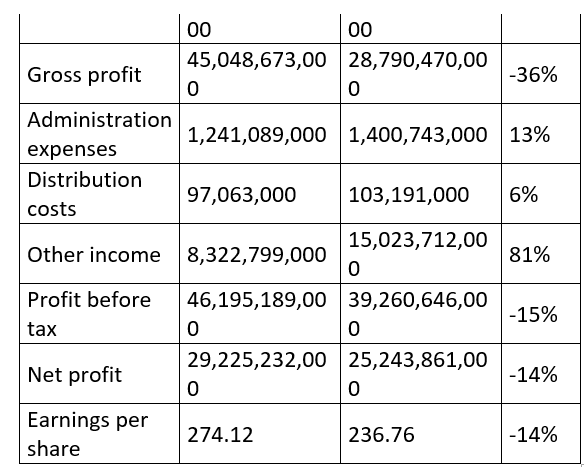

ATRL-quarterly review

Quarterly analysis of ATRL’s financial performance during FY24 reveals significant fluctuations with strong sales in the first quarter and notable declines in subsequent quarters. The reduction in gross and net profits across multiple quarters raises concerns regarding cost management and operational efficiency. Additionally, trends in earnings per share underscore these challenges, highlighting the necessity for the company to address fundamental issues affecting profitability. In the first quarter (July-September) of FY24, the company reported net revenue of Rs107.8 billion and net profit of Rs11.4 billion, resulting in earnings per share (EPS) of Rs107.53. However, in 2QFY24, ATRL’s net revenue decreased to Rs98.03 billion with a net profit of Rs4.9 billion. Therefore, the EPS were reported to be Rs46.43.

In 3QFY24, the company recorded net sales of Rs80.4 billion, yielding a net profit of Rs5.2 billion and an EPS of Rs49.40. The fourth quarter of FY24 saw a partial recovery in net sales. However, the overall financial performance remained constrained by high costs of sales, leading to reduced gross and net profits.

Pattern of shareholding

As of June 30, 2024, the company had a total of 106.6 million shares outstanding, which were held by 5,892 shareholders. Associated companies, undertakings and related parties collectively owned 62.7% of the company’s shares, followed by the local general public with 18.3% of the stake. Joint stock companies held approximately 7.1% of ATRL’s shares while foreign investors accounted for 5.5%. The remaining shares were distributed among other categories of shareholders, including Modarabas and mutual funds, banks, development finance institutions, and non-banking financial institutions.

Performance over 2020-2023

The company demonstrated a significant turnaround from losses to profitability, with substantial growth in net sales and profit over the years from 2020 to 2023. This trend indicates positive financial performance and improvements in operational efficiency and market positioning during the period. In 2020, the company incurred a net loss of Rs2.8 billion, which resulted in a loss per share of Rs26.50. The eruption of the Covid-19 pandemic led to a drastic reduction in demand for petroleum products and hence massive inventory losses.

The year 2021 marked a recovery as a gradual increase in oil prices and petroleum products helped ATRL reduce its losses. The company posted a net loss of Rs2.1 billion compared to Rs2.8 billion loss in 2020. In 2022, ATRL earned a net profit of Rs9.9 billion compared to a net loss of Rs2.1 billion in the earlier year. This improvement in margins was largely driven by increased demand for petroleum products following the easing of Covid-19 restrictions. Furthermore, the Ukraine crisis contributed to higher product prices, resulting in enhanced refinery margins, particularly in the last quarter of the year. In 2023, the company posted a profit-after-tax of Rs29.2 billion. The year witnessed record profit due to elevated gross refining margins, improved inventory management and optimal refinery throughput. Capitalising on its enhanced financial position, the company also made a premature settlement of an outstanding long-term loan.

About the company

ATRL, the country’s pioneer in refining crude oil, was incorporated as a private limited company in 1978 and transitioned to a public company the following year. Backed by a rich experience of successful operations, ATRL has evolved into a cutting-edge refinery with a nameplate capacity of 53,400 barrels per day.

Future outlook

The current business environment for refineries is very challenging due to a variety of factors. The company is contending with issues such as the influx of high-speed diesel from various sources, including smuggling and unauthorised imports, pressure on foreign exchange reserves, declining demand for furnace oil, elevated financing costs, rising power expenses, and adverse changes in tax regulations. In response, the management is proactively addressing these challenges and remains committed to enhancing operational efficiencies to increase revenue and reduce costs.

Credit: INP-WealthPk