INP-WealthPk

Shams ul Nisa

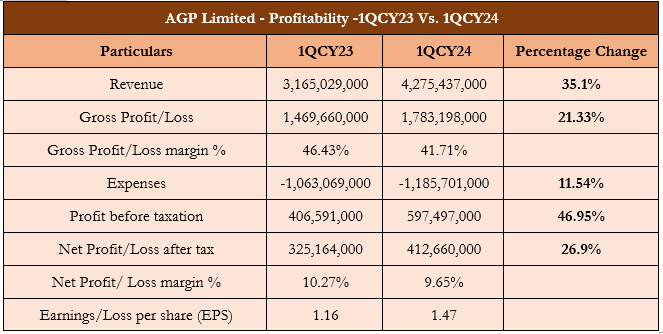

AGP Limited's revenue increased by 35.1%, indicating a noteworthy improvement in financial performance, as the company posted the highest-ever quarterly sales of Rs4.27 billion in 1QCY24, reports WealthPK.

The company attributed this increase in sales to the 32% growth in domestic retail sales, which were driven by the strong performance of leading brands. Furthermore, the topline growth was also greatly aided by supplies to the subsidiary company, OBS AGP (Private) Limited (OBS AGP). Despite the growth of 21.33% in gross profit, the gross margin slipped to 41.71% in 1QCY24 from 46.43% in 1QCY23, due to a considerable increase in the cost of doing business.

The company witnessed a moderate expansion of around 11.54% in expenses, despite significant inflationary pressure and increased business volume. At the end of the quarter, the profit before tax jumped to Rs597.49 million, up by 46.95%. Whereas, growth in super tax compressed the net profit to rise by around 26.9% to Rs412.66 million in 1QCY24. Thus, the net profit margin dropped to 9.65% in 1QCY24 from 10.27% in 1QCY23. However, earnings per share slightly improved from Rs1.16 in 1QCY23 to Rs1.47 in 1QCY24.

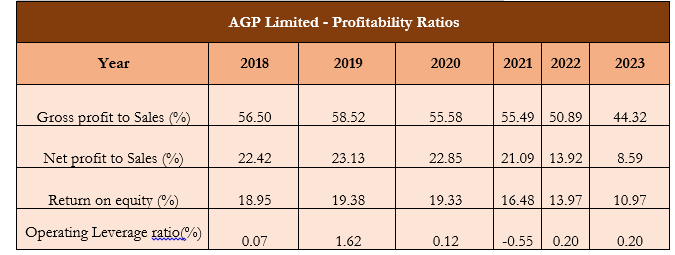

Profitability Ratios Analysis

The gross profit to sales ratio, net profit to sales ratio, return on equity, and operational leverage ratio all decreased from 2018 to 2023. Lower profitability and increasing goods costs per unit as a result of gradual currency depreciation contributed to the decline in profitability ratios.

The company recorded a net profit margins of 22.42% and gross profit margins of 56.50% in 2018. Likewise, return on equity was 18.95%, and its operational leverage ratio was 0.07% in 2018. The ratios saw an improvement in 2019 before continuing to decline in 2020, 2021, 2022, and 2023. Thus, at end of 2023 the company posted a gross profit margin of 44.32%, a net profit margin of 8.59% and a return on equity of 10.97%. The operational leverage ratio increased to 0.20% in 2022 and 2023 from -0.55% in 2021.

Historical Trend Analysis

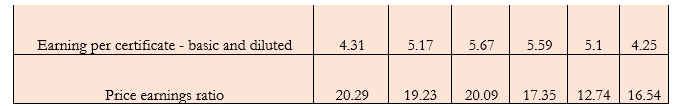

Between 2017 and 2022, the company's earnings per share varied, showing ups and downs in profitability due to market dynamics, regulatory changes, and economic uncertainty. The company reported an ESP of Rs4.31 in 2018, and it reached a maximum of Rs5.67 in 2020. From 20.29 in 2019 to 16.54 in 2023, the price earnings ratio fell overall. But in 2022, the price earnings ratio dropped to the lowest of 12.74 over the past six years.

Pharmaceutical Sector analysis

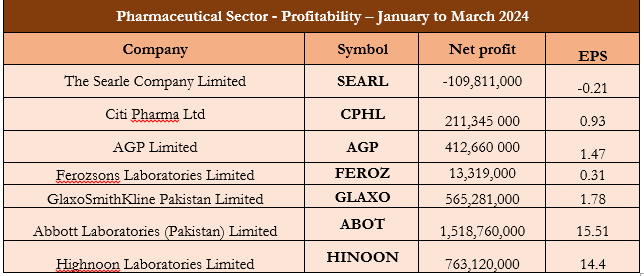

For the thorough comparison of the companies enlisted in the pharmaceutical sector, we have used the company’s net profit and earnings per share for the period January to March 2024 as proxies for comparison. Abbott Laboratories (Pakistan) Limited was the most profitable, with a net profit of Rs1.51 billion and an EPS of Rs15.51. Highnoon Laboratories Limited followed with a net profit of Rs763.12 million and an EPS of Rs14.4, reflecting robust operational efficiency and market demand. GlaxoSmithKline Pakistan Limited also showed strong profitability with a net profit of Rs565.28 million and an EPS of Rs1.78. Additionally, Citi Pharma Limited and Ferozsons Laboratories Limited had lower net profits, suggesting they need to explore strategies to enhance their market share and profitability. However, The Searle Company Limited suffered a net loss of 109.81 million and loss per share of Rs0.21.

Future Outlook

Despite a difficult economic condition, AGP is concentrating on market expansion and sustainable growth. The company is creating cutting-edge drugs and expanding its market share in both local and foreign markets by utilizing group synergies and current product portfolios. AGP is shifting to local suppliers, expanding its supplier base, and upholding quality standards in order to combat possible threats such as fluctuating foreign exchange values, high interest rates, and domestic inflation. To cut expenses, the company is also boosting its export capacities, maximizing inventory levels, and promoting operational efficiency. In order to increase its flexibility and competitiveness, AGP also intends to invest in growing its production capacity.

Company Profile

In May 2014, AGP Limited was founded as a public limited company. The company's primary activities include importing, marketing, exporting, distributing, wholesaling, and manufacturing various pharmaceutical products.

Credit: INP-WealthPk