INP-WealthPk

Fakiha Tariq

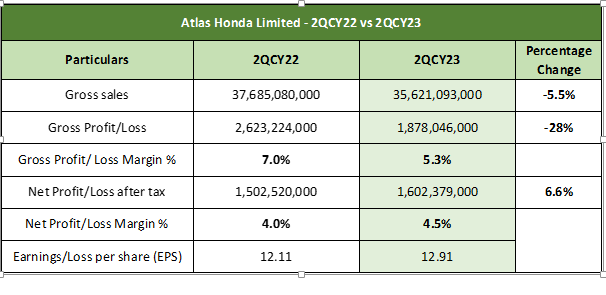

Atlas Honda Limited’s (ATLH) revenues and gross profit decreased by 5.5% and 28%, but net profit increased by 6.6% in the second quarter (April-June) of the ongoing calendar year 2023 as compared to the corresponding period of the previous year, WealthPK reports. The company observes its fiscal year from April to March, so April-June period is the firm’s first quarter of fiscal year 2023-24. In 2QCY23, ATLH made revenue of Rs35.6 billion and gross profit of Rs1.87 billion, thus coming up with a gross profit ratio of 5.3%. The company’s net profit stood at Rs1.60 billion and net profit ratio at 4.5%, respectively, in 2QCY23.

The earnings per share (EPS) stood at Rs12.91.

ATLH earned revenues of Rs37.6 billion, gross profit of Rs2.6 billion and net profit of Rs1.50 billion in 2QCY22.

The EPS stood at Rs12.11 in the same quarter of last year. Atlas Honda is listed on the Pakistan Stock Exchange under the symbol of “ATLH”. It is the third largest company registered in the automobile assembler sector with a market capitalisation of Rs33.4 billion. The auto assembler’s current share price ranges from Rs267.10 to Rs272.

Performance over past six years

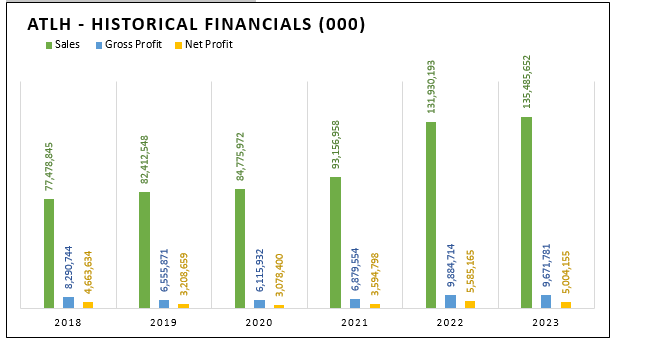

Analysis of ATLH sales shows that in the last six years, its sales kept increasing. The company posted its highest six-year sales in 2023 at Rs135 billion.

In terms of gross profit, ATLH hit the highest six-year gross profit in 2022 at Rs9.88 billion. The company posted gross profit of Rs8.2 billion in 2018, Rs6.5 billion in 2019, Rs6.1 billion in 2020, Rs6.87 billion in 2021 and Rs9.6 billion in 2023. The firm also posted the highest net profit of Rs5.5 billion in 2022. The auto maker posted net profit of Rs4.6 billion in 2018, which dropped to Rs3.2 billion in 2019 and to Rs3 billion in 2020. However, the net profit improved to Rs3.5 billion in 2021, and jumped to Rs5.5 billion in 2022. The net profit slightly decreased to Rs5 billion in 2023.

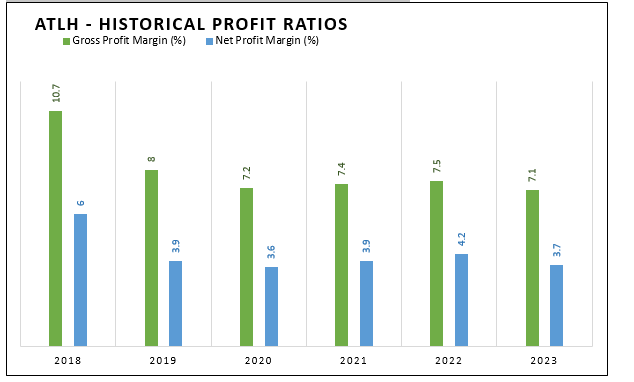

In the last six years, ATLH posted the highest gross profit ratio of 10.7% in 2018. The average gross profit ratio stood at 7.98%. ATLH reported the highest net profit ratio of 6% in 2018 followed by 4.2% in 2022. From 2018 to 2023, the company posted net profit ratio of 4.21% on average.

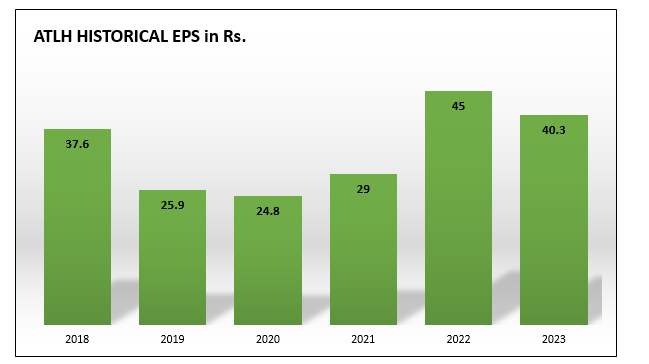

ATLH posted the highest six-year EPS of Rs45 in 2022. The company posted the second highest EPS of Rs40.3 in 2023.

Credit: INP-WealthPk