INP-WealthPk

Hifsa Raja

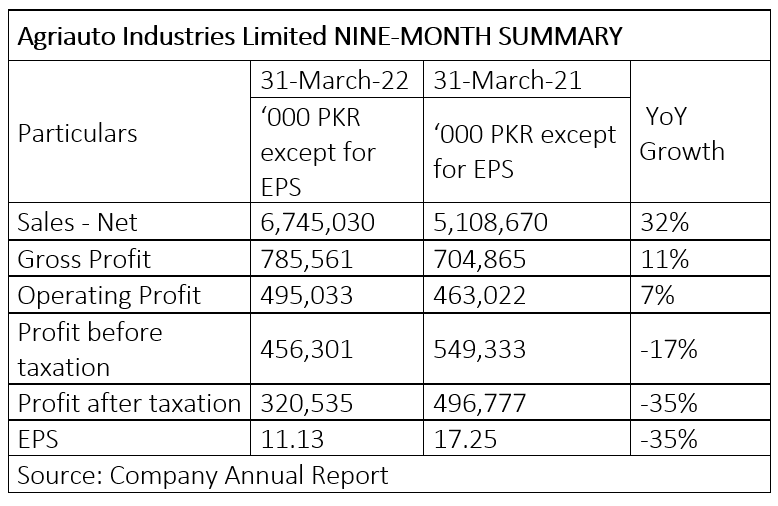

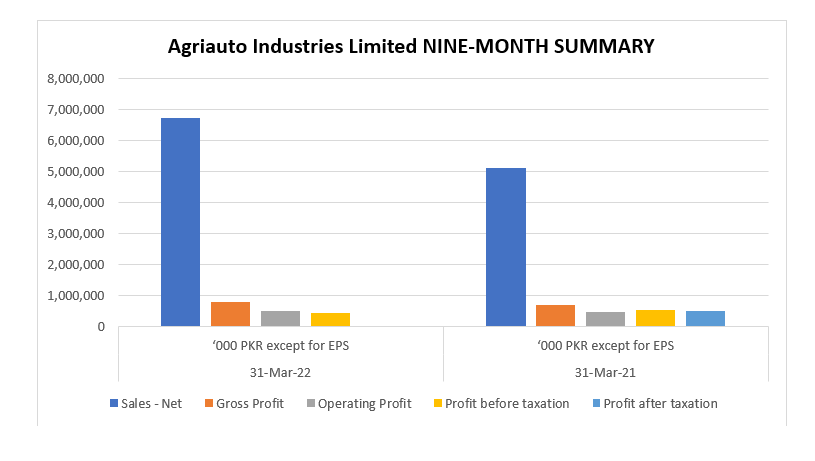

Agriauto Industries Limited’s gross revenue climbed 32% to Rs6.74 billion in the first nine months of the fiscal year 2021-22 (9MFY22) from Rs5.10 billion over the corresponding period of FY21.

The gross profit grew 11% to Rs785 million in 9MFY22 from Rs704 million over the same period of FY21.

The operating profit stood at Rs495 million, up 7% from Rs463 million in 9MFY21.

The before-tax profit declined 17% to Rs456 million in 9MFY22 from Rs549 million in 9MFY21. The after-tax profit decreased 35% to Rs320 million in 9MFY22 from Rs496 million in 9MFY21. The earnings per share (EPS) also dropped to Rs11.13 from Rs17.25 during the two comparable periods, reports WealthPK.

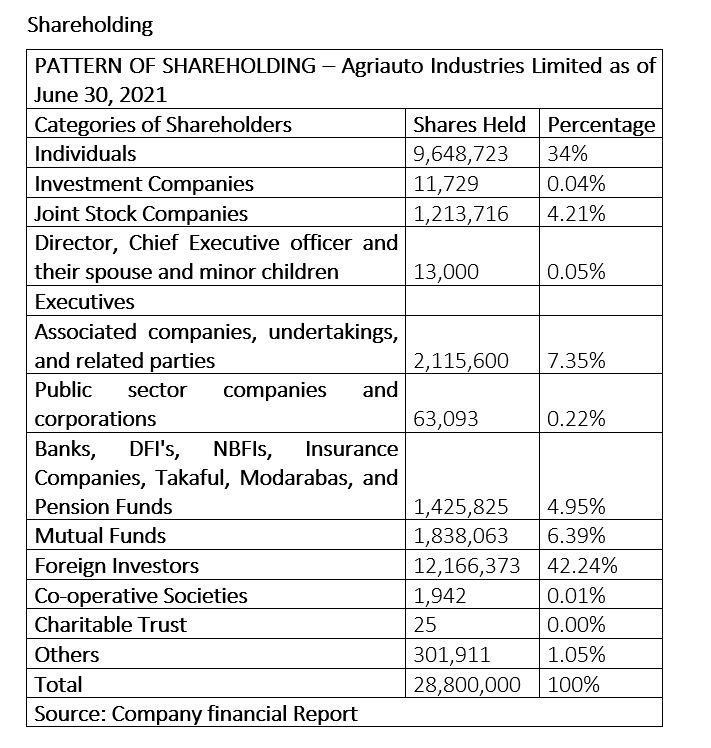

As of June 30, 2021, individuals owned 34% of the company’s shares, investment companies 0.04%, and joint stock companies 4.21%. Directors, their spouse(s) and minor children owned 0.05% of the shares.

Associated companies held 7.35% of the shares; public sector companies, undertakings and related parties 0.22%; banks, development financial institutions and non-banking financial institutions 4.95%; mutual funds 6.39%; foreign investors 42.24%; cooperative societies 0.01%; and ‘others’ 1.05%.

Financial Performance

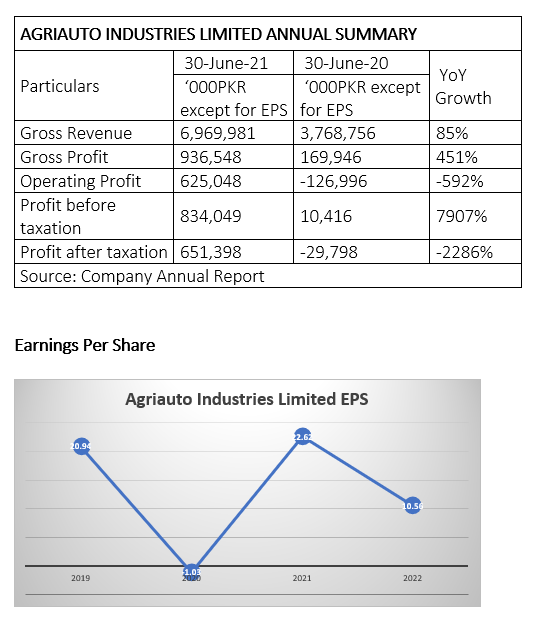

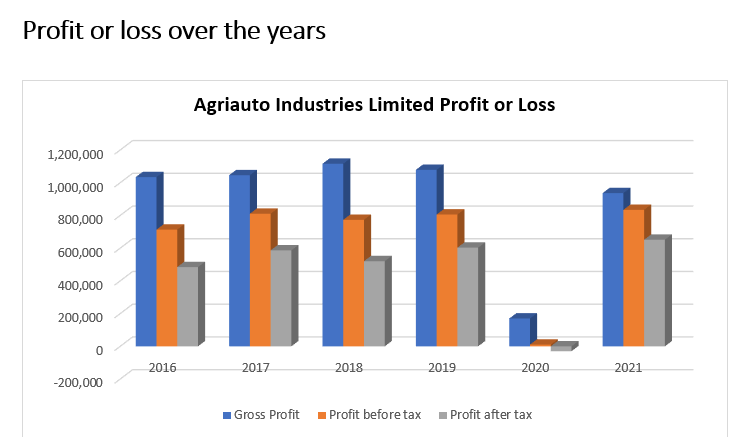

During the fiscal year 2020-21, the company generated revenue of Rs6.96 billion against Rs3.76 billion in 2019-20, registering an increase of 85%. The gross profit for FY21 was Rs936 million, up 451% from Rs169 million in FY20. The operating profit for FY21 surged 592% to Rs625 million from a loss of Rs126 million in FY20. The profit-before-tax for FY21 was Rs834 million compared to a paltry profit of Rs10 million in FY20, showing a big increase of 7907%. Similarly, the profit-after-tax for FY21 was Rs651 million, which was a huge turnaround from a loss of Rs29 million in FY20, posting a marked increase of 2286% year-on-year.

The EPS remained strikingly high at Rs20.94 in 2019, but then the company’s dwindling performance pushed it down to Rs1.03 loss per share in 2020. However, the company recovered from losses and performed healthily in 2021, when its EPS jumped to Rs22.62. But the EPS again plunged to Rs10.56 in 2022.

The profitability – gross profit, and profit before and after tax – remained high in 2019, but plunged steeply in the following year. The company saw a rebound in the triple profits in 2021.

The firm was incorporated in Pakistan on June 25, 1981 as a public-limited company, which is engaged in manufacture and sale of components for automotive vehicles, motorcycles and agricultural tractors.

Credit : Independent News Pakistan-WealthPk