INP-WealthPk

Hifsa Raja

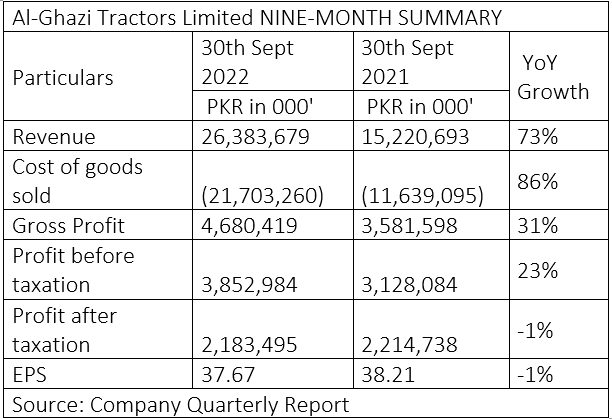

Al-Ghazi Tractors Limited’s revenue increased 73% to Rs26 billion in the first nine months of calendar year 2022 from Rs15 billion in the corresponding period of 2021, whereas the company’s cost of sales rose by 86% to Rs21 billion from Rs11 billion during the two comparable periods.

Despite growing import costs resulting from higher global commodity prices and less favourable local currency exchange rate, the gross profit of the company increased 31% to Rs4 billion in 9MCY22 from Rs3 billion in 9MCY21. The profit-before taxation during 9MCY22 increased to Rs3.8 billion from Rs3.1 billion in 9MCY21, showing a growth of 23% year-on-year. However, the profit-after taxation decreased 1% to Rs2.1 billion in 9MCY22 from Rs2.2 billion in 9MCY21, reports WealthPK.

Throughout the period under review, the company continued to operate in a challenging economic and business environment as the economy slowed due to devastating floods, policy contraction, and efforts to tackle fiscal and external imbalances. Despite these challenges, the company produced 19,008 tractors and sold 18,891 of them in the first nine months of CY22 compared to production of 12,547 units and sales of 13,759 units over the same period in CY21.

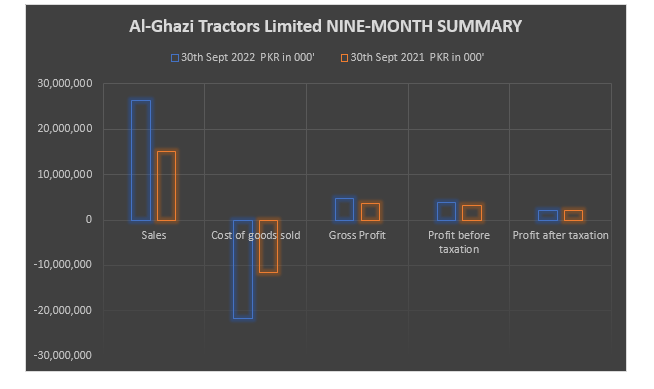

Earnings growth analysis

The earnings per share of the company kept increasing from 2019 onwards and stood at Rs51.03 in 2021. As the government has begun post-flood rehabilitation efforts with support from the UN and other donor agencies, the company is optimistic about the sales of its tractors. The business now focuses on enhancing the quality of its products and working to increase its market share.

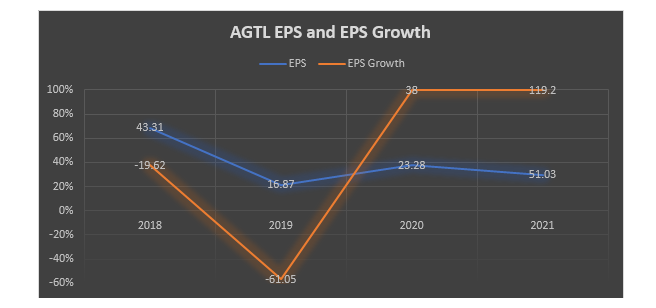

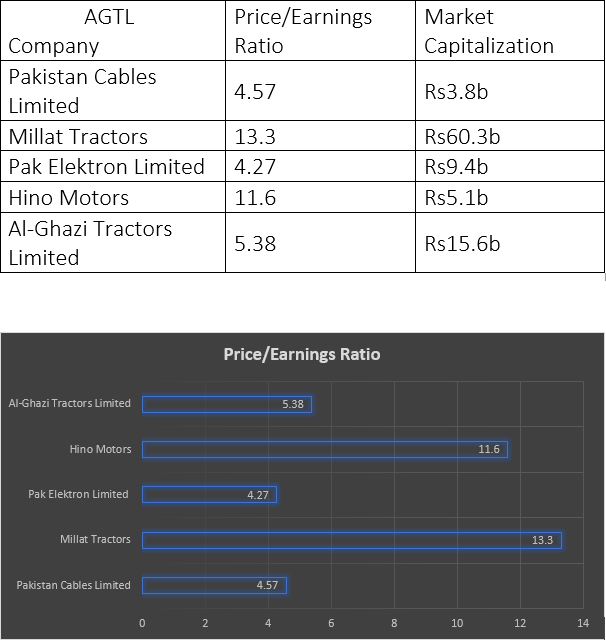

Industry comparison

Pakistan Cables Limited, Millat Tractors, Pak Elektron Limited, and Hino Motors are regarded as rivals of Al-Ghazi Tractors Limited. The price/earnings (PE) ratio of Al-Ghazi Tractors Limited stands at 5.38 with its market value clocking in at Rs15.6 billion. Al-Ghazi Tractors Limited is not overvalued when compared to its rivals, while Millat Tractors is the most overvalued business.

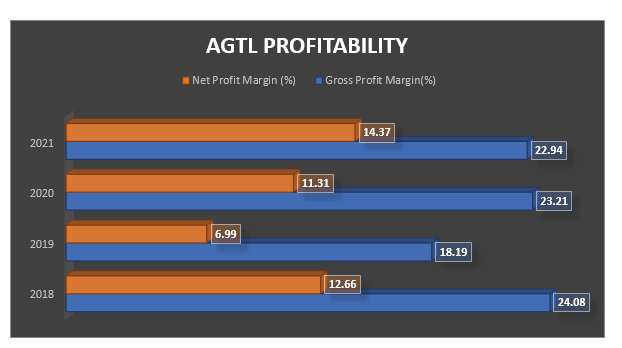

Profitability

The net profit margin and gross profit margin of Al-Ghazi Tractors Limited serve as indicators of its profitability. Both the profits kept fluctuating from 2018 to 2021, but remained in the positive territory.

Al-Ghazi Tractors Limited was incorporated in Pakistan under the Companies Act, 1913 (now Companies Act, 2017) as a public limited company in June 1983. The company is principally engaged in manufacture and sale of agricultural tractors, generators, implements, and spare parts. It also provides irrigation solutions. The company is a subsidiary of Al-Futtaim Industries Company LLC, UAE.

Credit: Independent News Pakistan-WealthPk