INP-WealthPk

Qudsia Bano

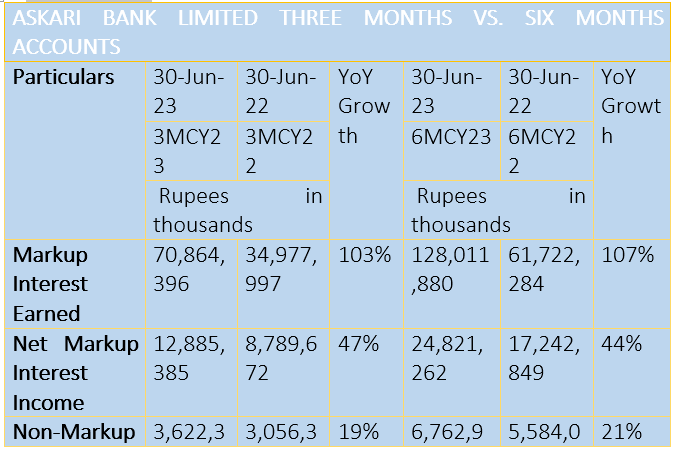

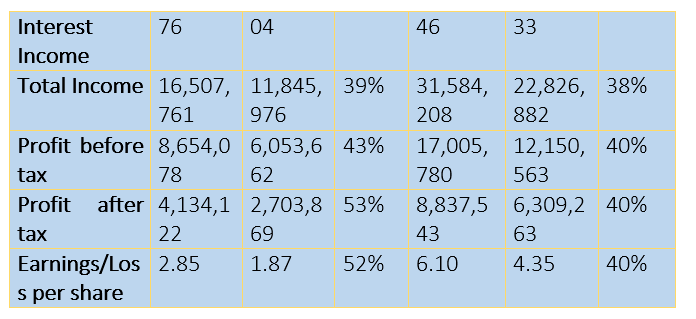

Askari Bank Limited, a prominent player in the banking industry, recently announced its performance for the three-month period ending on June 30, 2023, posting growth across key financial indicators and highlighting its ability to thrive and adapt in a dynamic market environment. During this quarter, Askari Bank’s interest income from loans increased significantly to Rs70.86 billion, representing a year-on-year growth of 103%. This remarkable progress can be attributed to the bank’s lending strategies and its adeptness in capitalising on market opportunities. The net markup interest income for the quarter stood at Rs12.89 billion, marking a noteworthy 47% increase compared to the same period last year. This growth reflects the bank’s efficient management of interest-related income and expenses, contributing to healthy margins. Non-markup interest income for the quarter reached Rs3.62 billion, representing a 19% year-on-year increase.

This growth showcases the bank’s diverse income sources beyond its lending activities, contributing to overall revenue generation. Askari Bank’s total income for the three months amounted to Rs16.51 billion, demonstrating a solid 39% growth compared to the same period the previous year. This comprehensive income figure indicates the bank’s ability to generate revenue from various segments. The profit-before-tax for the quarter reached Rs8.65 billion, showcasing a notable year-on-year growth of 43%. The profit-after-tax for the quarter amounted to Rs4.13 billion, reflecting a significant 53% increase from the corresponding period last year. This surge in profitability highlights the bank’s effective financial management and its ability to generate positive results for its stakeholders. Earnings per share (EPS) for the quarter stood at Rs2.85, reflecting a substantial 52% growth compared to the same period last year. This growth indicates that the bank’s earnings available to shareholders have increased significantly on a per-share basis.

In the first half of the ongoing calendar year ending on June 30, 2023, Askari Bank has demonstrated robust financial performance across various key metrics, reinforcing its position as a resilient and growth-oriented entity. The bank’s markup interest earned during the six months reached Rs128.01 billion, showcasing an impressive year-on-year growth of 107%. This growth signifies the bank’s effectiveness in capturing lending opportunities and optimising its interest-related revenue. The net markup interest income for the six months amounted to Rs24.82 billion, marking a solid 44% increase compared to the same period last year. This growth underscores the bank’s ability to manage its interest income efficiently. Askari Bank’s non-markup interest income for the first half of the ongoing calendar year stood at Rs6.76 billion, reflecting a 21% year-on-year increase.

This growth highlights the bank’s diverse revenue streams beyond traditional lending activities. The bank’s total income for the six months reached Rs31.58 billion, demonstrating a substantial 38% growth compared to the same period last year. This comprehensive income figure underscores the bank’s ability to generate robust revenue from various segments. The profit-before-tax for the six months amounted to Rs17.01 billion, showcasing a significant 40% increase from the corresponding period last year. This growth emphasises the bank’s efficient financial management and its ability to capitalise on market trends. The profit-after-tax for the six months reached Rs8.84 billion, reflecting a 40% year-on-year increase. This growth highlights the bank’s consistency in delivering positive financial results to its stakeholders. Earnings per share for the six months stood at Rs6.10, reflecting a commendable 40% growth compared to the corresponding period last year. This growth in EPS indicates that the bank’s earnings available to shareholders have increased significantly on a per-share basis.

Net profit margin

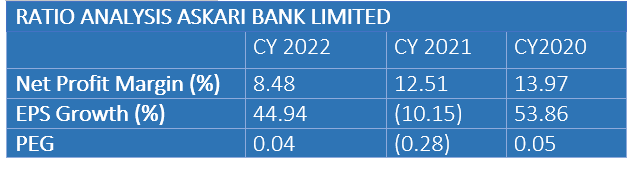

Net profit margin, a crucial indicator of a company’s profitability, reveals the proportion of revenue that translates into profit after covering all expenses. In 2022, Askari Bank’s net profit margin stood at 8.48%, marking a slight decrease from the previous year’s 12.51%. This shift might seem alarming at first glance, but it also showcases the bank’s precise management of costs in the face of evolving market dynamics. By balancing the equilibrium between expenses and revenue, Askari Bank continues to navigate the financial matters.

EPS growth

EPS growth is often regarded as an important part of a company’s profitability growth available to shareholders. In 2022, the bank’s EPS growth surged by an impressive 44.94%, bouncing back from the preceding year’s downturn of -10.15%. This roller-coaster ride in EPS shows the bank’s resilience in adapting to economic fluctuations. It highlights Askari Bank’s ability to not only withstand challenging times but also thrive when opportunities arise.

PEG ratio

The PEG ratio, which relates a company’s price-to-earnings ratio (P/E) to its earnings growth rate, gives insight into whether a stock is overvalued or undervalued relative to its growth potential. Askari Bank’s PEG ratio of 0.04 in 2022 signifies an interesting equilibrium between growth and valuation. With a PEG ratio lower than 1, the bank’s stock might be considered undervalued in relation to its EPS growth rate. This metric offers a glimpse into the bank’s ability to generate future value while maintaining a balanced market perception.

About the bank

Askari Bank was incorporated in Pakistan on October 9, 1991, as a public limited company. The bank is a scheduled commercial bank and is principally engaged in the business of banking as defined in the Banking Companies Ordinance, 1962. The ultimate parent of the bank is Fauji Foundation.

Credit: INP-WealthPk