INP-WealthPk

Ayesha Mudassar

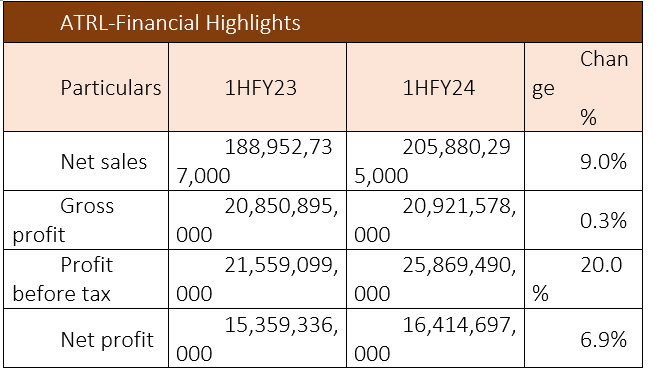

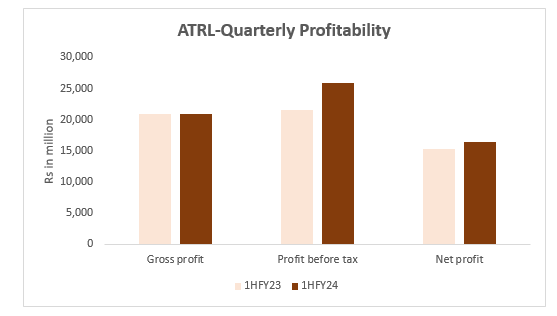

Attock Refinery Limited (ATRL) posted modest revenue and profit growth in the first half of the current fiscal year (1HFY24) compared to the corresponding period of FY23, according to WealthPK. The net sales revenue increased to Rs205.8 billion in 1HFY24 from Rs188.9 billion in 1HFY23, posting a 9% growth. The company’s gross profit slightly improved to Rs20.9 billion from Rs20.8 billion in 1HFY23. The profit-before-tax increased to Rs25.8 billion in 1HFY24 from Rs21.5 billion in 1HFY23, registering a 20% growth. Moreover, the net profit also increased to Rs16.4 billion in 1HFY24 from Rs15.3 billion in 1HFY23, posting a growth of 6.9%.

![]()

Furthermore, the company supplied 885,000 metric tonnes of various petroleum products while operating at about 78% of its capacity. The period under review witnessed favourable refining margins owing to better inventory management, and operating refinery at optimal throughput.

Performance over last four years (2020-2023)

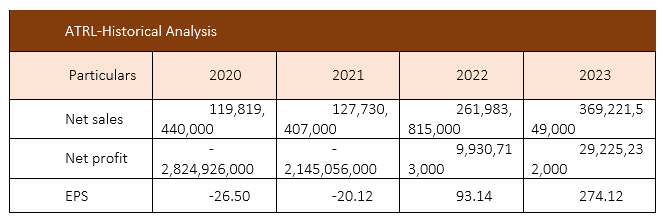

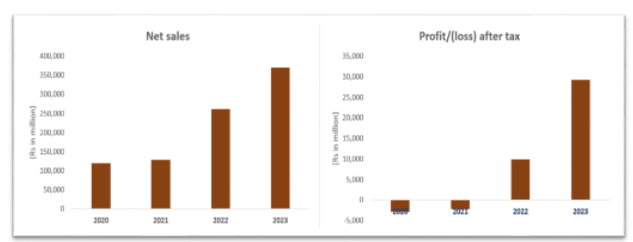

The company seems to have undergone a turnaround from losses to profits, with substantial growth in net sales and profitability over the years from 2020 to 2023. This suggests positive financial performance and potentially improved operational efficiency and market positioning during the period.

During 2020, the company suffered a loss-after-tax of Rs2.8 billion, which resulted in a loss per share of Rs26.50. The eruption of the Covid-19 pandemic resulted in a drastic reduction in demand for petroleum products and hence massive inventory losses. The year 2021 was a recovery year as a gradual increase in oil prices and petroleum products helped ATRL reduce losses. ATRL posted a net loss of Rs2.1 billion compared to a net loss of Rs2.8 billion in 2020. In 2022, the company earned a net profit of Rs9.9 billion as compared to a net loss of Rs2.1 billion in 2021. The improved margins were mainly due to higher demand for petroleum products after the easing of Covid-19 restrictions.

Furthermore, the Russia-Ukraine crisis resulted in higher product prices leading to better refinery margins, especially in the last quarter of the year. In 2023, the company posted a huge profit-after-tax of Rs29.2 billion. The year witnessed record profits owing to high gross refining margins, better inventory management and operating refinery at optimal throughput. Thanks to improved financial performance, the company made a premature settlement of an outstanding long-term loan.

Ratio analysis

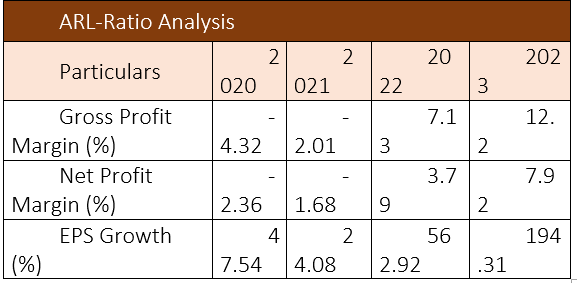

The company showed significant improvements in its gross profit margin, net profit margin and EPS growth over the four years, indicating better cost management, increased profitability and strong earnings growth.

In 2020 and 2021, the company had negative gross profit and net profit margins. However, the margins improved significantly in 2022 and 2023, suggesting an improvement in the company’s cost management. Moreover, the company experienced significant EPS growth from 2020 to 2023. In 2020, the EPS growth was 47.54%, followed by 24.08% in 2021. The growth skyrocketed in 2022 to 562.92% and remained high at 194.31% in 2023. Such substantial growth reflects strong performance and potentially effective management of resources and investments.

Company profile

ATRL, the country’s pioneer in refining crude oil, was incorporated as a private limited company in 1978 before becoming a public company the following year. Backed by a rich experience of successful operations, ATRL has now developed into a cutting-edge refinery with a nameplate capacity of 53,400 barrels per day.

Future outlook

The economy and overall business climate in the country are expected to remain difficult with rising costs of doing business, high inflation, and unstable refining margins. Hence, the management will continue to focus on proactively improving operational efficiencies to increase revenue and reduce costs.

INP: Credit: INP-WealthPk