INP-WealthPk

By Jawad Ahmed

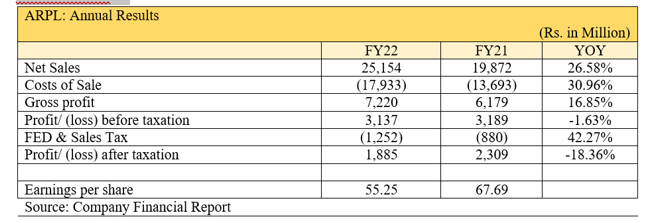

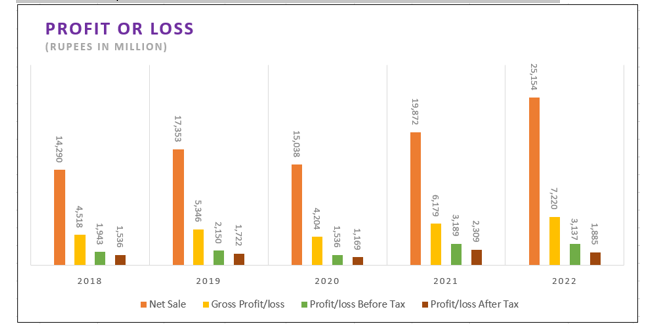

Archroma Pakistan Limited’s net sales increased 26.5% to Rs25.15 billion in the financial year that ended on June 30, 2022 compared with Rs19.87 billion in fiscal 2020-21.

The main business activities of Archroma Pakistan Limited include the production, import, and sale of chemicals, dyestuffs, coatings, adhesives and sealants.

The company is a subsidiary of Archorma Textiles Gmbh, registered and headquartered in Reinach, Switzerland, reports WealthPK.

The company posted a gross profit of Rs7.22 billion in FY22, up 16.8% from Rs6.17 billion in FY21.

The profit-before-tax for the year decreased marginally by 1.63% to Rs3.13 billion from Rs3.18 billion in FY21.

Due to sharp rise in taxes and manufacturing costs, the company's net income fell 18.36% to Rs1.88 billion in FY22 from Rs2.30 billion in FY21.

As a result, the earnings per share (EPS) decreased from Rs67.69 in FY21 to Rs55.25 in FY22.

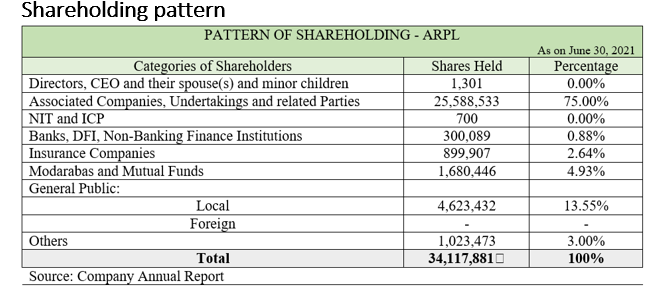

As of June 30, 2021, the company’s directors, the CEO, their spouses and minor children owned a negligible number of shares, whereas associated companies, undertakings and related parties possessed 75% of the shares. Banks, DFIs and NBFIs held 0.88% of the shares, insurance companies 2.64%, and modarabas and mutual funds 4.93%. Local investors owned 13.55% of the shares and “others” represented 3%.

Company’s performance over the years

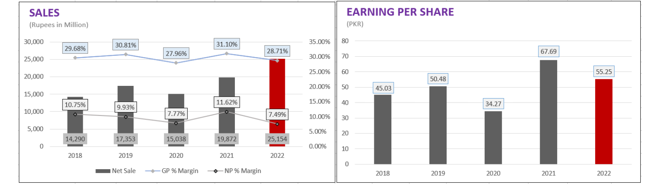

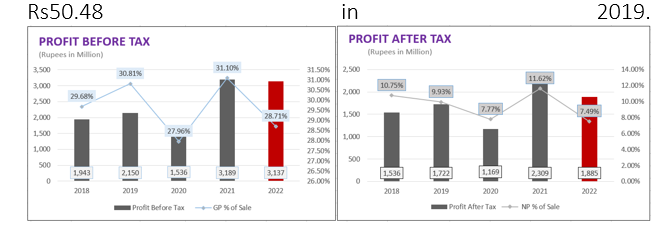

In 2019, the company’s sales revenue increased to Rs17.35 billion from Rs14.29 billion in 2018.

The company’s gross profit surged to Rs5.34 billion from Rs4.51 billion in the previous year, registering a 18.4% increase year-over-year.

The profit-after-tax for the year jumped to Rs1.72 billion, 12.42% higher than the previous year’s Rs1.53 billion. Resultantly, the EPS increased to Rs50.48 in 2019 from Rs45.03 the year before.

In 2020, the Covid-19 pandemic and the resultant challenging economic environment caused the company's sales to decrease 13.37% to Rs15 billion from Rs17.35 billion in 2019.

This caused the company's gross profit to drop from Rs5.34 billion in 2019 to Rs4.20 billion.

The company’s net profit also decreased from Rs1.72 billion in 2019 to Rs1.16 billion. The EPS also decreased to Rs34.27 from

In 2021, the company's top line climbed to Rs19.8 billion from Rs15 billion in 2020 as a result of an increase in product demand.

Because of increased demand and the economy's recovery following the lifting of the restrictions brought on by Covid-19, the gross profit increased to Rs6.17 billion from Rs4.20 billion the previous year.

The net profit also jumped from Rs1.16 billion the previous year to Rs2.30 billion in 2021.

As a result, the EPS increased from Rs34.27 to Rs67.69.

Credit : Independent News Pakistan-WealthPk