INP-WealthPk

Shams ul Nisa

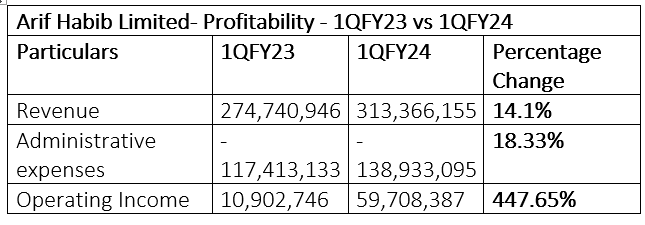

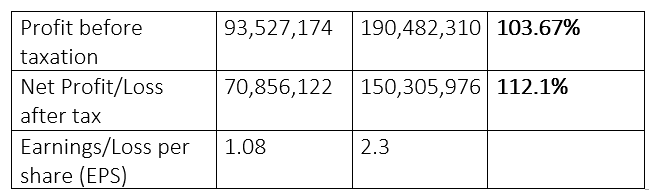

Arif Habib Limited’s net profit soared 112.1% year-on-year to Rs150.3 million in the first quarter of the ongoing fiscal year 2023-24 from Rs70.8 million over the same period last year, reports WealthPK. The revenue of Pakistan's largest securities brokerage, investment banking and research firm increased 14.1% to Rs313.36 million in 1QFY24 from Rs274.7 million in 1QFY23. However, the company's administrative expenses stood at Rs138.9 million, 18.33% higher than Rs117.4 million in 1QFY23. The company attributed this increase to the higher fixed costs due to investment in technology and workforce to ensure better service to customers.

Arif Habib Limited’s operating income showed a massive growth of 447.65% to Rs59.7 million in 1QFY24 from Rs10.9 million in 1QFY23. As a result, the profit-before-tax jumped to Rs190.48 million in 1QFY24, 103.67% higher than Rs93.5 million in the same period last year. At the end of the quarter, the earnings per share improved to Rs2.3 from Rs1.08 in 1QFY23.

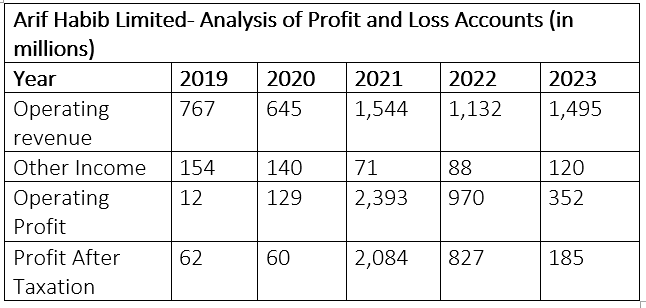

Analysis of profit and loss accounts

The operating revenue of Arif Habib Limited fluctuated overtime as it stood at R767.0 million in 2019 and peaked at Rs1.54 billion in 2021 before dropping to Rs1.13 billion in 2022. But in 2023, it bounced back, reaching Rs1.49 billion. From 2019 to 2021, the other income decreased from Rs154 million to Rs71 million. Nevertheless, this income increased to Rs88 million and Rs120 million in 2022 and 2023. On the other hand, the operating profit increased dramatically until 2021 and then decreased in the following years, reaching a maximum of Rs2.39 billion in 2022 and a minimum of Rs12 million in 2019. The company saw a mixed outcome for profit-after-tax from 2019 to 2023, with an increasing trend in 2020 and 2021 and a decreasing trend in 2022 and 2023.

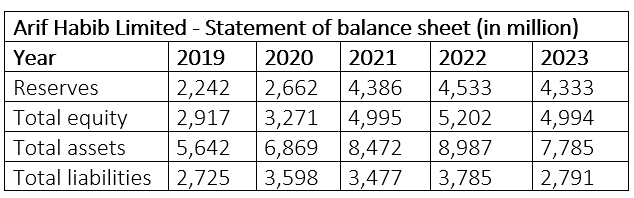

Statement of balance sheet

The reserves held by the company showed an upward trend, rising from Rs2.24 billion in 2019 to Rs4.53 billion in 2022 and then declining to Rs4.33 billion in 2023. Similarly, its total equity varied from Rs2.9 billion in 2019 to Rs5.2 billion in 2022. From 2019, when the total assets were valued at Rs5.6 billion, they increased to a peak of Rs8.98 billion in 2022, but then fell to Rs7.78 billion in 2023. The company’s total liabilities increased from Rs2.7 billion in 2019 to Rs3.59 billion in 2020. The total liabilities, however, declined to Rs3.47 billion in 2021 before steadily rising to Rs3.78 billion in 2022. They stood at Rs2.79 billion in 2023.

Credit: INP-WealthPk