INP-WealthPk

Shams ul Nisa

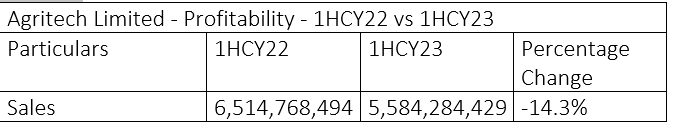

Agritech Limited recently released its financial report for the half-year period ending on June 30, 2023, reporting a decline in sales and a net loss because of gas curtailment to fertilizer plants and a slight shift in seasonal demand in line with Kharif crops sowing. The company reported total sales of Rs5.58 billion during the half-year period compared to Rs6.51 billion over the corresponding period last year, resulting in an overall decline of 14.3%. This fall in sales is attributed to the decline in urea production due to gas curtailment to the fertilizer plants. Apart from this, the demand and supply gap of urea continued to exist in the market during the period.

As a result of the fall in sales, the company’s gross profit also faced challenges as it plunged by 10.73% to Rs367.49 million in 1HCY23 from Rs411.64 million in 1HCY22. This shows that the company witnessed a rise in the cost of goods sold. The gross profit ratio, however, increased marginally to 6.58% in 1HCY23 from 6.32% in 1HCY22 due to a smaller gap between the sales and the gross profit achieved during the quarter under review.

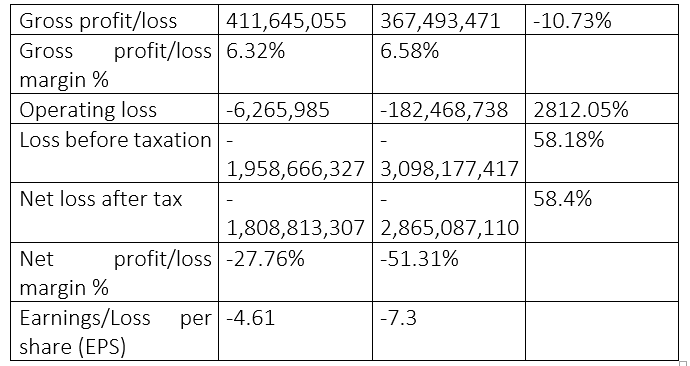

Agritech Limited observed a massive 2812.05% increase in operating loss as it jumped to Rs182.46 million in 1HCY23 from just Rs6.26 million in 1HCY22. This significant jump in operating loss shows the drastic hike in operational expenditures of the company. The loss-before-taxation further grew to Rs3.098 billion in 1HCY23 from Rs1.958 billion in 1HCY22, posting a negative growth of 58.18%. This jump in pre-tax loss is attributed to the acute spike in operating costs and financial challenges. Similarly, Agritech Limited’s net loss increased by 58.4% to Rs2.86 billion from Rs1.80 billion in 1HCY22.

The company faced financial constraints during the period because of the decrease in sales and increase in gross and net loss. The company’s net loss margin thus soared to 51.31% in 1HCY23 against 27.76% in 1HCY22. This reflects the worsening financial conditions during the period. The company’s shareholders witnessed a weighty loss per share of Rs7.3 in 1HCY23 compared to a loss of Rs4.61 in 1HCY22.

Assets analysis

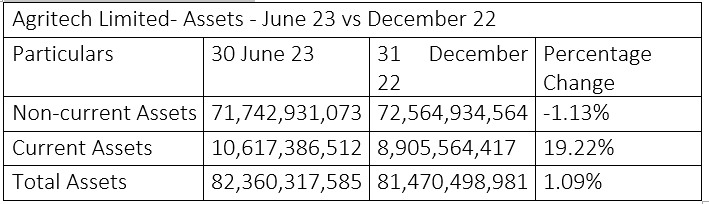

Despite the financial challenges faced by the company, the total assets increased marginally by 1.09% to Rs82.3 billion in June 2023 from Rs81.47 billion in December 2022. The company’s current assets grew by 19.22% during June 2023 compared to last year, thus offsetting the decrease in non-current assets of 1.13%.

During June 2023, the non-current assets stood at Rs71.7 billion compared to Rs72.5 billion in December 2022. The current assets in June 2023 stood at Rs10.61 billion against Rs8.905 billion in December 2022.

Equity and liabilities analysis

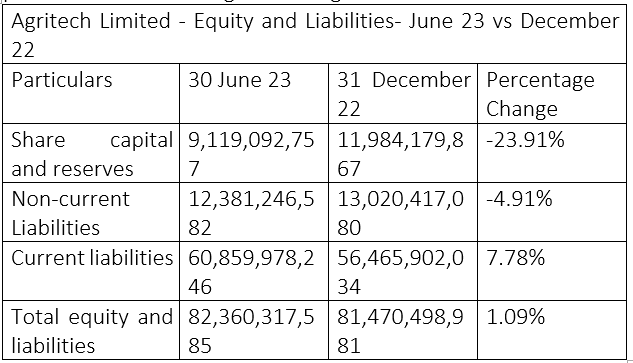

As of June 2023, the company’s shared capital and reserves stood at Rs9.11 billion compared to Rs11.98 billion in December 2022, showcasing a decline of 23.91%. The company’s non-current liabilities fell by 4.91% to Rs12.38 billion from Rs13.02 billion. This signifies that the company has paid off some of its long-term obligations.

In contrast, the company’s current liabilities grew by 7.78% to Rs60.85 billion in June 2023 compared to Rs56.46 billion in December 2022, reflecting the increase in short-term obligations. Agritech Limited’s total equity and liabilities grew slightly by 1.09% during the period under consideration.

Analysis of last four years

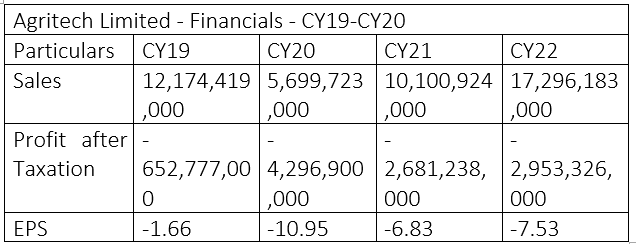

During the period from CY19 to CY22, the company’s sales exhibited a fluctuating trend. The highest sales of Rs17.29 billion were noted in CY22 and the lowest of Rs5.69 billion in CY19. However, the company kept posting net losses throughout these years.

The highest loss-after-tax of Rs4.29 billion was observed in CY20 and the lowest of Rs652.7 million in CY19. The company suffered the highest loss per share of Rs10.95 in CY20 and the lowest Rs1.66 in CY19.

Company’s profile

Agritech Limited was established in Pakistan on December 15, 1959. Its principal business is production, sale and marketing of fertilizers, particularly urea and granulated single super phosphate.

Credit: INP-WealthPk