INP-WealthPk

Hifsa Raja

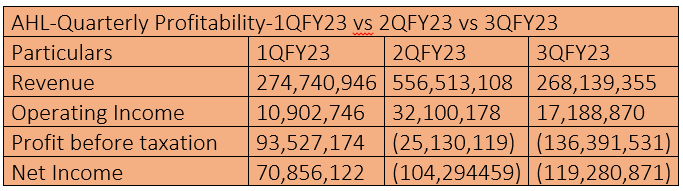

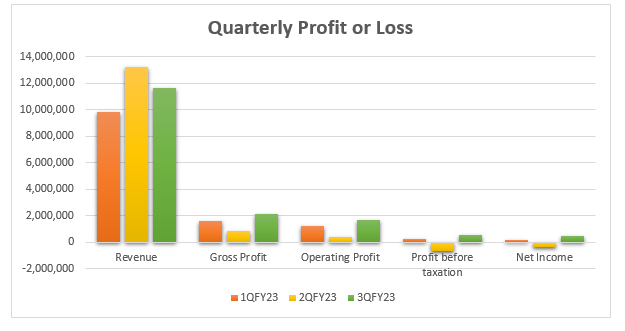

Arif Habib Limited (AHL) sustained net losses in the second and third quarters of the ongoing fiscal year 2022-23. In the first quarter (July-September) of FY23, AHL posted gross revenues of Rs274 million, profit-before-taxation of Rs93 million and net profit of Rs70 million.

In the second quarter (October-December), the AHL posted a gross revenue of Rs556 million – the highest of the three quarters – a loss-before-taxation of Rs25 million and a net loss of Rs104 million. In the most recent quarter (January-March), the company posted gross revenues of Rs268 million, loss-before-tax of Rs136 million and net loss of Rs119 million.

Nine-month comparison

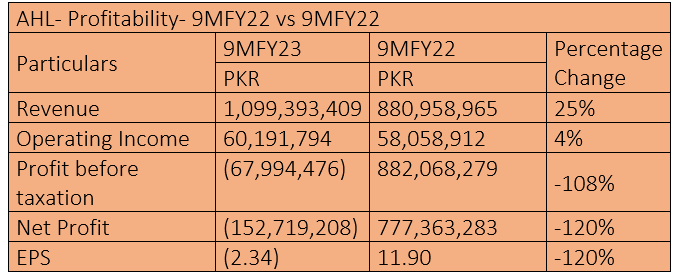

AHL’s revenue increased 25% to Rs1.09 billion in the first nine months of FY23 (9MFY23) from Rs880 million over the corresponding period of FY22. Similarly, the company’s operating income increased 4% to Rs60 million in 9MFY23 from Rs58 million over the corresponding period of FY22. However, the company witnessed loss-before-tax of Rs67 million in 9MFY23 compared to profit-before-taxation of Rs882 million in 9MFY22, posting a 108% negative growth. The firm also sustained net loss of Rs152 million in 9MFY23 compared to net profit of Rs777 million over the corresponding period of FY22, registering a 120% decline year-on-year. Similarly, the company’s loss per share stood at Rs2.34 in 9MFY23 compared to earnings per share of Rs11.90 in 9MFY22, posting a whopping 120% decline.

2021-22 summary

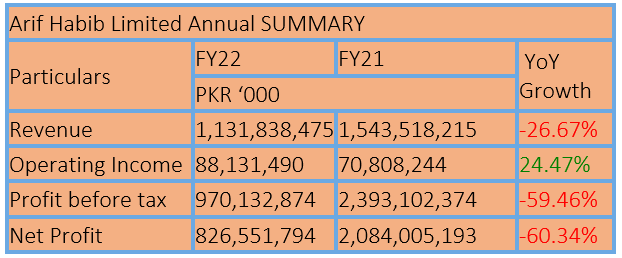

AHL’s gross revenue decreased 26% to Rs1.13 billion in the fiscal year 2021-22 from Rs1.54 billion FY21. However, the company’s operating profit increased 24% to Rs88 million in FY22 from Rs70 million in FY21. But the profit-before-taxation plunged 59% to Rs970 million in FY22 from Rs2.3 billion in FY21. The profit-after-taxation also plunged 60% to Rs826 million in FY22 from Rs2.08 billion in FY21.

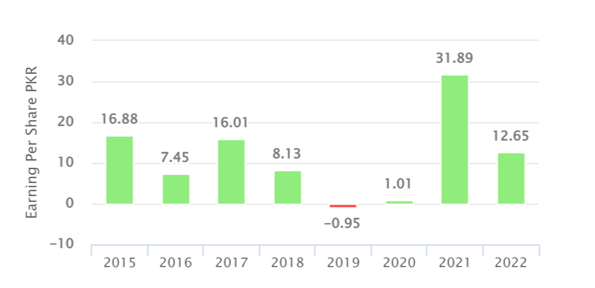

Earnings per share

The earnings per share in 2019 was negative at Rs0.95, but improved to Rs1.01 in 2020. It showed a remarkable growth and reached Rs31.89 in 2021. But then it decreased to Rs12.65 in 2022.

Market capitalisation

In 2022, AHL had market capitalisation of Rs3.41 billion compared to Rs4.01 billion in 2021, which was the highest since 2018. The company had the lowest market cap of Rs2.31 billion in 2020.

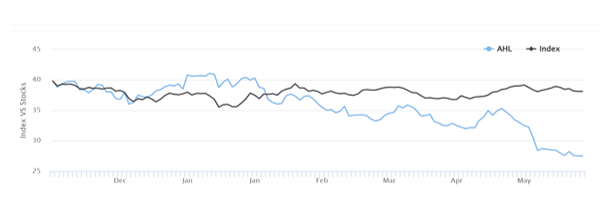

AHL stock vs index movement

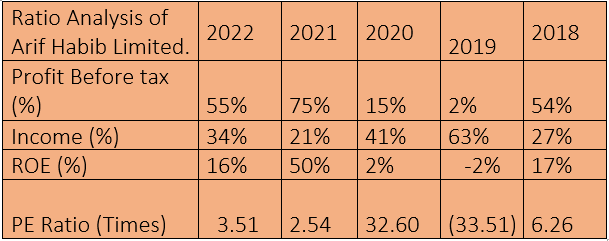

Ratio analysis

The ratio analysis of AHL from 2018 to 2022 shows fluctuations in profitability, income generation, return on equity, and market expectations. The profit-before-tax and income ratios varied across the years, indicating changing levels of profitability and income generation. The return on equity fluctuated, reflecting varying profitability in relation to shareholders' equity. The price-to-earnings ratio demonstrated changing market expectations.

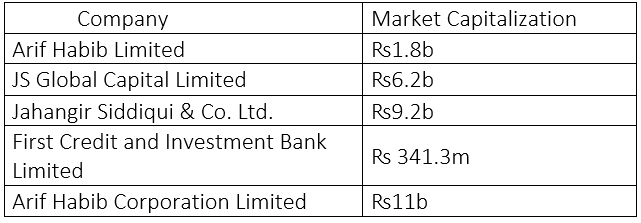

Industry comparison

AHL’s competitors include JS Global Capital Limited, Jahangir Siddiqui & Co. Ltd., First Credit and Investment Bank Limited and Arif Habib Corporation Limited.

Arif Habib Corporation Limited has the highest market capitalisation of ₨11 billion among its competitors. Jahangir Siddiqui & Co. Limited has the second highest market capitalisation of ₨9.2 billion. First Credit and Investment Bank Limited has the lowest market cap of Rs341 million. Arif Habib Limited has market capitalisation of Rs1.8 billion.

About the company

Arif Habib is a public listed company incorporated in Pakistan under the now repealed Companies Ordinance, 1984, which has since been replaced with Companies Act, 2017. The company was initially incorporated as an unquoted public limited company wholly owned by Arif Habib Corporation Limited. The principal activities of the company are investments, share brokerage, inter-bank brokerage, Initial Public Offer underwriting, advisory and consultancy services.

Credit: Independent News Pakistan-WealthPk