INP-WealthPk

Hifsa Raja

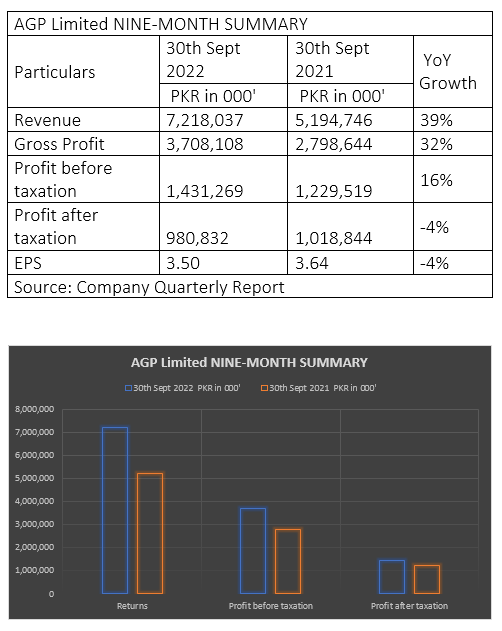

The revenue of AGP Limited, a pharmaceutical manufacturer, increased 39% to Rs7.2 billion in the first nine months of the calendar year 2022, from Rs5.2 billion over the corresponding period of the previous year.Similarly, the company’s gross profit in 9MCY22 increased to Rs3.7 billion from Rs2.8 billion over the same period of CY21, showing a 32% yearly growth. The profit-before-taxation inched up to Rs1.4 billion in 9MCY22 from Rs1.2 billion in 9MCY21. The post-tax profit, however, decreased 4% to Rs980 million in 9MCY22 from Rs1 billion in 9MCY21, reports WealthPK.

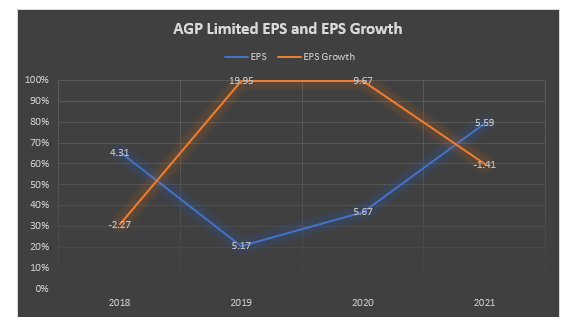

Earnings Growth Analysis

The company’s earnings per share growth stood negative in 2018, but then remained positive for the next two years. In 2021, the EPS growth was again negative. In terms of market share, AGP Limited is one of the leading pharmaceutical companies in Pakistan. To stay competitive, AGP Limited focuses on innovation, quality, and customer service, as well as expanding its product portfolio and exploring new markets. Overall, the pharmaceutical industry in Pakistan is highly competitive, with a mix of local and global players vying for market share. Companies like AGP Limited must continue to innovate and adapt to remain competitive in the market.

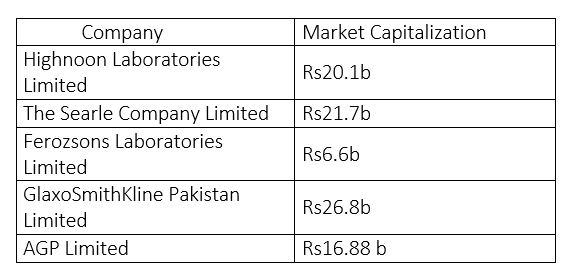

Industry Comparison

Highnoon Laboratories Limited, The Searle Company Limited, Ferozsons Laboratories Limited and GlaxoSmithKline Pakistan Limited have all been regarded as rivals of AGP Limited. It's important to note here that market capitalisation can be influenced by a range of factors, including company performance, market trends, and investor sentiment, which can result in changes to these rankings over time.

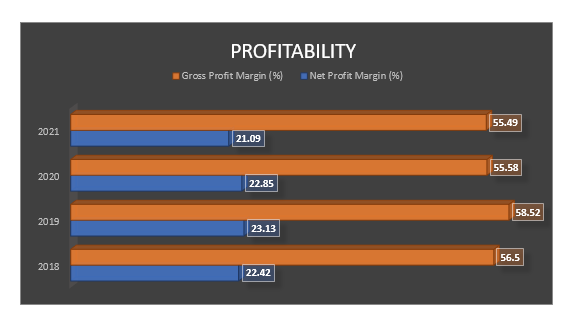

Profitability

AGP Limited appears to be a profitable company as it has been sustaining a healthy gross profit margin for the last four years. The company is generating a reasonable level of profitability from its sales and operations, even after accounting for all expenses. The company is also generating a reasonable return on equity, which indicates that it is able to generate profits for its shareholders. However, it's important to note that financial ratios are just one aspect of analysing a company's profitability and should be considered in conjunction with other factors such as market trends, industry competition, and company strategy.

Company Profile

AGP was incorporated as a public limited company in May 2014 under the Companies Ordinance, 1984, which has now been replaced with Companies Act, 2017. The company got listed on Pakistan Stock Exchange on March 5, 2018. The principal activities of the firm include manufacturing, import, marketing, export, dealership and distribution of pharmaceutical products. Aitkenstuart Pakistan (Private) Limited (the parent company) holds 55.80% of AGP’s share capital. West End 16 Pvt Limited, Singapore, is its ultimate parent company.

Credit: Independent News Pakistan-WealthPk