INP-WealthPk

Shams ul Nisa

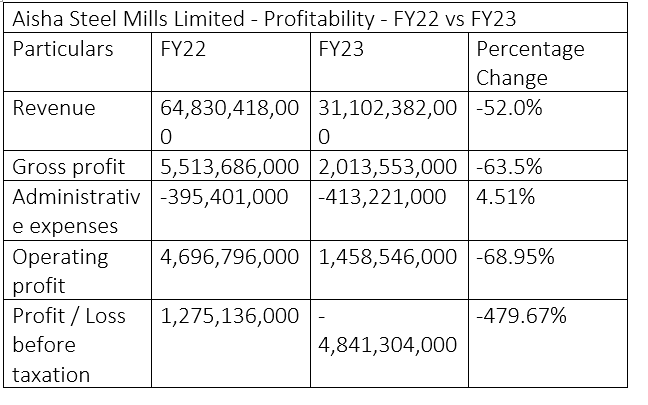

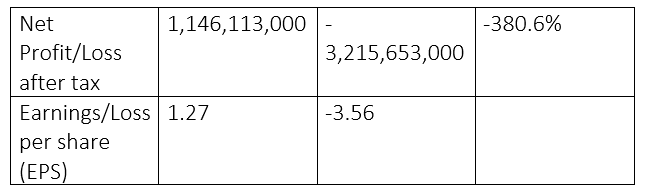

Aisha Steel Mills Limited announced a net loss of Rs3.2 billion in the fiscal year ending on June 30, 2023 compared to a net profit of Rs1.14 billion in the previous year, registering a massive decline of 380.6%. Similarly, the company incurred a staggering pre-tax loss of Rs4.84 billion in FY23 compared to a pre-tax profit of Rs1.27 billion in FY22, posting a mammoth 479.67% decline. These losses were attributed to a reduction in hard rolled coil prices, rupee depreciation and high interest rates.

In FY23, the company’s revenue plunged 52% to Rs31.10 billion from Rs64.83 billion in FY22 mainly due to a substantial decrease in sales volume and restrictions on the opening of letters of credit by the government to import raw material. As a result, the company slashed its production because of raw material shortage and failed to achieve its sales targets. The gross profit declined 63.5% to Rs2 billion in the year under review from Rs5.51 billion in the previous year.

The administrative expenses rose to Rs413.2 million in FY23 from Rs395.4 million in FY22, driven by a hike in interest rate and currency devaluation. The operating profit dropped by 68.95% to Rs1.45 billion in FY23 from Rs4.69 billion in FY22. The company posted a loss per share of Rs3.56 in FY23 compared to earnings per share of Rs1.27 in FY22.

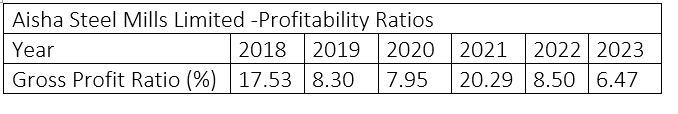

Analysis of profitability ratios

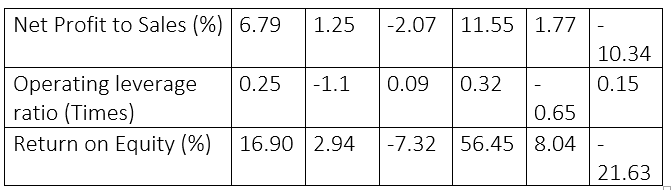

The profitability ratio analysis for the last six years showed a fluctuating trend in the gross profit ratio. The company recorded the highest gross profit margin of 20.29% in 2021. However, the gross profit margin overall reduced from 17.53% in 2018 to 6.47% in 2023. The company attributed this decline to the reduction in sales volume, currency depreciation and rise in borrowing costs. The company's net profit-to-sales ratio varied overtime, with negative values of 2.07% in 2020 and 10.34% in 2023. This is mainly due to a decrease in steel demand in the international market accompanied by difficulties in opening letters of credit by the State Bank of Pakistan.

Meanwhile, the operating leverage ratio remained below 1 and even recorded negative values of 1.1 in 2019 and 0.65 in 2022. This shows that the company's variable cost was high and it had to bear extra costs for producing each unit. The steel manufacturing company registered the highest 56.45% return-on-equity in 2021.

Analysis of liquidity ratios

The current ratio measures a company’s ability to use its current assets to cover its short-term obligations. Over the years, Aisha Steel Mills current ratio remained below 1, reflecting risk to cover the liabilities, while it stood at its highest level of 1.05 in 2021. Similarly, the quick ratio remained below 1 over the years, reflecting the lesser ability of the company to cover its obligations. Likewise, the company had sufficient cash to cover its current liabilities as the cash-to-current liability ratio remained below 1 from 2018 to 2023.

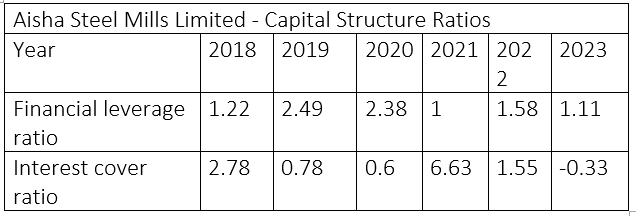

Analysis of capital structure ratios

The financial leverage ratio measures a company’s dependency on debt or equity to finance its operations and asset purchases. The company witnessed financial leverage greater than 1 over the years and the highest of 2.49 in 2019, indicating the company’s greater dependency on debt to finance its assets and operations. The interest cover ratio measures the ability of a company to pay interest rates of obligations. The higher the ratio, the better the company’s financial position. In 2018, the company recorded an interest cover ratio of 2.78, but it declined in the subsequent two years. However, it jumped to 6.63 in 2021 before falling to -0.33 in 2023.

Credit: INP-WealthPk