INP-WealthPk

Ayesha Mudassar

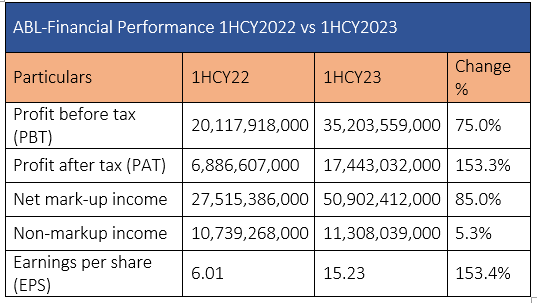

Allied Bank Limited (ABL), one of Pakistan’s prominent banks, has declared an unconsolidated profit-before-tax of Rs35.2 billion for the half year ended June 30, 2023, posting an impressive growth of 75% over the corresponding period of last year, reports WealthPK. According to the financial results submitted to the Pakistan Stock Exchange, the bank recorded a profit-after-tax of Rs17.4 billion for 1HCY23 versus Rs6.8 billion over the corresponding period of last year. ABL announced an earnings per share of Rs15.2 for the period under review.

The net markup income posted massive growth, reaching Rs50.9 billion in 1HCY23 compared to Rs27.5 billion in 1HCY22. High interest rates along with timely repositioning within the asset base improved margins over the corresponding period of last year. Furthermore, the non-markup interest income for the six months reached Rs11.3 billion, representing a 5.3% year-on-year increase. The bank’s continuous focus on investing in its digital financial avenues, combined with maintaining diversification of revenue streams facilitated a robust fee income growth of 29%, reaching Rs5 billion during the first six months of calendar year 2023 as compared to Rs3.9 billion over the corresponding period of last year. The bank’s dividend income increased by 23% to Rs1.6 billion for the half-year period ended June 30, 2023, as compared to Rs1.3 billion over the corresponding period of 2022. The foreign exchange income also grew by 1.5% during the period under review.

Furthermore, the total assets exceeded Rs2.3 trillion and deposits reached Rs1.6 trillion as of June 2023. The bank's equity base stood at Rs136 billion as of June 30, 2023 compared to Rs127 billion as of December 31, 2022. The return on assets and return on equity stood at a robust level of 1.5% and 27.1%, respectively. Moreover, the bank’s outreach was expanded to 1,465 branches, including 1,340 conventional, 118 Islamic banking and seven digital branches. Meanwhile, the bank had a robust network of 1,565 automated teller machines, including 1,309 on-site, 251 off-site, and five mobile banking units. Overall, the bank pursued its approach of consistent growth through a robust risk management framework and improving customer experience through technologically driven automation and digitisation.

Banking industry of Pakistan

Despite numerous challenges, the banking sector has performed well. The industry's total asset base expanded by 14% from Rs34.5 trillion on December 31, 2022 to Rs39.4 trillion on June 30, 2023. The industry’s total deposits reached Rs25.5 trillion as of June 30, 2023, as against Rs22.4 trillion on June 30, 2022, showing an increase of 14%. In addition, the total investments depicted a growth of 17% and stood at Rs20.8 trillion during the period under review as compared to Rs17.9 trillion as of June 30, 2022.

Credit: INP-WealthPk