INP-WealthPk

Hifsa Raja

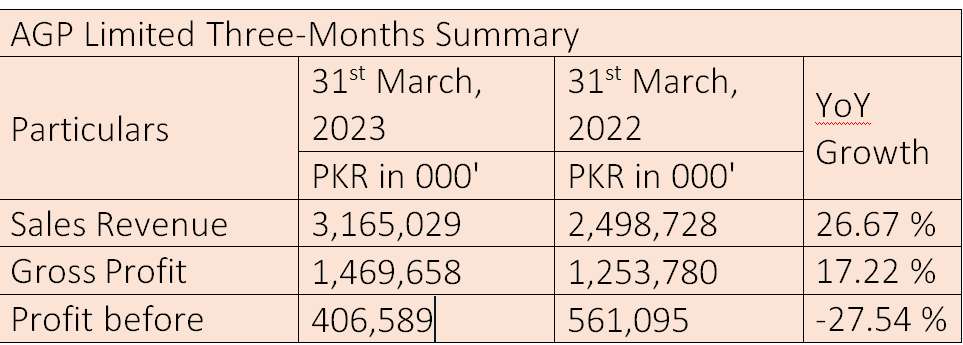

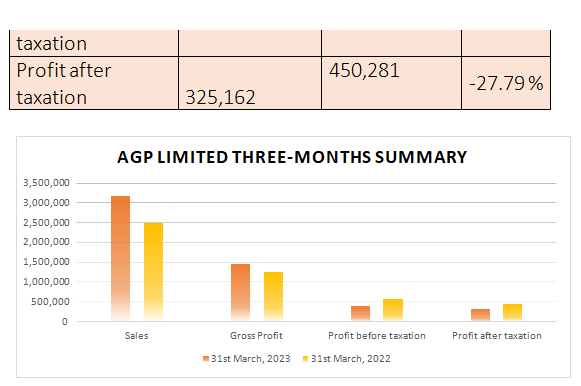

Medicines maker AGP Limited’s sales increased by 26.67% to Rs3.1 billion in the first three months of the ongoing calendar year 2023 from Rs2.4 billion over the corresponding period of the previous year. This gain is mostly due to increase in shipments to Afghanistan and strong domestic retail sales. Sales to Afghanistan increased thanks to the persistent efforts of the management to grow the company's regional market share. Margin pressure, however, persisted because of the huge depreciation of the local currency and a large rise in operating expenses. Similarly, the company’s gross profit in 3MCY23 increased to Rs1.4 billion from Rs1.2 billion over the same period of CY22, showing a 17.2% yearly growth. However, the profit-before-taxation decreased 27.54% to Rs406 million in 3MCY23 from Rs561 million in 3MCY22. The post-tax profit also decreased 27% to Rs325 million in 3MCY23 from Rs450 million in 3MCY22.

Performance in CY22

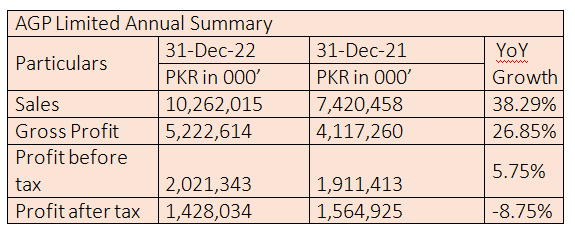

In the calendar year 2022, the company’s net sales revenue increased 38.29% to Rs10.2 billion from Rs7.4 billion in the previous year. The gross profit increased to Rs5.2 billion, up 26.85% from the previous year's Rs4.1 billion.

The company’s profit-before-tax inched up 5% to Rs2 billion in CY22 from Rs1.9 billion in CY21. However, the company’s post-tax profit inched down 8% to Rs1.4 billion in CY22 from the previous year's Rs1.5 billion.

Earnings growth analysis

In 2018 and 2019, the increase in earnings per share contributed to robust EPS growth during this period. But the trend became negative for the next three years notwithstanding the EPS stayed quite close to Rs5.

Industry comparison

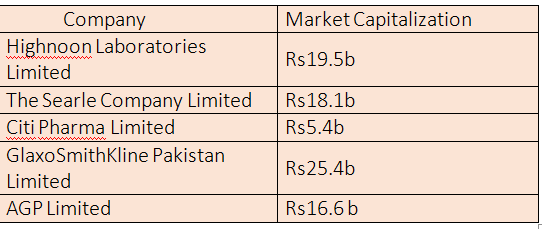

Rivals of AGP Limited include Highnoon Laboratories Limited, the Searle Company Limited, Citi Pharma Limited and GlaxoSmithKline Pakistan Limited. AGP Limited’s market value is Rs16.6 billion. GlaxoSmithKline Pakistan Limited has the highest market value of Rs25.4 billion and Citi Pharma Limited has the lowest of Rs5.4 billion.

Profitability

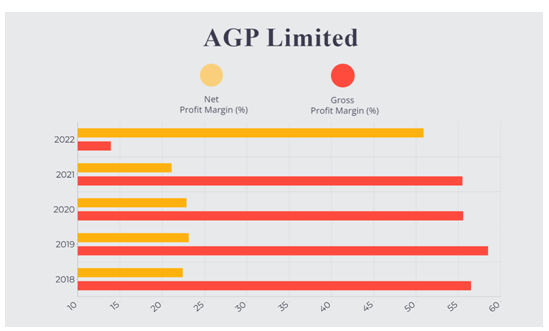

AGP Limited has exhibited fluctuating trends in both net profit and gross profit margins over the past five years. The net profit margin shows a relatively stable performance with minor fluctuations. It started at 22.42% in 2018, reached its peak at 23.13% in 2019, and then slightly declined to 22.85% in 2020. However, in 2021, there was a more noticeable drop to 21.09%. Notably, in 2022, there was a significant surge, with net profit margin jumping to an impressive 50.89%. Such a substantial increase in the net profit margin indicates a remarkable improvement in the company's ability to generate profits from its revenue.

The gross profit margin has been relatively steady over the years, except a considerable decline in 2022. Starting at a high of 56.5% in 2018, 58.52% in 2019, the margin then dropped slightly to 55.58% in 2020 and 55.49% in 2021. However, the gross margin declined substantially to 13.92% in 2022. This significant drop might be attributed to increased production costs or pricing pressures. The contrasting trends in net and gross profit margins raise questions about AGP Limited's overall cost management and pricing strategies.

In conclusion, AGP Limited's net profit margin demonstrated commendable improvement in 2022, indicating enhanced profitability. However, the significant decline in gross profit margin during the same period warrants attention and investigation.

Company profile

AGP was incorporated as a public limited company in May 2014 under the Companies Ordinance, 1984, which has now been replaced with Companies Act, 2017. The company got listed on Pakistan Stock Exchange on March 5, 2018. The principal activities of the firm include manufacturing, import, marketing, export, dealership and distribution of pharmaceutical products. Aitkenstuart Pakistan (Private) Limited (the parent company) holds 55.80% of AGP’s share capital. West End 16 Pvt Limited, Singapore, is its ultimate parent company.

Credit: INP-WealthPk