INP-WealthPk

Shams ul Nisa

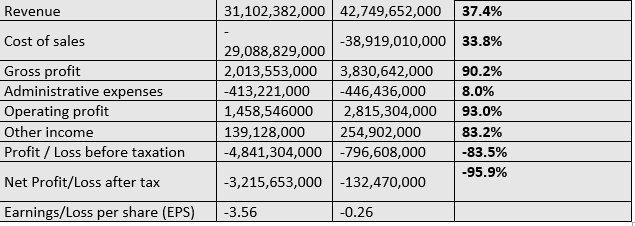

Aisha Steel Mills Limited managed to cut net losses by a substantial 95.9% to Rs132.4 million in the last fiscal year 2023-24 from Rs3.21 billion in the earlier fiscal, reports WealthPK.

During the year under review, local mills faced challenges as elevated inflation dampened demand coupled with lower-cost imports from China and exemption of sales tax on products manufactured in tribal and settled districts of Khyber Pakhtunkhwa. Notwithstanding challenges, the company achieved a substantial recovery with the revenue rising by 37.4% and the gross profit surging by 90.2% in FY24 despite a 33.8% increase in cost of sales during this period. Revenue growth was fuelled by a rise in sales volume, which grew to 164,732 tonnes, including 21,135 tonnes of exports, in FY24 compared to 122,334 tonnes sold and 3,609 tonnes exported in FY23, posting a 35% increase year-on-year. Total production also grew by 42% to 159,444 tonnes, while average inventory dropped from 17,362 tonnes to 11,505 tonnes.

![]()

Administrative expenses rose moderately by 8.0%, reflecting effective cost control. The operating profit surged by 93.02%, and other income climbed 83.21% in FY24. Despite these gains, the company reported a pre-tax loss of Rs796.6 million. The company’s efforts to decrease net losses in FY24 also resulted in loss per share decreasing to Rs0.26 from Rs3.56 in FY23.

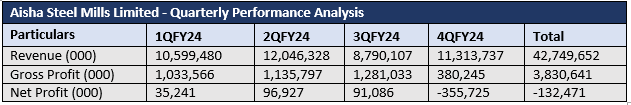

Quarterly performance analysis

Quarterly analysis of Aisha Steel Mills for FY24 reflects an overall positive trend in revenue and profitability despite some mixed results. In 1QFY24, the international steel market remained steady. Locally, economic difficulties persisted but showed improvement due to the government’s stabilisation measures. With a 3% increase in production, the company’s sales rose by 51% in the first quarter of FY24, resulting in a revenue of Rs10.5 billion, a gross profit of Rs1.03 billion and a net profit of Rs35.2 million. In the second quarter of FY24, thanks to steady hot rolled coils prices in China, and an IMF agreement helping ease the balance of payments crisis, the company’s sales grew by 12%, and production surged by 125%. However, finance costs remained high due to elevated interest rates. The revenue reached Rs12.04 billion in 2QFY24, with a gross profit of Rs1.13 billion and a net profit of Rs96.9 million.

In the third quarter of FY24, hot rolled coil prices declined due to weak demand in China and western countries. Pakistan’s manufacturing sector also faced sluggish demand with slowdowns in both the auto and construction industries. The local market struggled due to competition from tax-exempt steel products, leading to a 5% drop in sales despite 12% growth in production. Consequently, the revenue fell to Rs8.7 billion, and the net profit to Rs91.0 million, although the gross profit increased to Rs1.2 billion in this quarter. During the fourth quarter, hot rolled coil prices continued to decline due to low demand in China and western markets. However, production cuts, stimulus in China and potential demand growth in the US saw a gradual recovery in demand during this period. The company’s sales for the fourth quarter stood at Rs11.3 billion, the gross profit at Rs380.2 million, but it reported a net loss of Rs355.7 million. The company’s total sales volume for FY24 rose by 138% and production by 63% compared to the previous year.

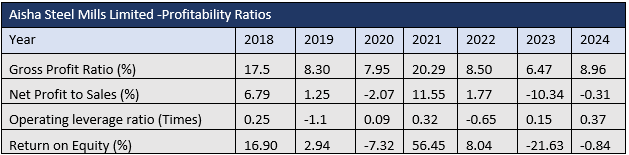

Profitability ratios

Aisha Steel Mills profitability ratios from 2018 to 2024 reveal considerable variability, influenced by market dynamics and operational performance. The gross profit margin varied, reaching 20.29% in 2021 but falling to 6.47% in 2023, with a modest recovery to 8.96% in 2024. The net profit to sales ratio was 6.79% in 2018, which increased to 11.55% in 2021, but dipped to -0.31% in 2024. The operating leverage ratio shifted from negative values to slightly positive gains, ending with a positive 0.37 in 2024, indicating enhanced operational efficiency. Return on equity also showed volatility, decreasing from 16.90% in 2018 to -21.63% in 2023, before improving to -0.84% in 2024.

Future outlook

The company is optimistic that the long-term IMF agreement and discount rate cut will boost demand in the automotive and construction sectors. Furthermore, the Federal Board of Revenue’s measures to impose sales tax on products manufactured in tribal and settled districts of Khyber Pakhtunkhwa would ensure fair price competition. Despite international price challenges, local mills anticipate increased capacity utilisation and a larger flat steel segment demand.

Company profile

Aisha Steel Mills was established in Pakistan on May 30, 2005, as a public limited company. The company's primary activity is producing and marketing cold rolled coils and hot dipped galvanised coils. It has established a cold rolling mill complex and a galvanisation factory at Bin Qasim, Karachi.

Credit: INP-WealthPk