INP-WealthPk

Hifsa Raja

Atlas Honda Limited engages in the manufacturing and marketing of motorcycles and spare parts primarily in Pakistan. The business, founded in 1962, works with a network of dealers to provide its goods. Additionally, it sends its goods to the United Arab Emirates, Afghanistan, Bangladesh, and Nigeria.

Prior to 1992, the business was known as Atlas Autos Limited. The company is based in Lahore. Atlas Honda Limited is a subsidiary of Shirazi Investments (Private) Limited.

WealthPK had a talk with the company’s Financial Manager Muhammad Rehan on the firm’s future plans and effects of the fluctuating exchange rate on its production and sales.

Q: What are the reasons behind fluctuations in the exchange rate? How it negatively affects your company? And what steps are being taken to overcome the effects?

A: Undoubtedly, the rupee’s devaluation against other currencies, especially the US dollar, is negatively impacting our business. A rising Japanese yen and dollar generally has a negative effect on our profits since it appreciates the value of imported raw materials. We continuously track currency forecasts and manage them through a forward buying and hedging policy. We are also looking at other options for localising our primary input materials.

Q: How may increasing exposure to changes in economic and political environment as well as other factors impact your business and how are you tackling them?

A: Changes in external environment could have a major influence on the demand for our products and supply chain given our widely-dispersed sales distribution. We continue to balance retail sales among major sales regions keeping in view macroeconomic and political events. Additionally, we have a diverse vendor base and run two manufacturing facilities to reduce the chance of disruptions. The ongoing observation contributes to maintaining operations without supply disruptions.

Q: There are sharp fluctuations in commodity prices, creating significant business challenges. How is your business planning to overcome such challenges?

A: Commodity price risk puts our performance and profitability at risk. This could happen as a result of changes in commodity prices that are beyond the entity's control. Manufacturing costs, product pricing and profits are impacted by sharp swings in commodity prices. In order to effectively manage its financial performance and profitability in light of this price volatility, a business must manage the impact of commodity price fluctuations across its value chain. To address sudden changes in material pricing, we have contracts with suppliers. Additionally, appropriate protection is implemented by dual resourcing and forward buying.

Q: How has your company progressed so far?

A: After experiencing a rather prolonged market downturn as a result of Covid-19-related lockdowns, motorcycle sales are starting to pick up again. During this time, Atlas Honda (PSX: ATHL) has sold more two-wheelers than ever before, generating handsome revenues. Despite the company's great current marketing year, which ends in March, its margin profile remained the same.

Q: How could technological developments together with the scarcity of specialist resources result in a significant change in the two-wheeler industry?

A: Not employing innovative technology could make production processes obsolete and expensive. So, we continue to make significant investments in modernising our production facilities. Additionally, we keep putting emphasis on investing in both new and old models.

Company’s most recent performance

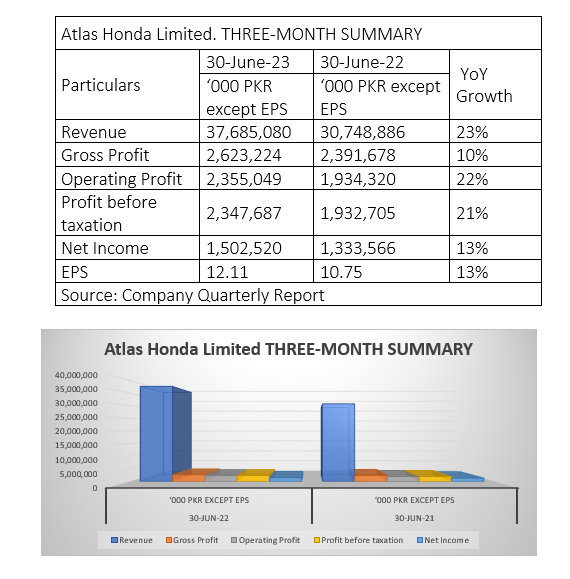

Revenue of Atlas Honda climbed 23% to Rs37.68 billion in the first three months (April-June) of the firm’s own financial year 2022-23, compared with Rs30.74 billion in the corresponding period of the previous year.

It is important to note here that a financial year of ATLH begins on April 1 and ends on March 31.

The company’s gross profit registered a growth of 10% during the three-month period of FY23 to Rs2.62 billion from Rs2.39 billion in the corresponding period of FY22.

The company’s operational efficiency increased by 22% in the first quarter of FY23.

The net income increased 13% to Rs1.50 billion in the first three months of FY23 compared with Rs1.33 billion over the corresponding period of FY22. The net sales showed a year-on-year growth of 23% owing to a lift in sales of company’s products and services thanks to favourable market conditions.

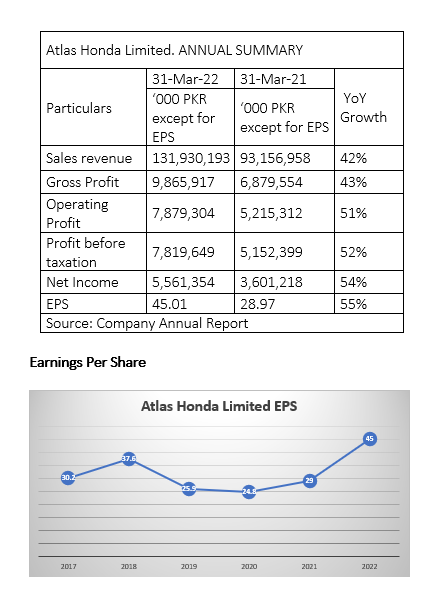

During the fiscal year 2021-22 that ended on March 31, the company generated net sales revenue of Rs131 billion against Rs93.15 billion in 2020-21, registering an increase of 42%.

The gross profit for FY22 was Rs9.86 billion, up 43% from Rs6.87 billion in FY21.

The profit-after-tax for FY22 was Rs5.56 billion compared to Rs3.60 billion in FY21, posting an increase of 54%.

The earnings per share (EPS) increased from Rs30.2 in 2017 to Rs37.6 in 2018. But then it decreased to as low as Rs25.9 in 2019 and further to Rs24.8 in 2020. The EPS registered decent growth in 2021 and stood at Rs29. It ballooned to Rs45 in 2022, showing the company’s sound financial position.

Credit : Independent News Pakistan-WealthPk