INP-WealthPk

Shams ul Nisa

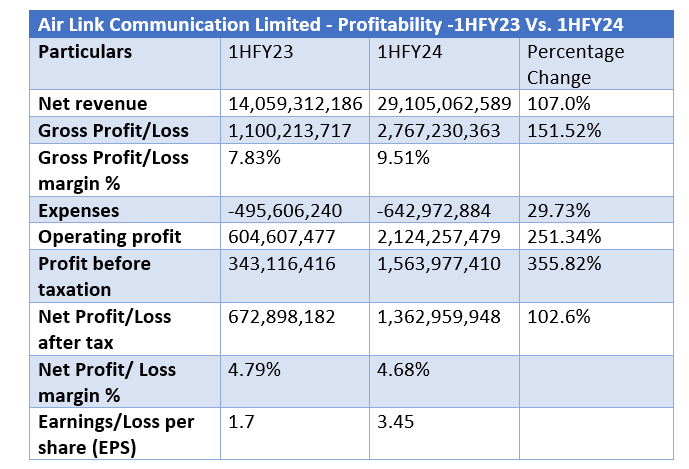

Air Link Communication Limited (ALCL) experienced a remarkable growth of 107.0% in net revenue and 102.6% in net profit in the first half of the current fiscal year (1HFY24) compared to the same period las year. The net revenue clocked in at Rs29.10 billion and the net profit at Rs1.36 million during this period. ALCL’s gross profit expanded by 151.52% to Rs2.76 billion from Rs1.1 billion in 1HFY23. During 1HFY24, the gross profit margin climbed to 9.51% from 7.83% in 1HFY23

Administrative expenses and selling and distribution costs increased by 29.73% to Rs642.9 million in 1HFY24. The operating profit surged by 251.34% and the profit-before-tax by 355.82%. However, the company observed a marginal decline in the net profit margin to 4.68% in 1HFY24 from 4.79% in the same period last year. The rise in net profit pushed the earnings per share to Rs3.45 in 1HFY24 from Rs1.7 in 1HFY23.

Quarterly analysis

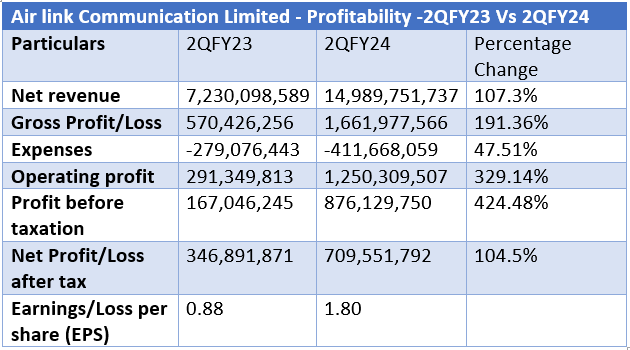

At the end of the second quarter (2QFY24), the company’s net revenue stood at Rs14.98 billion, up by 107%. Similarly, the gross profit surged by 191.36% to Rs1.66 billion from Rs570.4 million in 2QFY23. The expenses increased to Rs411.6 million, 47.51% higher than Rs279.07 million in the same period last year. The company managed to collect a total of Rs1.25 billion in operating profit in 2QFY24, indicating a significant expansion of 329.14%. During 2QFY24, the profit-before-tax and the net profit surged by 424.48% and 104.5%, respectively. Earnings per share jumped to Rs1.80 in 2QFY24 from Rs0.88 in the same period last year.

Financials analysis

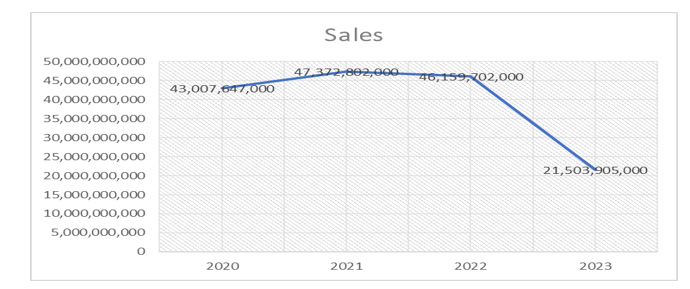

Air Link Communication Limited's sales observed a fluctuating trend from 2020 to 2023. Starting from Rs43.07 billion in 2020, the company’s sales increased to Rs47.37 billion in 2021, but decreased to Rs46.15 billion in 2022 before plunging to Rs21.5 billion in 2023. Earnings per share went downhill, from Rs4.88 in 2020 to Rs2.33 in 2023.

![]()

Ratios analysis

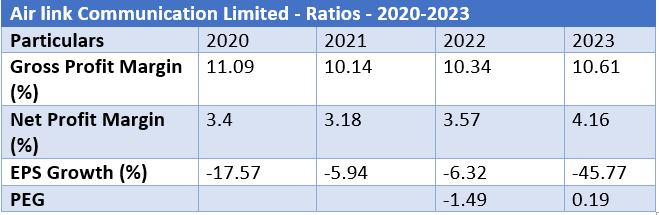

In 2020, Air Link Communication posted an 11.09% gross profit margin thanks to higher sales. However, in the subsequent year, the gross margin dropped to 10.14% and witnessed a marginal recovery to 10.34% in 2022 and 10.61% in 2023. The net profit margin stood at 3.4% in 2020, and declined slightly to 3.18% in 2021. However, it increased to 4.16% in 2023. Over the four years, the company’s earnings per share growth remained negative ranging between -5.94% to -45.77%. Similarly, price-earnings growth stood at -1.49 in 2022 and 0.19 in 2023.

Sector analysis

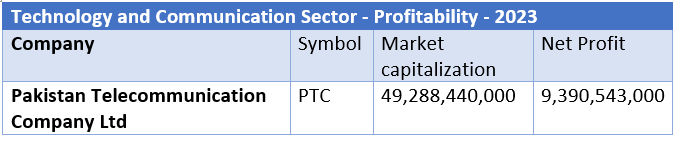

We have taken the market capitalisation and net profits of companies in 2023 to analyse the profitability of the technology and communication sector. Except for Pakistan Telecommunication Company, whose fiscal year ends in December, all the other companies' fiscal years end in June.

The market capitalisation provides insight into the worth of a company, determined by the total market value of all outstanding shares. Within the technology and communication sector, Pakistan Telecommunication Company holds 37% of the total outstanding shares. TRG Pakistan Limited comes next with a 28% share of the market capitalization, followed by Air Link Communication with 18%..

In terms of net profit in 2023, Pakistan Telecommunication Company leads the technology and communication sector with a net profit of Rs9.39 billion, followed by Hum Network Limited with a profit of Rs2.14 billion and Air Link Communication Rs1.6 billion. TRG Pakistan Limited bore a net loss of Rs1.33 billion during the period under review.

Company profile

ALCL was established on January 02, 2014, as a private company and was registered as a public limited company in 2019. The company deals in the import, export, distribution, identification, wholesale, and retail of goods and services linked to communication and information technology. These include accessories for laptops, tablets, cell phones, and smartphones, as well as related products.

Credit: INP-WealthPk