INP-WealthPk

Ayesha Mudassar

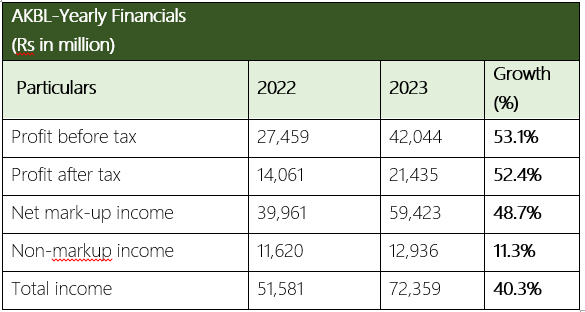

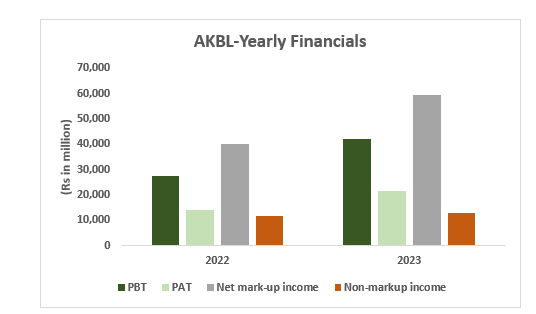

Askari Bank Limited (AKBL) has achieved considerable growth in core earnings, resulting in a notable 53% year-on-year (YoY) increase in profit before tax (PBT) for the year ending December 31, 2023, reaching Rs42.04 billion, reports WealthPK. As per the Unconsolidated Interim Statement, the profit after tax (PAT) also posted a remarkable growth of 52.4% to reach Rs21.4 billion, translating into earnings per share (EPS) of Rs14.79 compared to EPS of Rs9.70 reported in the last calendar year.

Furthermore, the strong volumetric growth in average earning assets and improved spreads enabled the bank to post a net markup income of Rs59.4 billion for the year ending December 31, 2023, depicting a growth of 49%. The bank’s non-markup income surged to Rs12.9 billion against Rs11.6 billion in the last year with major contributions from fee commission income (Rs1.8 billion), dividend income (Rs225.5 million), and other income (Rs121.2 million). In 2023, the bank generated a total income of Rs72.3 billion, reflecting a 40% increase over the earnings recorded last year.

The sound financial results for the year were enabled by the continuous focus on delivering the long-term strategy, connecting and optimizing resources for the accelerated value chain, and continued business sustainability. Going forward, the profit and loss statement shows that the total non-markup expenses expanded by 28.1% year-on-year (YoY) to Rs29.5 billion in 2023 compared to Rs23.07 billion in 2022. The increase was attributed to a 27.5% spike in operating expenses. Additionally, the bank’s expenses related to the workers’ welfare fund and other charges went up during the review period.

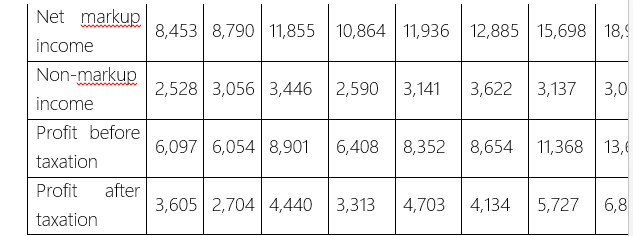

Quarterly Performance Analysis 2022-2023

Net markup income represents the company’s income from its core banking activities, mainly the interest earned on loans and advances, and interest paid on deposits. It shows a consistent increase over the quarters, indicating growth in interest earnings. From Rs8,453 million in the first quarter of 2022, it rises to Rs18,904 million in the fourth quarter of 2023. This increase was broad-based, driven by improved earning margins along with volumetric growth in earning assets.

Non-markup income includes income from sources other than core banking activities, such as fees and commissions, dividends, and foreign exchange. The bank's non-markup income also shows a generally increasing trend with some fluctuations, indicating diversified revenue streams. In addition, the bank’s profit before tax witnessed a notable increase over the quarters, indicating improved operational efficiency and potentially higher revenues. Similar to profit before tax, there is a consistent increase in profit after tax, which suggests that the company is effectively managing its expenses.

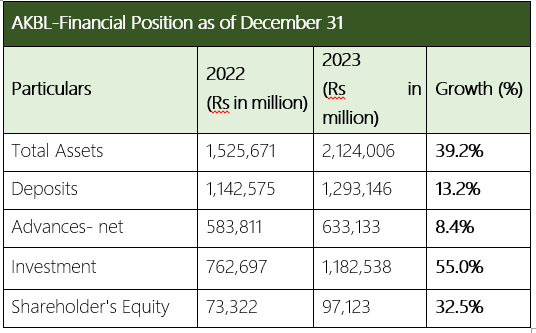

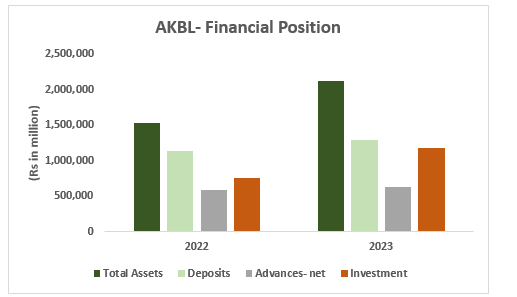

Financial Position as of December 31

The total assets of the bank grew by 39% and were recorded at Rs2.12 trillion as of December 2023. Average earning assets registered a 21% growth YoY, mainly funded by a 19% increase in average customer deposits.

The analysis of asset mix highlights that net investments and net advances increased by 55% and 8.4%, respectively, during the year. Moreover, the customer deposits grew by 13.2% YoY to close at Rs1.3 trillion.

About the bank

Askari Bank was incorporated as a public limited company on October 9, 1991. The bank is a scheduled commercial bank and is principally engaged in the business of banking as defined in the Banking Companies Ordinance, 1962. The bank offers conventional, corporate, Islamic, consumer, and agricultural banking services across the country. The ultimate parent of the bank is the Fauji Foundation.

Future Outlook

The bank remains steadfast in its dedication to producing outstanding results and creating a sustainable value for stakeholders. With a strong foundation and a growth-oriented strategy, the management is confident of its ability to achieve new heights in future.

Credit: INP-WealthPk