INP-WealthPk

Ayesha Mudassar

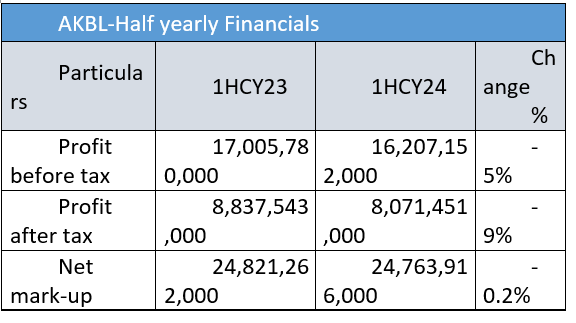

Askari Bank Limited (AKBL) reported a total income of Rs32.2 billion in the first half of the ongoing calendar year 2024, representing a 2% increase from Rs31.5 billion earned over the same period of 2023, according to WealthPK.

The bank recorded a net markup income of Rs24.7 billion for 1HCY24, posting a slight decrease from Rs24.8 billion in the first half of 2023. Additionally, the non-markup income registered an 11% year-on-year (YoY) increase. This growth in non-markup income was primarily driven by gains on securities and an increase in dividend income.

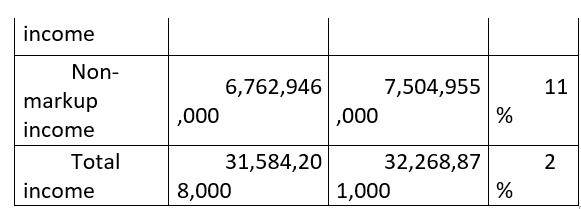

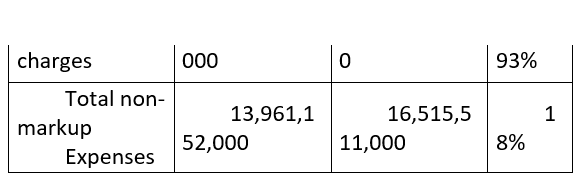

Despite higher income, Askari Bank’s net profit for 1HCY24 decreased by 9% compared to the same period last year. This reduction is attributed primarily to higher credit loss allowances, operating expenses, and an increased taxation rate. On the expense side, the bank’s non-markup expenses grew by 18% YoY to Rs16.5 billion, up from Rs13.9 billion in 1HCY23. The increase was largely driven by a 19% increase in operating expenses, which rose from Rs13.5 billion to Rs16.2 billion during the period under review. Additionally, the workers’ welfare fund increased to Rs270 million compared to Rs237.8 million in the first half of CY23.

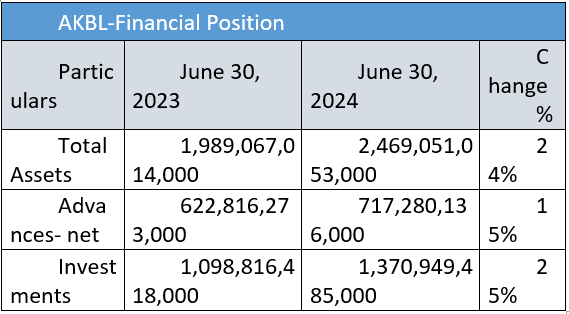

AKBL- financial position as of June 30, 2024

As of June 30, 2024, the bank’s total assets increased by 24%, reaching Rs2.4 trillion. This growth was primarily supported by a 15% rise in net advances and a 25% increase in investments.

Amidst challenging operating conditions, Askari Bank has demonstrated resilience and achieved notable growth in its balance sheet.

Pattern of shareholding

As of December 2023, AKBL had an outstanding share capital of 1.4 billion shares, which were held by 14,194 shareholders. Associated companies and related parties were the largest shareholders of AKBL, representing over 72% of its share capital. The general public held 15% of AKBL’s shares, while Modarba and mutual funds owned 4.1%. Insurance companies held 1.2% of the shares, with the remaining shares distributed among other categories of shareholders.

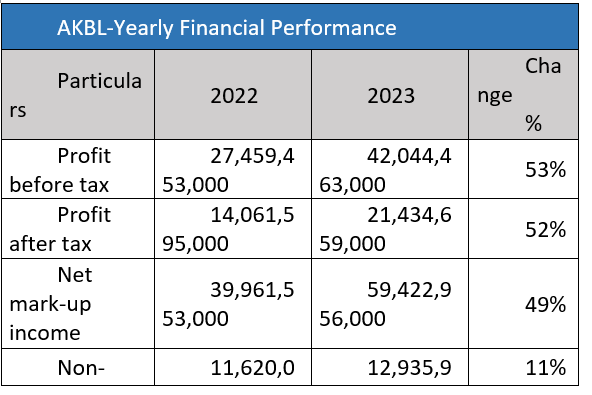

Performance in 2023

Askari Bank achieved significant growth in core earnings, with a 53% YoY increase in profit-before-tax for the year ended December 31, 2023. The bank’s profit-after-tax also experienced a notable rise of 52%, which translated into earnings per share of Rs14.79 compared to an EPS of Rs9.70 reported in CY22.

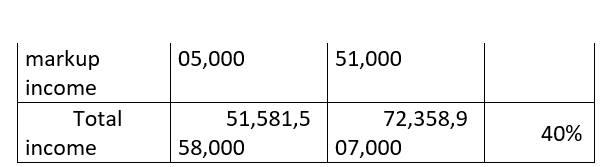

Furthermore, the robust volumetric growth in average earning assets and improved spreads enabled the bank to post a 49% growth in net markup income for the year ended December 31, 2023. The bank’s non-markup income surged to Rs12.9 billion from Rs11.6 billion in the last year, with major contributions coming from fee commission income (Rs1.8 billion), dividend income (Rs225.5 million), and other income (Rs121.2 million). Overall, the bank generated a total income of Rs72.3 billion in 2023, marking a 40% increase compared to the previous year’s income of Rs51.6 billion. The robust financial results were achieved through a steadfast commitment to long-term strategic goals, optimised resource allocation, and sustained business growth.

About the bank

Askari Bank was incorporated as a public limited company in Pakistan on October 9, 1991. The bank is a scheduled commercial bank and is principally engaged in banking as defined in the Banking Companies Ordinance, 1962. The bank offers conventional, corporate, Islamic, consumer, and agricultural banking services across the country. The ultimate parent of the bank is the Fauji Foundation.

Credit: INP-WealthPk