INP-WealthPk

Ayesha Mudassar

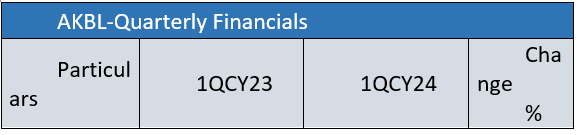

Askari Bank Limited (AKBL) reported a total revenue of Rs16.6 billion for the quarter ended March 31, 2024, reflecting a 10% increase from the same period of 2023, according to WealthPK. As per the quarterly report, the bank recorded a net markup income of Rs12.8 billion, up from Rs11.9 billion in 1QCY23. This increase in markup income was primarily attributable to growth in earning assets. Furthermore, the non-markup interest income for the quarter reached Rs3.7 billion, representing a 20% year-on-year (YoY) increase. Higher non-markup income was mainly contributed by gains from investment and foreign exchange income.

Despite higher income, Askari Bank's net profit declined to Rs3.7 billion during 1QCY24, nearly 21% lower than its profit in the same period last year. This reduction in profit is primarily due to increased credit loss allowances, higher operating expenses and an increased taxation rate. Going forward, the profit and loss statement shows that operating expenses for the current quarter rose by 22%, driven primarily by inflation, currency devaluation and costs associated with the addition of 60 new branches to the nationwide network over the last 12 months.

Pattern of shareholding in 2023

As of December 2023, AKBL had an outstanding share capital of 1.4 billion shares, which were held by 14,194 shareholders. Associated companies and related parties were the largest shareholders of AKBL, representing over 72% of its share capital. This was followed by the general public holding 15% shares. Modarba and mutual funds had a stake of 4.1% in AKBL followed by insurance companies owning 1.2% shares. The remaining shares were held by other categories of shareholders.

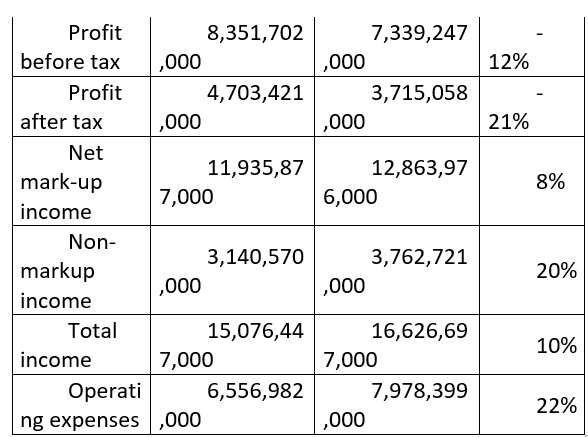

Financial performance in CY23

Askari Bank achieved significant growth in core earnings, evidenced by a 53% YoY increase in profit-before-tax for the year ended December 31, 2023. Similarly, the profit-after-tax witnessed a notable rise of 52%, reaching Rs21.4 billion, translating into earnings per share (EPS) of Rs14.79 compared to an EPS of Rs9.70 reported in CY22.

![]()

Furthermore, the robust volumetric growth in average earning assets and improved spreads enabled the bank to post a net markup income of Rs59.4 billion for the year ended December 31, 2023, depicting a growth of 49%. The bank's non-markup income surged to Rs12.9 billion from Rs11.6 billion last year, with major contributions from fee commission income (Rs1.8 billion), dividend income (Rs225.5 million), and other income (Rs121.2 million). Overall, the bank generated a total income of Rs72.3 billion in 2023, marking a 40% increase compared to the previous year's income. The sound financial results for the year were enabled by the continuous focus on delivering the long-term strategy, connecting and optimising resources for the accelerated value chain, and continued business sustainability.

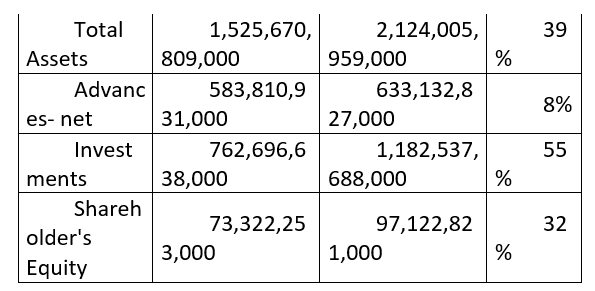

Assets position

The total assets of the bank grew 39% to Rs2.12 trillion as of December 2023. Average earning assets registered a 21% growth YoY, mainly funded by a 19% increase in average customer deposits.

The analysis of the assets mix highlights that net investments and net advances increased by 55% and 8%, respectively, during the year. Moreover, the customer deposits grew by 13% YoY to close at Rs1.3 trillion.

About the bank

Askari Bank was incorporated as a public limited company in Pakistan on October 9, 1991. The bank is a scheduled commercial bank and is principally engaged in the business of banking as defined in the Banking Companies Ordinance, 1962. The bank offers conventional, corporate, Islamic, consumer, and agricultural banking services across the country. The ultimate parent of the bank is the Fauji Foundation.

Future outlook

The bank remains steadfast in its dedication to producing outstanding results and creating sustainable value for stakeholders. With a strong foundation and a growth-oriented strategy, the management is confident in its ability to achieve new heights in the future.

Credit: INP-WealthPk