INP-WealthPk

Ayesha Mudassar

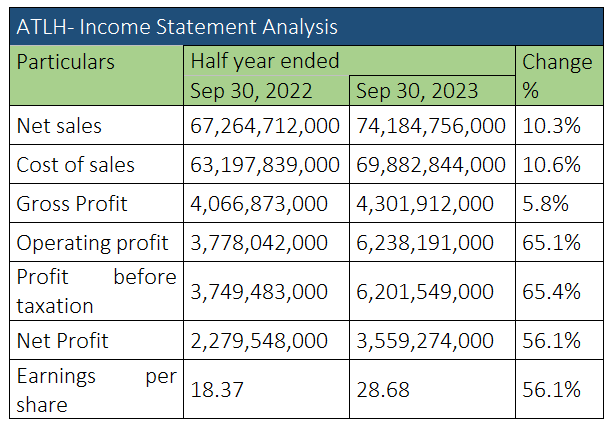

Atlas Honda Limited (ATLH) posted modest revenue growth as its sales increased by 10.3% to Rs74.1 billion during the half-year period ended September 30, 2023 from Rs67.2 billion over the corresponding period of the previous year, reports WealthPK. The company observes its fiscal year from April to March. During the period, the gross profit increased by 5.8% to Rs4.3 billion, signifying the company's efforts to manage costs and enhance operational efficiencies. Furthermore, the firm’s net profit rose by 56.1% to Rs3.5 billion during the period under review from Rs2.2 billion previously.

The company’s selling and marketing expenses rose 16.1% to Rs1.48 billion, which was attributable to an increase in fuel prices and promotional activities. The financial costs for the half-year period surged from Rs28.5 million to Rs36.6 million. The company, however, implemented financial discipline to curb the escalating finance cost. The earnings per share (EPS) increased to Rs28.68 from Rs18.37, indicating a rise in the company’s profitability.

Quarterly review

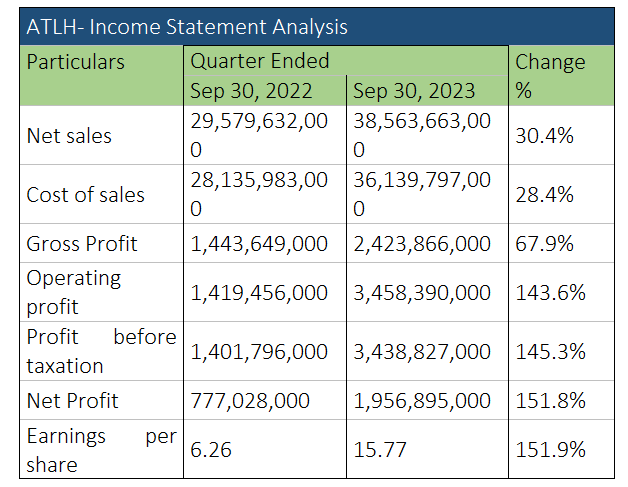

During the July- September quarter of 2023, the net sales of Atlas Honda Limited increased by 30.4%, gross profit by 67.9%, and net profit by 151.8% compared to the corresponding period of the prior year.

ATLH earned revenues of Rs38.5 billion, gross profit of Rs2.4 billion and net profit of Rs1.9 billion during the quarter under review. Atlas Honda is listed on the Pakistan Stock Exchange under the symbol "ATLH". It is the third largest company registered in the automobile sector with a market capitalisation of Rs47.8 billion.

Performance over the past four years

Analysis of ATLH sales shows its sales kept increasing in the last four years. The company posted the highest sales in 2023 at Rs135.4 billion. In terms of net profit, the automobile assembler hit the highest four-year net profit in 2022 at Rs5.5 billion. The company posted a net profit of Rs3.07 billion in 2020 and Rs3.59 billion in 2021. The net profit slightly decreased to Rs5 billion in 2023. In the last four years, ATLH posted the highest gross profit ratio of 7.49% in 2022. The company posted the highest net profit ratio of 4.2% in 2022. ATLH posted the highest four-year EPS of Rs45 in 2022. The company posted the second-highest EPS of Rs40.3 in 2023.

Credit: INP-WealthPk