INP-WealthPk

Shams ul Nisa

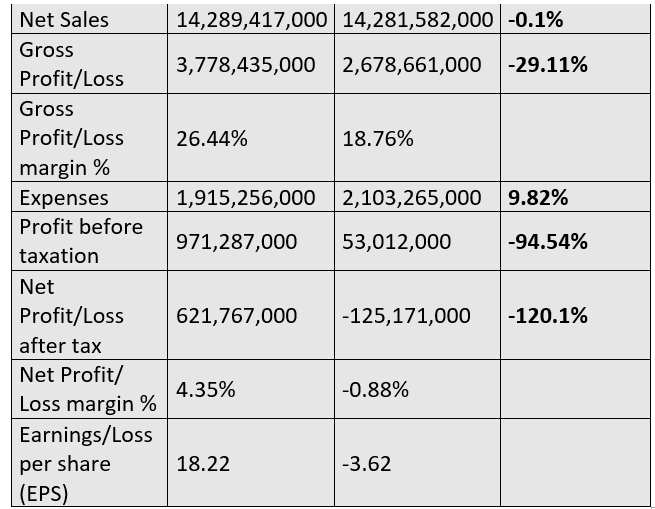

Archroma Pakistan Limited sustained a net loss of 120.1% in the first half of the current fiscal year (1HFY24) compared to the corresponding period of FY23. The company posted a net loss of Rs125.1 million in 1HFY24 compared to a net profit of Rs621.7 million in 1HFY23. Increased selling and administrative expenses coupled with higher borrowing costs and taxation caused the net losses. The company reported a net loss margin of 0.88% and a loss per share of Rs3.62 in 1HFY24 compared to a profit margin of 4.35% and earnings per share of Rs18.22 in 1HFY23.

The net sales of the chemical maker slightly contracted 0.1% to Rs14.28 billion during 1HFY24 compared to the corresponding period of FY23, reports WealthPK. This downtick in sales in both domestic and foreign markets was primarily caused by rising energy and commodity prices amid the ongoing conflict between Russia and Ukraine. The increase in imported raw material costs due to the devaluation of Pakistani currency compressed the gross profit by 29.11%, resulting in a decline in gross profit margin to 18.76% during the period under review compared to 26.44% in 1HFY23.

![]()

The chemical company's distribution, marketing and administrative expenditures pushed the expenses to Rs2.1 billion in 1HFY24, up by 9.82% from the same period in FY23. The profit-before-tax reduced significantly by 94.54% to Rs53.01 million in 1HFY24.

Historical trend

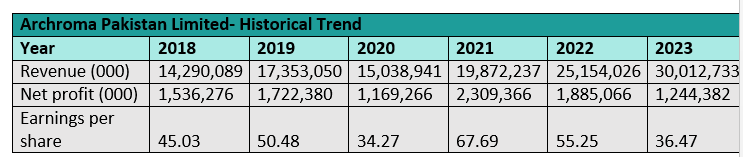

The chemical company posted growth in revenue over the years from 2018 to 2023, except for a decline in 2020. The net profit also fell in 2020, but recovered in 2021. However, the profit slid in 2022 and 2023 despite an increase in revenue. The earnings per share followed a similar path over these years.

In 2019, the revenue grew by 21.43% from Rs14.29 billion in 2018. It fell by 13.34% in 2020 due to the Covid-19 lockdown that decreased the demand for company products. However, it continued to expand in the subsequent years. A growth of 110.02% was recorded in revenue from 2018 to 2023. The main contributing factor to this growing revenue was the increase in sales volume, particularly in the textile and construction sector. The company's net profit dropped by 19% from Rs1.53 billion in 2018 to Rs1.24 billion in 2023. In 2023, rising energy costs, commodity prices, high inflation, and currency devaluation pushed the cost of sales, thus compressing the profit. The company recorded the highest earnings per share of Rs67.69 in 2021 and the lowest of Rs34.27 in 2020.

Activity/turnover ratios analysis

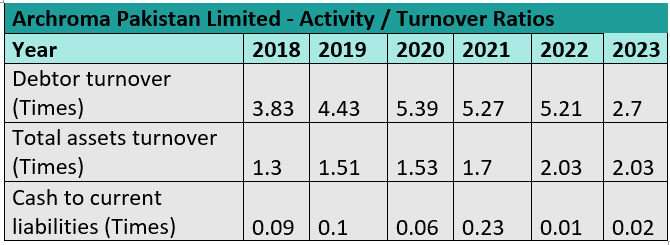

The company's debtor turnover ratio remained stable over the years, indicating that it was efficiently collecting outstanding account receivables. The debtor turnover peaked at 5.39 in 2020. Similarly, the total assets turnover ratio over the years remained above 1, with the highest of 2.03 recorded in 2022 and 2023. This implies the company's total assets were generating ample revenue.

However, the company possessed less cash compared to its current liabilities over the six years. The highest cash to current liabilities ratio of 0.23 was registered in 2021 and the lowest of 0.01 in 2022.

Future outlook

The conflict in the Middle East has pushed the global energy and commodity prices, affecting Pakistan's balance of trade and forex reserves, and impacting the country's business and economic outlook. However, additional financing and fiscal measures being discussed with the International Monetary Fund for a long-term loan facility would likely improve Pakistan's macroeconomic situation. These measures are expected to support business development in the textiles and construction industries. The company is confident it will be able to control the net working capital with stringent measures and a strong pipeline of projects to increase market share. The firm expects to return to profitable growth in the short to medium term.

Company profile

Archroma Pakistan is a limited liability company subsidiary of Archroma Textiles GmbH. The production, import, and retailing of chemicals, adhesives, sealants, dyes and coatings are among its principal business operations. Moreover, it also serves as an indenting agent.

Credit: INP-WealthPk