INP-WealthPk

Qudsia Bano

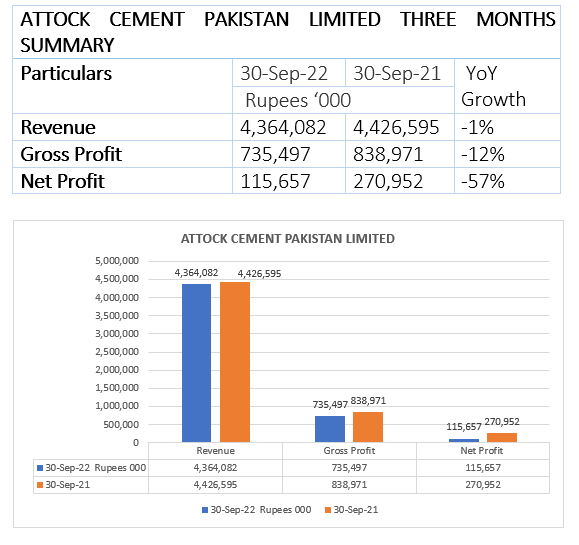

Attock Cement Pakistan Limited’s revenue from sales edged down 1% to Rs4.3 billion in the first quarter of the ongoing financial year 2022-23 (1QFY23) from Rs4.4 billion in the corresponding period of the previous fiscal. Similarly, the gross profit of the company decreased 12% to Rs735.5 million in 1QFY23 from Rs838.9 million recorded in 1QFY22. The company’s net profit also decreased 57% to Rs115.6 million in 1QFY23 from Rs270.9 million over the corresponding period of FY22, shows a WealthPK analysis of the firm’s quarterly performance.

Performance in 2021-22

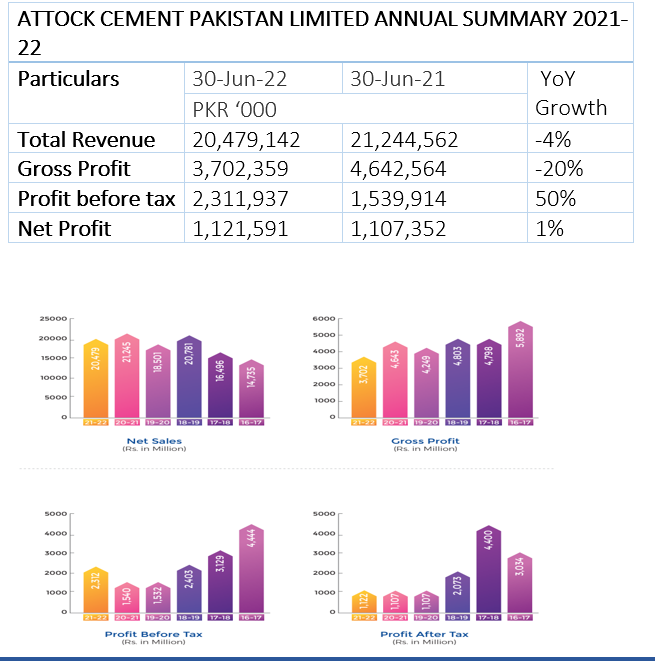

During the fiscal year 2021-22, the company’s gross sales went down to Rs20.5 billion from Rs21.2 billion in FY21, posting a decrease of 4% year-on-year. The gross profit for FY22 stood at Rs3.7 billion, down 20% from Rs4.6 billion in FY21. The profit-after-tax for the year slightly went up to Rs1.12 billion from Rs1.10 billion in FY21.

Shareholding Pattern

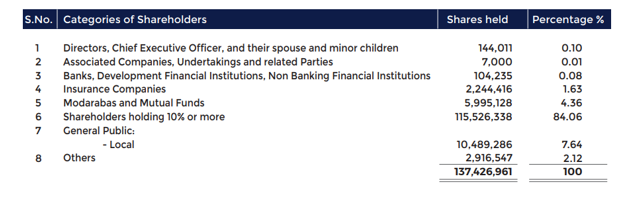

As of June 30, 2022, directors, the chief executive officer, their spouses and minor children owned 0.10% of the company’s shares. Associated companies held 0.01% of the shares; banks, development financial institutions and non-banking financial institutions held 0.08% of the shares. Insurance companies held 1.63% of the shares, Modarabas and mutual funds 4.36%, the general public (local) 7.64%, and general public (foreign) 2.12%. Shareholders holding 10% or more owned 84.06% of the shares.

Earnings Per Share

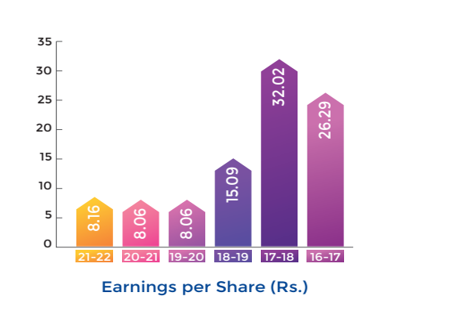

The earnings per share (EPS) of the company peaked in 2017-18 at Rs32.02. However, EPS decreased to Rs15.09 in 2018-19, and then remained almost unchanged at Rs8.06 during the next two years before slightly increasing to Rs8.16 in 2021-22.

About the company

Attock Cement Pakistan Ltd was incorporated on October 14, 1981, as a public limited company. The company is a subsidiary of Pharaon Investment Group Limited Holding S.A.L, Lebanon. Its main business activity is the manufacturing and sale of cement.

Credit : Independent News Pakistan-WealthPk