INP-WealthPk

Shams ul Nisa

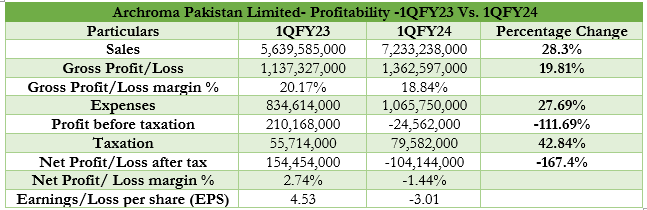

The Archroma Pakistan Limited's net profit plunged by 167%, despite the hike of 28.3% in net sales during the first quarter that ended on December 2023, reports WealthPK. The company's fiscal year ends in September each year. During the period under review, the company posted a net loss of Rs 104.14 million, compared to a net profit of Rs154.45 million in the corresponding period last year. The main factors that led to the reduction in net profitability are higher energy and commodity prices, accompanied by the highest inflation in all costs because of the continuing Russia-Ukraine conflict and growing conflict in the Middle East. The company registered net sales of Rs 7.23 billion in 1QFY24, due to the jump in net sales that was observed because of the increase in sales mainly by the textile effects and paper, packaging, and coatings business. Gross profit increased by 19.81% to Rs1.36 billion in 1QFY24 from Rs1.13 billion in 1QFY23.

Regardless of the growth in net sales and gross profit, gross profit margin went down to 18.85% in 1QFY24, compared to 20.17% in the same period last year, mainly driven by increased costs due to the devaluation of currency. On the expenses side, those grew by 27.69% to stand at Rs1.06 billion in 1QFY24, which includes distribution and marketing expenses, administrative expenses, impairment loss, and other expenses. At the end of the quarter under review, the company observed a loss before tax of Rs24.56 million, compared to a profit before tax of Rs210.16 million in 1QFY23, reflecting a decline of 111.69%. The company bore a tax of Rs79.58 million, 42.84% higher than Rs55.7 million in the same period last year. As a result, the company posted a loss margin of 1.44% in 1QFY24 against a net profit margin of 2.74% in 1QFY23. Similarly, a loss per share of Rs3.01 was posted in 1QFY24 compared to earnings per share of Rs4.53 in the same period last year.

Historical Trend

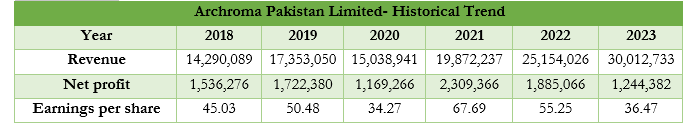

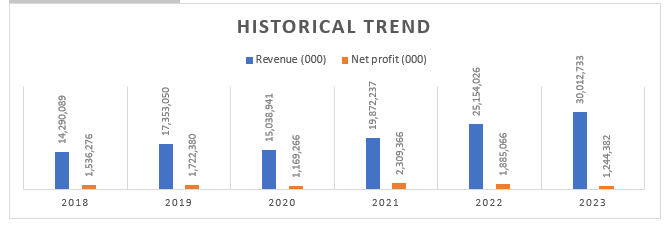

The historical revenue trend of Archroma Pakistan Limited shows that in the last six years, the company observed the highest revenue of Rs30.01 billion in 2023. From Rs14.29 billion in 2018, the company's revenue kept increasing, with only one dip of Rs15.03 billion in 2020. Whereas, the net profit remained volatile as it declined over the six years from Rs1.5 billion in 2018 to Rs1.2 billion in 2023. The company earned the highest net profit of Rs2.3 billion in 2021 and the lowest of Rs1.16 billion in 2020.

A similar pattern was followed by earnings per share, declining from Rs45.03 in 2018 to Rs36.47 in 2023. Over the six years, the highest earnings per share of Rs67.69 was recorded in 2021, and the lowest of Rs34.27 in 2020.

Profitability Ratios Analysis

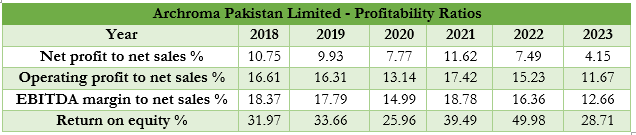

The Archroma Pakistan Limited's net profit to net sales varied over the past six years, ranging between a minimum of 4.15% in 2023 and a maximum of 11.62% in 2021. Starting from 10.75% in 2018, it declined to 7.77% in 2020, peaked in 2021, but then dropped in later years. Operating profit to net sales followed a similar track, registering 11.67% in 2023 compared to 16.61% in 2018. The EBITDA margin to net sales went down from 18.37% in 2018 to 14.99% in 2020 but surged to the highest of 18.78% in 2021. However, it kept on declining, reaching the lowest of 12.66% in 2023. This shows that the company generated positive profitability before accounting for interest, taxes, and expenses. The return on equity observed an overall decline in the past six years, with two major dips of 25.96% in 2020 and 28.71% in 2023. In 2022, the company posted a return on equity of 49.98%.

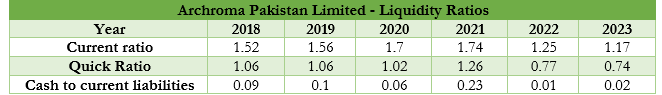

Liquidity Ratios Analysis

The current ratio shows a risk of covering debt using assets. A ratio greater than 1.2 is considered safe, and the company's current ratio remained above 1.2 over the years. whereas in 2023, it remained slightly below standing at 1.17. For six years, the quick ratio stayed above 1 from 2018 to 2021, reflecting enough quick assets to cover short-term obligations. However, it decreased and remained below 1 in 2022 and 2023, indicating a higher risk of paying back short-term obligations. The company lacked cash over the six years, as cash to current liabilities remained below 1.

Future outlook

The global surge in energy and commodities prices due to the armed conflicts in the Middle East has made it difficult to balance trade and forex reserves. Nonetheless, the textile sector is optimistic in the remaining months of the fiscal year as IMF-discussed additional financing programs and some corrective fiscal measures are anticipated to positively contribute to improving Pakistan's overall macroeconomic situation, which is expected to support business development for the nation's construction and textile.

Company profile

Archroma Pakistan Limited is a limited liability company. Its core activities include the manufacture, import, and sale of chemicals, dyestuffs and coating, adhesives, and sealants. It also acts as an indenting agent.

inpCredit: INP-WealthPk