INP-WealthPk

Shams ul Nisa

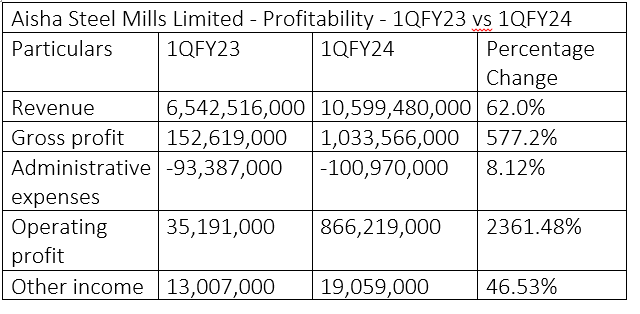

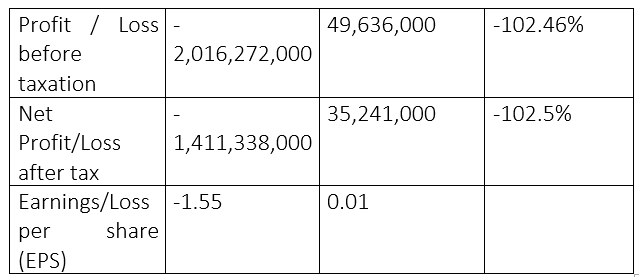

Aisha Steel Mills Limited reported a massive surge of 102.5% in profitability in the first quarter (July-September) of the current fiscal year 2023-24 as the company secured a net profit of Rs35.24 million compared to a net loss of Rs1.41 billion recorded in 1QFY23. The revenue of the company expanded by 62% to Rs10.59 billion in 1QFY24 from Rs6.54 billion in 1QFY23. The company observed a tremendous growth of 577.2% in its gross profit during the period under review. In 1QFY24, the company registered a gross profit of Rs1.033 billion compared to Rs152.6 million in the corresponding period last year.

On the expenses side, administrative expenses grew moderately to Rs100.97 million in 1QFY24 from Rs93.38 million in 1QFY23, indicating an expansion of 8.12%. Moreover, during the period under review, operating profit surged exceptionally by 2361.48% to Rs866.21 million from Rs35.19 million in the same period last year. Other income jumped to Rs19.05 million in 1QFY24 from Rs13.007 million in 1QFY233, posting an increase of 46.53%. The company registered a profit-before-tax of Rs49.63 million in 1QFY24 compared to a loss-before-tax of Rs2.016 billion in 1QFY23. Similarly, the firm posted earnings per share of Rs0.01 in 1QFY24 against a loss per share of Rs1.55 in the same period last year.

Assets analysis

![]()

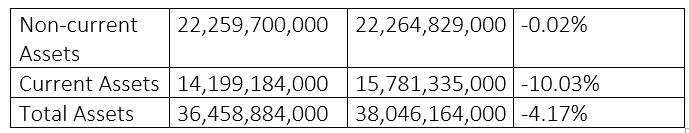

Aisha Steel Mills Limited reported a small decline in its non-current assets in September 2023, which inched down 0.02% to Rs22.259 billion from Rs22.264 billion in June 2023. The company's current asset saw a decrease of 10.03% from Rs15.78 billion in June 2023 to Rs14.19 billion in September 2023. As a result, the total assets decreased by 4.17% to Rs36.45 billion at the end of September 2023 from Rs38.04 billion in June 2023.

Equity and liabilities analysis

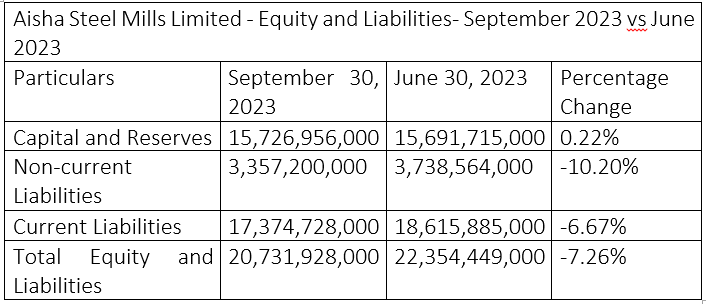

At the end of September 2023, the steel manufacturing company reported capital and reserves of Rs15.72 billion, up 0.22% from Rs15.69 billion recorded at the end of June 2023. In contrast, Aisha Steel Mills reported a drop in non-current liabilities from Rs3.73 billion in June 2023 to Rs3.35 billion in September 2023. This demonstrates that the company only used internal funds to support its activities, and the reduction in overall liabilities demonstrates the company's stable financial position. Current liabilities decreased by 6.67% to Rs17.37 billion in September 2023 from Rs18.61 billion in June 2023. This demonstrates that the company successfully managed its main operations and kept a close watch on its costs during this time. As a result, at the end of the first quarter of FY24, the company's total equity and liabilities fell to Rs20.73 billion from Rs22.35 billion in June 2023.

Credit: INP-WealthPk