INP-WealthPk

Shams ul Nisa

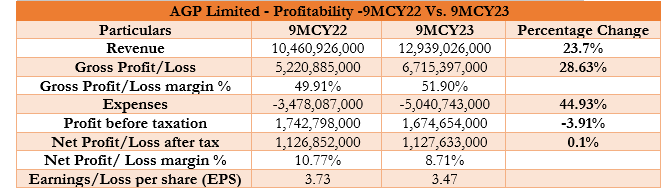

The AGP Limited reported revenue of Rs12.9 billion for the nine months of the calendar year 2023, a 23.7% surge over the same period the previous year, report WealthPK. The gross profit for the 9MCY23 stood at Rs6.7 billion, up 28.63% from Rs5.2 billion in 9MCY22. This represents a rise in gross margin to 51.90% in 9MCY23, against 49.91% of 9MCY22.

The company’s expenses ballooned by 44.93% to Rs5.04 billion during the period under review. The company attributed the devaluation in domestic currency as a cause of the hike in expenses. Therefore, the profit before tax slipped to Rs1.67 billion in 9MCY23 from Rs1.74 billion in 9MCY22, reflecting a decline of 3.91%. However, in 9MCY23, the company recorded a gain of 0.1% in net profit, which amounted to Rs1.127 billion against Rs1.126 billion in 9MCY22. The net profit margin came in at 8.71% in 9MCY23, slightly below 10.77% in the same period last year. The company announced earnings per share (EPS) of Rs3.47 in 9MCY23 as opposed to ESP of Rs3.73 in 9MCY22.

Quarterly Analysis

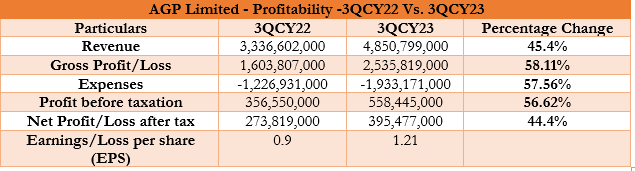

The quarterly analysis of AGP Limited has delivered an impressive performance backed by a robust hike in revenue of 45.4%, gross profit by 58.11%, and net profit by 556.62%. The company registered a revenue of Rs4.8 billion, Rs2.5 billion, and Rs395.47 million in 3QCY23. In terms of expenses, the significant rise in administrative, marketing, and selling expenses, other expenses, and finance costs widen overall expenses by 44.50% to Rs1.93 billion from Rs1.22 billion in 3QCY22. Despite the hike in expenses, the profit before tax surged to Rs558.4 million, 56.62% higher than Rs356.5 million in the same quarter last year. The company’s EPS improved to Rs1.21 in 3QFY23 from Rs0.9 in 3QFY22, indicating higher profitability per outstanding share.

Profitability Ratios Analysis

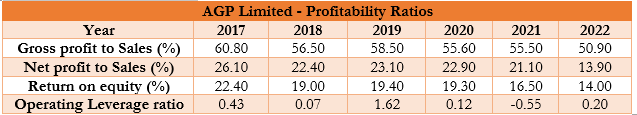

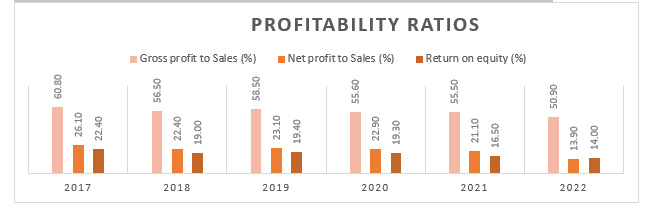

In the past six years, the gross profit to sales, net profit to sales, return on equity, and operating leverage ratio declined overall from 2017 to 2022. This could be the outcome of decreased profitability and a rise in the per unit cost of the goods due to currency devaluation over the years.

In 2017, the gross and net profit to sales stood at 60.80% and 26.10%. The company’s return on equity was 22.40%, with an operating leverage ratio of 0.43. However, the profitability ratios declined in 2018, with gross profit to sales reaching 56.50% and net profit to sales 22.40%. Similarly, the return on equity and operating leverage ratio dropped to 19.00% and 0.07.

In 2019, the ratios improved slightly but continued to decline in the following years, with gross to sales reaching 50.9%, net profit to sales 13.9%, and return on equity 14.00% in 2022. However, the company’s operating leverage ratio remained negative with a value of -0.55 in 2021 but improved to 0.20 in 2022.

Liquidity Ratios Analysis

![]()

![]()

The current ratio measures the company’s liquidity position to meet its current obligation using current assets. AGP Limited remained stable over the period from 2018 to 2022, as the value remained above 1.2. The company observed the highest current ratio of 1.71 in 2020 and the lowest of 1.27 in 2018. In a similar vein, the quick ratio assesses how well a company can use its most liquid assets to fund its immediate liabilities. From 2018 to 2023, the quick ratio stayed below 1, indicating a higher risk because there aren't enough quick assets to cover all of the company's short-term obligations. In 2022, the company recorded a minimum quick ratio of 0.73 and a maximum of 0.95 in 2021.

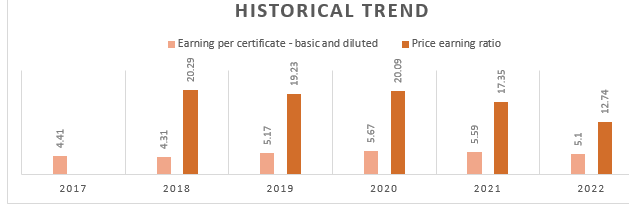

Historical Trend Analysis

![]()

From 2017 to 2022, the company’s EPS remained volatile, showcasing ups and downs in profitability. This could be due to economic uncertainties, market conditions, and regulatory changes. The company reported the highest ESP of Rs5.67 in 2020 and the lowest of Rs4.31 in 2018. The price-earnings ratio ranged between Rs12.74 in 2022 and Rs20.29 in 2018.

Future Outlook

AGP Limited aims to continue to work and grow its market share across a range by using effective marketing techniques and allocating resources as needed. The company is anticipated to maintain its competitive market position on the strength of its strong portfolio and realize economies of scale through the introduction of new goods, line expansions, and internalization of some recently acquired brands through its subsidiary companies.

Company Profile

AGP Limited was established as a public limited company in May 2014. The company's main operations include importing, marketing, exporting, distribution, wholesale, dealership, and production of various pharmaceutical items.

INP: Credit: INP-WealthPk