INP-WealthPk

Shams ul Nisa

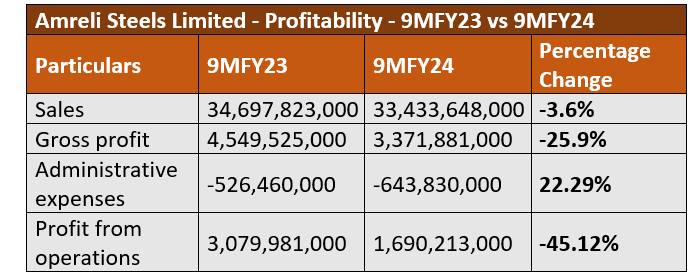

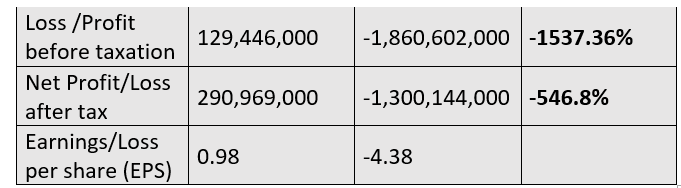

Amreli Steels Limited sustained a whopping Rs1.3 billion net loss in the first nine months of the current fiscal year (9MFY24) compared to Rs290.9 million net profit in 9MFY23, translating into a mammoth 546.8% negative growth, reports WealthPK. This massive loss was caused by a variety of circumstances, including consumer spending restraint, trade route disruption due to the Red Sea crisis, infrastructure project impediments, and smuggling that impacted the steel market. The decrease in demand caused the sales to decline to Rs33.43 billion in 9MFY24 from Rs34.69 billion in 9MFY23, registering a 3.6% drop. The gross profit also dropped by 25.9% to Rs3.37 billion during this period because of the muted demand, which was caused by general elections, rising borrowing costs and ongoing increases in energy prices.

Administrative expenses climbed to Rs643.8 million in 9MFY24, up 22.29% from Rs526.4 million in the same period last year. The company also saw a 45.12% reduction in its operating profit in 9MFY24. As a result, at the end of 9MFY24, the company incurred a loss-before-tax of Rs1.86 billion compared to a profit-before-tax of Rs129.4 million in 9MFY23, showcasing an exponential decline of 1537.26%. Likewise, the company reported a loss per share of Rs4.38 in 9MFY24 against earnings per share of Rs0.98 in 9MFY23.

Engineering sector – net profit in 3QFY24

Overall, the net profit of a majority of companies in the engineering sector declined significantly in 3QFY24 compared to 3QFY23. Aisha Steel Mills Limited was the only firm in the sector that earned a net profit of Rs91.08 million in 3QFY24 compared to a net loss of Rs48.18 million in 3QFY23 due to the extra quantity it sold in both domestic and international markets.

However, the net profit of Crescent Steel & Allied Products Limited reduced by 67.46%; Amreli Steels Limited’s by 4.15%; Mughal Iron & Steel Industries Limited’s by 92.11%, International Industries Limited’s by 29.14%, and International Steels Limited’s by 53.45%, respectively, during the period under review. Agha Steel Ind Ltd suffered a net loss of Rs1.81 billion (699.37%) compared to a net profit of Rs302.8 million in 3QFY23. Ittefaq Iron Industries Limited sustained a net loss of Rs160.3 million in 3QFY24. The challenges of high inflation, monetary tightening, and lower demand affected the performance of building and construction, infrastructure and automotive industries.

Ratio analysis

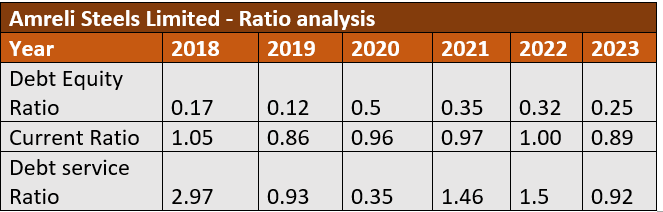

The debt-equity ratio is the value that measures the debt of a company in relation to the amount invested by its owners. From 2018 to 2023, the debt-to-equity ratio of Amreli Steels was below 1, indicating it faced reduced financial risk. The year 2020 saw the greatest value of 0.5 and 2019 the lowest value of 0.12. The current ratio, which measures a company’s ability to finance its short-term obligations using its current assets, remained below 1.2 over the years, indicating an increasing risk the company faced to cover its short-term obligations.

The debt service ratio of a business indicates how well it can use cash from operations to pay off its debt. A debt service ratio above 1 is generally regarded as safe. An optimum ratio is above 2. Amreli Steels debt service ratio peaked in 2018 at 2.97 but then steadily declined to 1.46 in 2021 and slightly increased to 1.5 in 2022. However, in 2020, 2023, and 2019 it stayed below 1.

Credit: INP-WealthPk