INP-WealthPk

Ayesha Mudassar

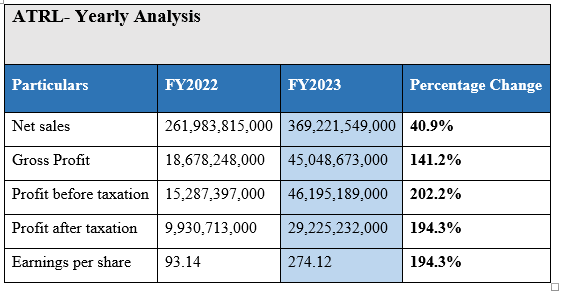

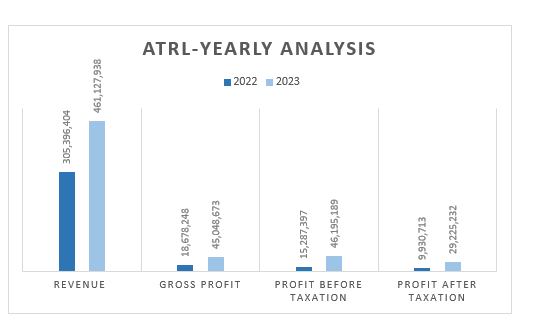

Attock Refinery Limited (ATRL) posted robust revenue and profit growth in the last fiscal year (FY23) compared to FY22, WealthPK reports. The net sales revenue increased to Rs369.2 billion in FY23 from Rs261.9 billion in FY22, thus posting a strong 40.9% year-on-year growth. This surge reflects higher petroleum product prices as a result of rupee devaluation.

Furthermore, the company’s gross profit ballooned to Rs45.04 billion from Rs18.6 billion in FY22, registering a 141% yearly growth. The profit-before-taxation skyrocketed to Rs46.2 billion in FY23 from Rs15.3 billion in FY22, registering a whopping 202% growth year-on-year.

The after-tax profit also leapt to Rs29.2 billion in FY23 from Rs9.9 billion in FY22, posting a growth of 194% year-on-year. The period under review witnessed record profit owing to high gross refining margins (GRMs), better inventory management, and operating refinery at optimal throughput.

During FY23, the refinery contributed Rs103 billion to the national exchequer in the form of taxes and duties. Moreover, foreign exchange savings of $378 million were also achieved through import substitution and exports. Taking benefit of improved financial performance, the company made a premature settlement of the outstanding long-term loan. The business environment in Pakistan remained extremely challenging and volatile, especially for the oil refining sector.

Factors like stringent environmental regulations, reliance on alternative energy sources, economic recession, smuggling from neighbouring countries, and political instability have added to the difficulties of refineries. However, the ATRL management met these challenges courageously and continued the smooth operations of the company. The refinery was operated at around 78% of its capacity and supplied 1.768 million tonnes of various petroleum products, fully meeting standard quality specifications.

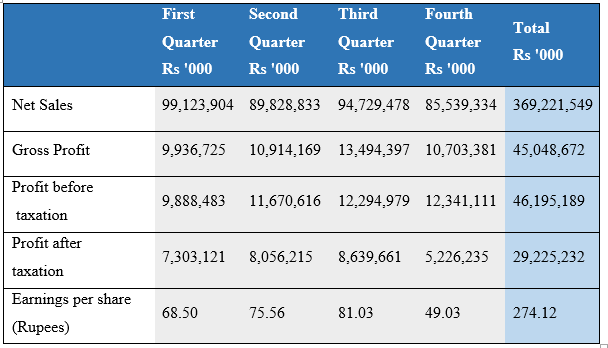

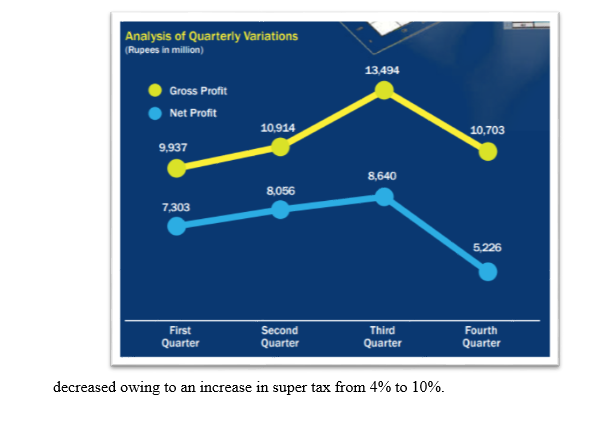

ATRL- analysis of quarterly variations

Sales revenue was higher in the first quarter of FY23 due to higher prices of petroleum products as compared to the remaining quarters of the fiscal.

Between the first and third quarters, there was a rising trend in gross and net profit, which was mainly due to increasing prices of petroleum products. The profit for the fourth quarter

Company profile and future outlook

ATRL, the country’s pioneer in refining crude oil, was incorporated as a private limited company in 1978 before becoming a public company the following year. Backed by a rich experience of successful operations, ATRL has now developed into a cutting-edge refinery with a nameplate capacity of 53,400 barrels per day.

Amidst a continuously changing economic landscape, the refinery is striving to be a leading organisation that continuously produces high-quality, diversified, environment-friendly energy resources and petrochemicals.

Credit: INP-WealthPk