INP-WealthPk

Ayesha Mudassar

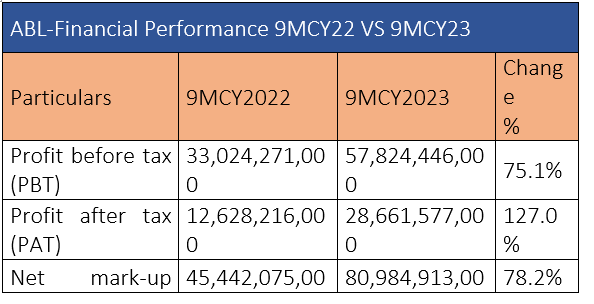

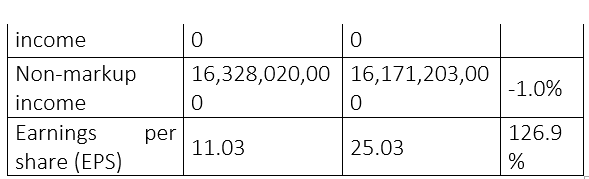

Allied Bank Limited (ABL), one of Pakistan’s prominent banks, has declared an unconsolidated profit-before-tax (PBT) of Rs57.8 billion for the nine months ended September 30, 2023, with an impressive growth of 75% over the corresponding period of the earlier year, reports WealthPK. According to the financial results submitted to the Pakistan Stock Exchange (PSX), the bank recorded a profit-after-tax (PAT) of Rs28.6 billion for 9MCY23 versus a PAT of Rs12.6 billion in the corresponding period of the last year, posting a substantial 127% growth. ABL announced earnings per share of Rs25.03 for the period under review.

The net markup income posted massive growth, reaching Rs80.9 billion for 9MCY23, compared to Rs45.4 billion in 9MCY22. Higher yields on investments, advances, and bank placements improved margins over the same period of last year. Furthermore, the non-markup interest income for the nine months reached Rs16.1 billion, representing a 1% year-on-year decline. The bank’s continuous focus on investing in its digital financial avenues, combined with maintaining diversification of revenue streams, facilitated a robust fee income growth of 30%, reaching Rs7.7 billion during the nine months of calendar year 2023 as compared to Rs5.9 million over the corresponding period of last year.

ABL's dividend income increased by 29.8% to Rs2.5 billion for the nine months ended September 30, 2023, as compared to Rs1.9 billion for the nine months ended September 30, 2022. Furthermore, the total asset base crossed Rs2.2 trillion mark and deposits reached Rs1.7 trillion as of September 30, 2023. The return on assets and return on equity stood at a robust level of 1.5% and 27.1%, respectively. Overall, the bank sought to achieve consistent growth through a robust risk management framework and improve customer experience through technologically driven automation and digitisation.

Review of banking sector

The banking sector remained resilient against a challenging operating environment and relatively subdued economic activity throughout the first nine months of 2023. As of September 30, 2023, the total assets of the industry amounted to Rs41,823 billion, reflecting a 21% increase compared to Rs34,530 billion as of December 31, 2022. This growth was primarily driven by a 26% improvement in investments and a significant 64% increase in cash and balances. In contrast, advances declined 0.5%. On the liability side, deposits improved by 17% to Rs26,318 billion as of September 30, 2023, as compared to Rs22,467 billion as of December 31, 2022.

Credit: INP-WealthPk