INP-WealthPk

Hifsa Raja

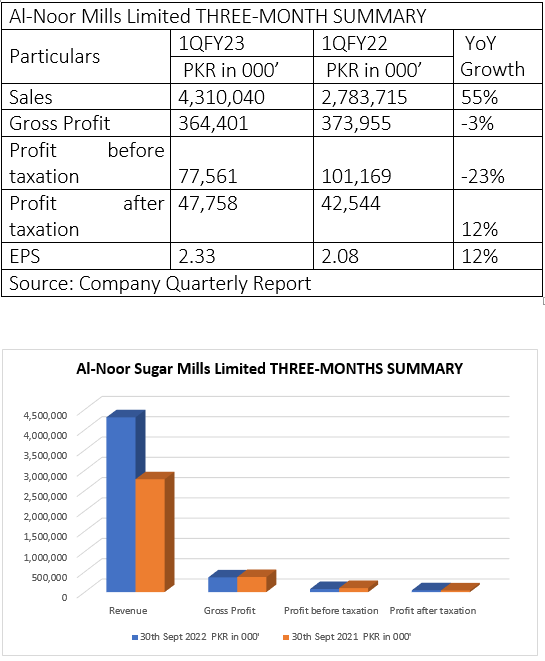

Al-Noor Sugar Mills Limited’s sales increased 55% to Rs4.3 billion in the first quarter (July-September) of the current fiscal year 2022-23 from Rs2.7 billion over the corresponding period of the previous year. However, the company’s gross profit dropped 3% to Rs364.4 million in 1QFY23 from Rs373.9 million in 1QFY22. The profit-before-taxation decreased to Rs77.5 million in 1QFY23 from Rs101 million in 1QFY22. However, the post-tax profit increased 12% to Rs47 million in 1QFY23 from Rs42 million 1QFY22, reports WealthPK.

The profit margins of the company were significantly higher in 1QFY22 compared to 1QFY23. In comparison to 1QFY22, when the gross profit margin stood at 13.43, it was 8.45 in 1QFY23. The net profit margin stood at 1.11 in 1QFY23 compared to 1.53 in 1QFY22.

Earnings growth analysis

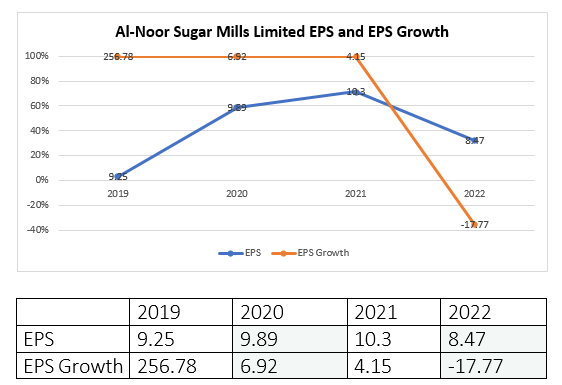

The earnings per share in 1QFY23 stood at Rs2.33 compared to Rs2.08 in 1QFY22. The EPS continued to increase from 2019 to 2021, when it stood at Rs10.3. However, the EPS dropped to Rs8.47 in 2022.

The company paid a dividend of Rs5 to its shareholders in 4QFY22, which was the most recent payout. The company paid the same amount of dividend to shareholders in the entire FY21, showing 9.66% dividend yield.

Enterprise value and market capitalisation

The company’s enterprise value significantly dropped in 1QFY23 compared to 1QFY22. The enterprise value stood at Rs1.25 billion in 1QFY23 as opposed to Rs4 billion in 1QFY22. The company’s market capitalisation in 1QFY23 stood at Rs1.25 billion compared to Rs1.58 billion in 1QFY22.

Company profile

Al-Noor Sugar Mills Limited operates sugar and medium density fiber board segments in Shahpur Jahania, Shaheed Benazirabad district of the Sindh province. The sugar segment is engaged in manufacturing and sale of refined sugar. The medium density fiber board segment is engaged in manufacturing of medium-density fiberboard. The company’s associated undertakings include Shahmurad Sugar Mills Limited, Shahmurad Distillery Unit, Reliance Insurance Company Limited and First Al-Noor Modaraba.

Credit: Independent News Pakistan-WealthPk