INP-WealthPk

Qudsia Bano

Askari Securities Limited (ASL) is a renowned corporate investment house in Pakistan, which meets the capital market investing needs of corporate and retail clients. Founded on October 16, 1999, ASL is a fully-owned subsidiary of Askari Bank Limited. ASL is a TRE Certificate Holder of both the Pakistan Mercantile Exchange Limited and the Pakistan Stock Exchange Limited.

The company provides investors with ease of investing in commodities as well as shares and other securities. WealthPK conducted an interview with ASL Chief Financial Officer (CFO) Moeen Javed Satti on the state of Pakistan’s economy, growth and investment prospects, especially in the context of a volatile world economic outlook.

Q: Given the economic conditions of Pakistan, what do you think of the market sentiment?

A: The Pakistan Stock Exchange’s benchmark KSE-100 Index remained at 44,434.80 points at the start of the year 2021, and with a slight increase of 0.40% on the last day of the year, it closed at 44,596.07 points, improving by a net 1.9% during the year.

In the first half of the year 2021, significant optimism was witnessed with the market surpassing the 48,000-point barrier in June 2021. Sentiment in the stock market and expectations for the economy remained bullish during the first half. However, due to some political factors and fluctuations in the market, the market could not sustain the trend.

Q: What are the reasons behind fluctuations in the exchange rate and how it affects the economy?

A: There are two ways to determine the price of a currency: a floating rate or a fixed rate. The open market uses supply and demand to decide the floating rate most of the time. Consequently, if there is a great demand for money, its value will rise. The governments have now shunned the practice of fixing the exchange rate artificially, leaving it for markets to determine the rate as the fixed rate is not viable for the economy.

According to my viewpoint, the exchange rate should be managed in a way that neither it is free floating nor fixed.

Q: Financial analysis of the companies shows their revenues are on a decreasing trend in the half-yearly reports. What is the reason behind it?

A: Following the opening up of the global economies after Covid-19, commodity prices surged due to pent-up demand and supply bottlenecks. This led to inflationary pressures. The markets also responded to these factors and did not perform well in the first half of 2022. Another reason is that the currency was not stable in the given period. The last highest exchange rate we witnessed was Rs246 to the US dollar and given the circumstances, no investor wanted to invest in an unstable currency. To improve the economic conditions of the country, we need to boost our exports for dollar inflows to bridge the current account deficit and stabilise the balance of payments.

Q: How can foreign direct investment (FDI) be attracted to give impetus to economic growth?

A: FDI can really contribute to the GDP growth. In fact, FDI is a catalyst for change in the operations of recipient countries. When a country gets FDI, it goes on to make its currency stronger as demand for foreign exchange cools.

Q: What steps have you taken to improve the earnings per share (EPS) of your company in the last two years?

A: Change in management hierarchy helped Askari Securities improve its financial position. Appointment of new CEO, better performance of new sales team, commission sharing, change in the management structure of sales and marketing have contributed to growth in earnings per share.

Q: What measures can be taken to improve the country’s economic conditions?

A: The most important factor for an economy to perform better is political stability. The change of the government should have no impact on the status of development projects funded with foreign investment because these are sovereign agreements, and any obstacle to their smooth execution does not bode well for the country’s image abroad.

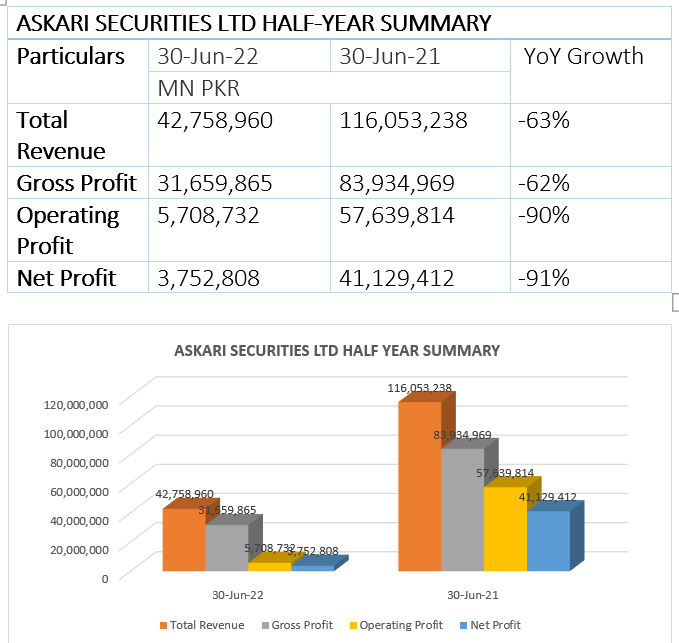

Askari Securities – Performance in first half of 2022

The company’s revenue declined 63% to Rs42.75 million in the six months ending June 30, 2022, compared with Rs116 million in the corresponding period of last year.

Similarly, the gross profit decreased 62% during the period to Rs31.6 million from Rs83.9 million in the corresponding period of the previous year. The net income also decreased 91% to Rs3.7 million compared with a profit of Rs41 million in the corresponding period last year, reports WealthPK.

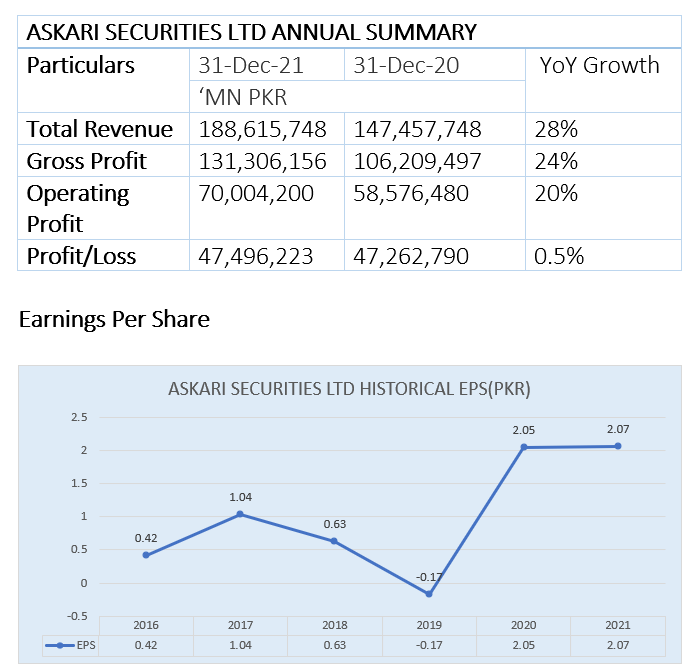

Performance in 2021

During the calendar year 2021, the company maintained a strong sales trend, generating revenue of Rs188 million against Rs147 million in 2020, posting a growth of 28% year-on-year. The gross profit in 2021 stood at Rs131 million, 24% up from Rs106 million the previous year.

The profit-after-taxation for the year stood at Rs47.5 million, slightly up from a profit of Rs47.2 million in 2020.

The EPS of the company stood at Rs0.42 in 2016 before moving up to Rs1.04 in 2017. However, the EPS dipped to Rs-0.17 in 2019. Afterwards, the EPS jumped to Rs2.05 in 2020, and marginally increased to Rs2.07 in 2021.

Credit : Independent News Pakistan-WealthPk