INP-WealthPk

Shams ul Nisa

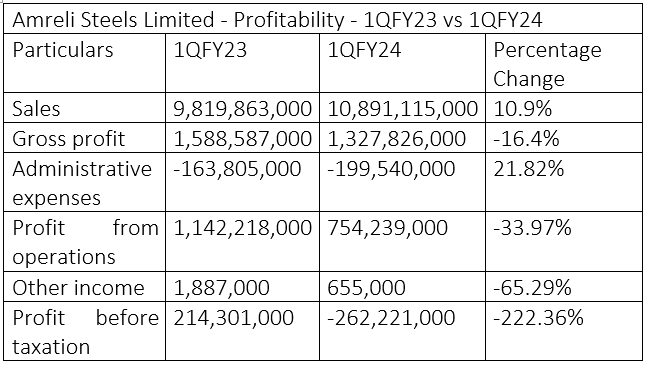

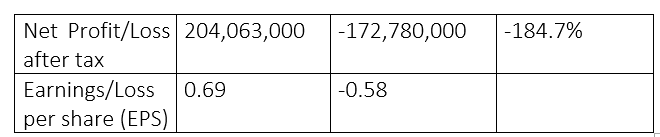

Amreli Steels Limited bore a net loss of Rs172.78 million in the first quarter (Jul-Sept) of the ongoing fiscal year 2023-24 compared to a profit of Rs204.06 million over the same period of FY22 because of the demand contraction caused by economic slowdown. In percentage terms, the firm registered a hefty profit decline of 184.7% year-on-year. However, the net sales grew by 10.9% from Rs9.81 billion in 1QFY23 to Rs10.89 billion in 1QFY24. The steel manufacturer’s gross profit went down by 16.4%. Its administrative expenses increased 21.82% to Rs199.5 million in 1QFY24 from Rs163.8 million in 1QFY23.

The company’s operating profit contracted significantly to Rs754.23 million in 1QFY24 from Rs1.14 billion in QFY23, due to higher interest rates. Other income shrank by 65.29%. As a result, the company incurred a loss-before-tax of Rs262.2 million in 1QFY24 compared to a profit-before-tax of Rs214.2 million in 1QFY23. The company also suffered a loss per share of Rs0.58 in 1QFY24 compared to earnings per share of Rs0.69 in 1QFY23.

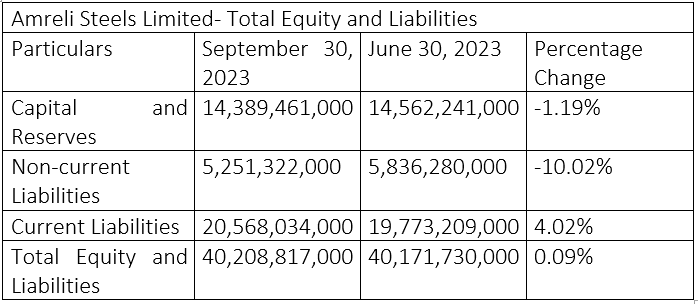

Total equity and liabilities analysis

Amreli Steels capital and reserves contracted by 1.19% between June 2023 and September 2023. This indicates that the company financed its operations by external sources. The steel manufacturing company observed a reduction in its long-term obligations as the non-current liabilities dwindled to Rs5.25 billion in September 2023 from Rs5.836 billion in June 2023. This shows that the company successfully paid off its debt obligations. However, the current liabilities grew by 4.02% in September 2023. At the end of September 2023, the total equity and liabilities increased slightly to Rs40.208 billion from Rs40.171 billion in June 2023.

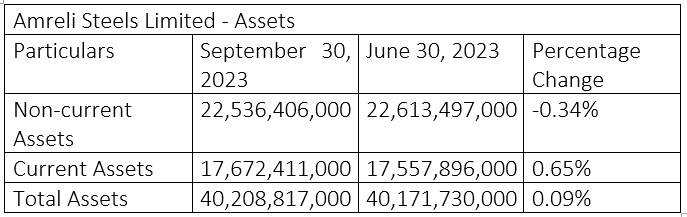

Assets analysis

The non-current assets of Amreli Steels witnessed a marginal decline of 0.34% from June 2023 to September 2023. This indicates the company reduced its long-term assets holdings during the period under review. However, the current assets increased by 0.65% and total assets by 0.09%, respectively. This shows a rise in short-term asset holdings.

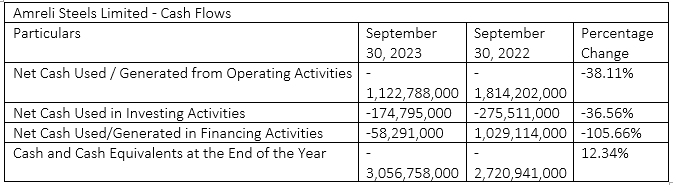

Cash flow analysis

Amreli Steels used net cash of Rs1.122 billion in operating activities in September 2023 compared to Rs1.814 billion used in September 2022. The company utilised 36.56% less cash in investing activities in September 2023 compared to September 2022. This means that the company invested in purchasing property, plant and equipment. However, the company used Rs58.29 million in financing activities in September 2023 compared to Rs1.029 billion used in September 2022. The company had Rs3.056 billion cash and cash equivalents at the end of September 2023 compared to Rs2.720 billion at the end of September 2022.

Credit: INP-WealthPk