INP-WealthPk

Shams ul Nisa

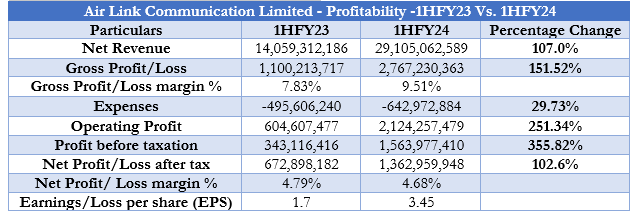

The Air Link Communication Limited displayed impressive financial results as the company posted a stupendous 107% year-to-year (YoY) expansion in net revenue to reach Rs29.1 billion during the first half (July-Dec) of the ongoing fiscal year, compared to Rs14.05 billion in 1HFY23. The company registered a staggering growth of 151.52% in gross profit, clocking in at Rs2.76 billion in 1HFY24, against Rs1.1 billion in 1QFY23. Therefore, the gross profit margin inched up from 7.83% in 1HFY23 to 9.51% in the period under review.

On the expenses side, the company's administrative expenses, selling, and distribution costs widened to Rs642.9 million in the 1HFY24, some 29.73% higher than Rs495.6 million in the same period last year. During the period under review, the company witnessed a significant hike in operating profit to Rs2.12 billion, compared to Rs604.6 million in 1HFY23, indicating a 251.34% YoY increase. The company witnessed an increase of 355.82% YoY in profit before tax to stand at Rs1.56 billion in 1HFY24. During the period, profit after tax jumped 102.6%, climbing to Rs1.36 billion from Rs672.8 million in 1HFY23. However, the higher taxation during the period resulted in a slight decline in the net profit margin to 4.68% in 1HFY24, against 4.79% in the corresponding period last year. The company registered earnings per share of Rs3.45 in 1HFY24, compared to Rs1.7 ESP in 1HFY23.

Quarterly Analysis

![]()

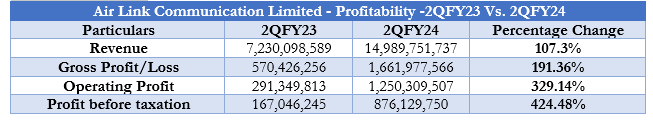

The second quarter analysis of the period ending in December witnessed a significant improvement in financial results as revenue showed an increase of 107.3% and gross profit by 191.36%. In 2QFY24, revenue stood at Rs14.98 billion, and gross profit was Rs1.66 billion. Operating profit surged to Rs1.25 billion in 2QFY24 from Rs291.3 million over the same period of FY23, showcasing a 329.14% yearly growth. Additionally, the company's profit before tax witnessed a significant growth of 424.48% to Rs876.1 million in 2QFY24 from Rs167.04 million in 2QFY23. The net profit stood at Rs709.5 million in 2QFY24, 104.5% greater than Rs346.8 million in the corresponding period of the previous year. Thus, ESP moved to Rs1.8 in 2QFY24 from Rs0.88 in 2QFY23.

Assets Analysis

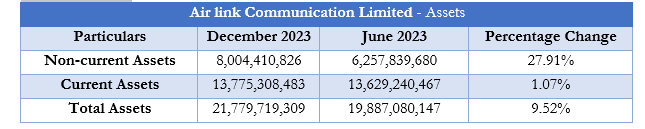

At the end of December 2023, the company's current and non-current assets grew by 1.07% and 27.91%, respectively. The current assets stood at Rs13.77 billion in December 2023 and non-current assets at Rs8.004 billion. This increase in current assets indicates a better liquidity position and higher operational efficiency. Similarly, the non-current assets growth signifies higher investment to widen the company's resources. As a result, the total assets moved to Rs21.77 billion at the end of December 2023 from Rs19.88 billion in June 2023, showcasing an expansion of 9.52%.

Equity and Liabilities Analysis

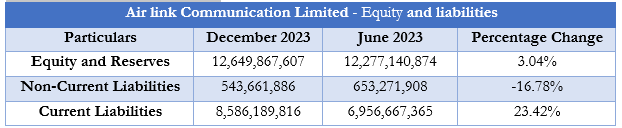

In comparison to June 2023, the Air Link Communication Limited posted an increase of 3.04% to Rs12.6 billion in equity and reserves in December 2023. This indicates that the company has witnessed improved profitability and higher operations over the period. The company's non-current liabilities inched down from Rs653 million in June 2023 to Rs 543 million in December 2023, posting a decrease of 16.78%. This decline highlights that the company successfully repaid long-term obligations through effective debt management and higher profitability. However, current liabilities experienced a significant surge of 23.42% to Rs8.58 billion in December 2023 from Rs6.95 billion in June 2023.

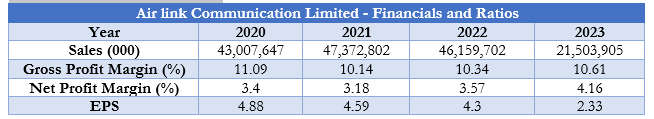

Financials and Ratios Analysis

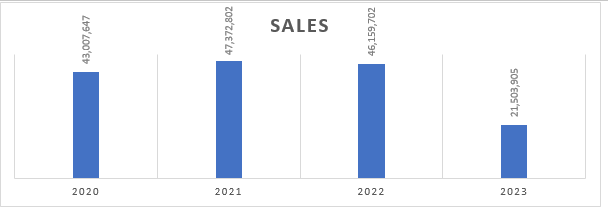

The four-year trend of sales followed a downward trajectory, starting from Rs43.007 billion in 2020 to Rs21.5 billion in 2023. However, the gross margin varied over the period, with a gross margin of 11.09% in 2020, followed by a dip of 10.14% in 2021. Whereas, in 2022 and 2023, gross margin showed a decimal improvement to 10.34% and 10.61% respectively. In 2020, the net profit margin stood at 3.4%, which declined to 3.18% in 2021 but improved to 3.57% and 4.16% in 2022 and 2023, respectively. In contrast, the ESP decreased substantially from Rs4.88 in 2020 to Rs2.33 in 2023.

Company profile

The Air Link Communication Limited was founded as a private company on January 02, 2014. The company is involved in the import, export, distribution, identification, wholesale, and retail of products and services related to information technology and communication. These consist of associated products and accessories for tablets, smartphones, cell phones, and laptops.

inpCredit: INP-WealthPk