INP-WealthPk

Shams ul Nisa

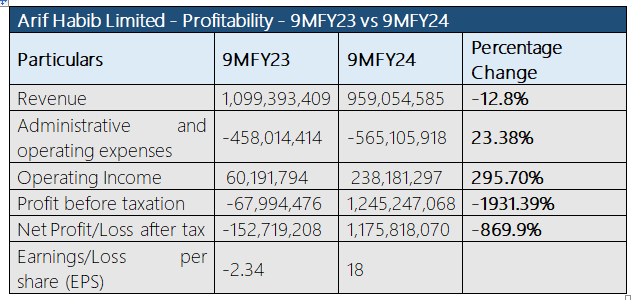

ISLAMABAD, June 10 (INP-WealthPK) – Arif Habib Limited’s net profit skyrocketed 869.9% to Rs1.17 billion in the nine months of the ongoing Fiscal Year 2024 against a net loss of Rs152.7 million in 9MFY23, reports WealthPK. This impressive result was made possible by the favorable market conditions which positively impacted the company’s investment portfolio. However, the revenue fell 12.8% from Rs1.09 billion in 9MFY23 to Rs959.05 million in 9MFY24. During the review period, the company witnessed a notable rise in salaries and other benefits, fees and subscriptions, repairs and maintenance, advertisement, and business promotion costs, pushing the administrative and operating expenses by 23.38% to Rs565.1 million.

The operating income increased dramatically from Rs60.19 million in 9MFY23 to Rs238.18 million in 9MFY24. This represents a 295.70% increase on account of growth in markup on loans to Javedan Corporation Limited and Aisha Steel Mills Limited. Furthermore, during the review period, the company earned a hefty profit on savings accounts and exposure deposits. Consequently, in 9MFY24, the profit before tax increased remarkably by 1931.39% to Rs1.24 billion compared to a loss before tax of Rs67.99 million in the corresponding period of the previous year. As a result, the earnings per share increased to Rs18 at the end of 9MFY24 from a loss per share of Rs2.34 in 9MFY23.

Investment banks/securities sector

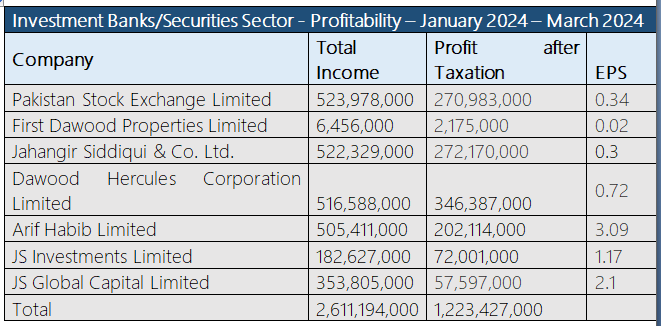

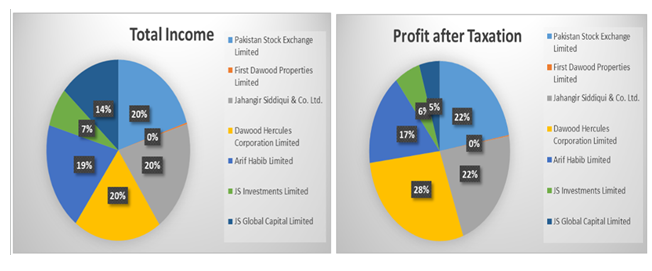

The Pakistan Stock Exchange Limited earned the highest total income of Rs523.9 million from January 2024 to March 2024, becoming the third-highest profitable company with a net profit of Rs270.9 million. The company posted an earnings per share of Rs0.34 during the review period. The company contributed 20% of total income and 22% of net profit to the sector.

Jahangir Siddiqui & Co. Ltd secured the second-highest total income and net profit from January 2024 to March 2024, with a Rs522.3 million total income and Rs272.17 million net profit. The company’s EPS remained at Rs0.3.

Dawood Hercules Corporation Limited ranked as the most profitable company in the sector with a net profit of Rs346.3 million during the review period. However, with a total income of Rs516.58 million, it marked its name as third on the list. The company’s EPS value for the review period was Rs0.72. Arif Habib Limited hit the highest EPS, with a value of Rs3.09. followed by an EPS of Rs2.1 by JS Global Capital Limited and Rs1.17 by JS Investments Limited. The sector posted a total income of Rs2.61 billion and a net profit of Rs1.22 billion from January to March 2024.

Analysis of profit and loss account

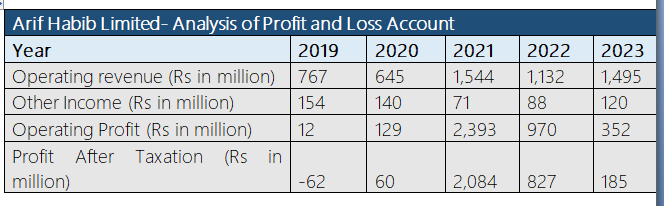

Arif Habib Limited's profit and loss account reveals a dynamic financial performance characterized by fluctuations in the operating revenue, other income, operating profit, and profit after taxation over the five years. The operating revenue declined from Rs767 million in 2019 to Rs645 million in 2020. However, a substantial increase of Rs1.544 billion in 2021 suggests a significant rebound or successful expansion efforts. With a slight drop to Rs1.13 billion in 2022, the company’s operating revenue again moved to Rs1.495 billion in 2023.

Other income, including non-operating sources like investment gains or one-time revenues, also displays fluctuations, possibly influenced by changes in investment strategies and market volatility. Other income declined from Rs154.0 million in 2019 to Rs120.0 million in 2023. The company reported the highest Rs140.0 million other income in 2020. The operating profit started from Rs12 million in 2019 to the highest of Rs2.39 billion in 2021, before declining in subsequent years. Similarly, the company registered two dips, a loss after taxation of Rs62 in 2019 and a profit after tax of Rs185.0 million in 2023, possibly due to tax regulation changes and increased expenses.

Future outlook

The company's future success relies heavily on political and economic stability. Positive developments can boost market volumes and valuations, attracting new companies to raise equity from public markets. The company is expanding its online and retail client base to increase investor participation and capitalize on market opportunities. The management anticipates activity in debt listings, mergers and acquisitions, privately placed TFCs, Sukuks, and equity listings.

Company profile

The company's main business operations are investments, share brokerage, interbank brokerage, underwriting for initial public offerings (IPOs), advising, and consulting services.

Credit: INP-WealthPk